DXY eased lower Friday night as EUR rallied:

The EUR/USD long remains extreme despite recent reversals:

AUD failed to capitalise:

AUD/USD CFTC position moved more bearish with a goodly drop to 16.8k net short positions:

EM forex was even more weak:

The breakdown in BRL is not good sign for EMs:

Gold fell:

Oil fell as US rigs jumped another 10 to 844:

Base metals lifted:

Big miners too:

EM stocks eased:

But EM junk was still bouncing:

The Treasury curve hit all-new flats:

Not bunds:

Stocks firmed and the S&P has broken out of it wedge pattern:

US consumer confidence was out and fell:

Indeed, the confidence spike has been somewhat illusory:

Which has forecasters doubting this week’s retail numbers, from BoAML:

‘According to BAC aggregated credit and debit card data, retail sales ex-autos declined 0.1% mom seasonally adjusted in April. This suggests that the better momentum in consumer spending seen in March failed to carry over to start the second quarter. We saw two headwinds for the consumer in April: weather and higher gasoline prices.

We find evidence that unseasonably cold weather conditions likely played a role in holding back consumer activity. Specifically, the Midwest and the Northeast experienced below average temperatures …

Higher gasoline prices also likely dampened overall consumer spending. According to the Energy Information Administration, retail gasoline prices jumped 6.4% mom in April as crude oil prices rose on negative supply shock and solid global demand. This led to a surge in spend at gasoline stations and a shift away from other categories. …

…Bottom line: Retail spending softened in April. The weather impact should prove temporary but rising gasoline prices is likely to persist, eating away some of the positive impact from higher after-tax wages seen post tax reform.

If right, that may hinder DXY this week.

Even so, AUD/USD spreads keep hitting new wides. Friday night saw the two year hit 54bps and five year 44bps. The 10 year is already at thirty year lows:

It’s never been cheaper to sell the AUD!

—————————————————————-

David Llewellyn-Smith is the chief strategist at the MB Fund which offers two options to benefit from a falling AUD so he is definitely talking his book. The first option is to use the MB Fund International Stocks Portfolio which is always 100% long as a part of your own asset allocation mix. The second option is to use an MB Fund tactical allocation in which we choose the asset mix for you, including exclusively international stocks, but with bonds and other assets as well to ensure a more conservative mix.

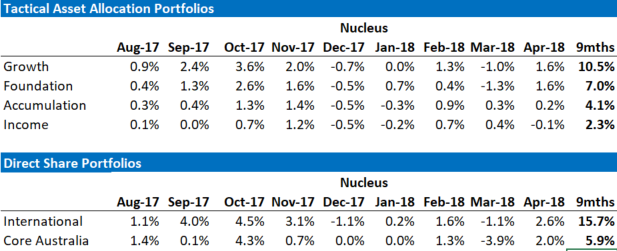

The recent performance of both is below:

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance.