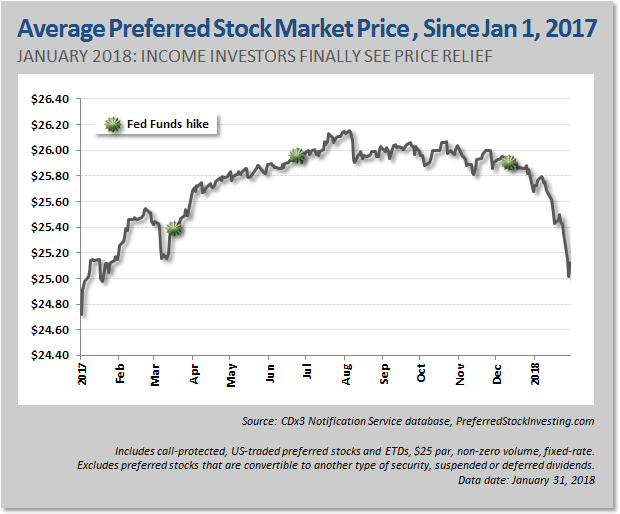

Preferred stock investors finally realized long-awaited price relief during January, with the average market price of U.S. preferred stocks dropping $0.72 to $25.13 per share. Income investors are now being treated to higher paying preferred stocks for lower prices.

After ignoring the Fed’s repeated federal funds rate increases, it was December’s tax reform act that did the trick. The Act provides a number of tax benefits to individuals and businesses so for at least the 2018 tax year businesses will realize substantial cash savings making common stocks attractive.

Income investors make their money from the dividends generated by income securities (preferred stocks, bonds) while value investors make their money from an increase in the stock price of the company they have invested in (common stocks).

Income investors are generally buy-and-hold investors (they rarely sell their shares) and therefore see a period of falling prices as an opportunity to buy more dividend-paying shares at a bargain price. As we saw during January, a period of falling prices boosts the return earned by income investors on their purchases.

Conversely, value investors see a period of falling prices as a time to sell their shares, hopefully in time to avoid a loss – exactly the opposite of the strategy used by income investors when prices are falling.

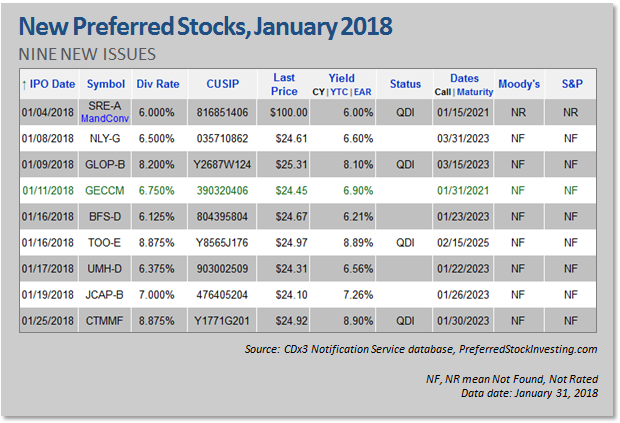

January’s new issues

January’s nine new preferred stocks are offering an average dividend (coupon) of 7.2 percent. Here are the nine new issues introduced during January for the consideration of preferred stock investors.

Note that I am using IPO date here, rather than the date on which retail trading started. The IPO date is the date that the security’s underwriters purchased the new shares from the issuing company.

A special note regarding preferred stock trading symbols: Annoyingly, unlike common stock trading symbols, the format used by exchanges, brokers and other online quoting services for preferred stock symbols is not standardized. For example, the Series A preferred stock from Public Storage is “PSA-A” at TDAmeritrade, Google Finance and several others but this same security is “PSA.PR.A” at E*Trade. For a cross-reference table of how preferred stock symbols are denoted by sixteen popular brokers and other online quoting services, see “Preferred Stock Trading Symbol Cross-Reference Table.”

There are currently 84 high quality preferred stocks selling for an average price of $24.80 (January 31), offering an average coupon of 5.54 percent and a current yield of 5.57 percent. And 48 of these high quality issues are selling below their $25 par value. By high quality I mean preferreds offering the characteristics that most risk-averse preferred stock investors favor such as investment grade ratings, cumulative dividends and call-protection.

There are now a total of 899 of these securities trading on U.S. stock exchanges (including convertible preferred stocks).

Buying new shares for wholesale

Note that the newest issue – CTMMF from Costamare Inc. (CMRE) – is still trading on the wholesale Over-The-Counter exchange (as of January 31). This is a temporary OTC trading symbol until this security moves to the NYSE exchange, at which time it will receive its permanent symbol.

But there is no need to wait; during a period of relatively high prices, individual investors, armed with a web browser and an online trading account, can often purchase newly introduced preferred stock shares at wholesale prices just like the big guys (see "Preferred Stock Buyers Change Tactics For Double-Digit Returns" for an explanation of how the OTC can be used to purchase shares for discounted prices during a period of high preferred stock prices).

Those who have been following this strategy of using the wholesale OTC exchange to buy newly introduced shares for less than $25 are more able to avoid a capital loss as prices start to drop (if they choose to sell).

Your broker will automatically update the trading symbols of any shares you purchase on the OTC. CTMMF will become CMRE-E.

About the new issues

There is quite a bit of diversity with January’s nine new offerings.

Three of January’s new preferreds were issued by property REITs, one from a mortgage REIT, three from shipping companies, one utility and one Business Development Corporation. All nine new issues are unrated but offer cumulative dividends. “Cumulative” means that if the issuer misses a dividend payment to you, they still owe you the money (short of a bankruptcy); their obligation to you accumulates.

Property Real Estate Investment Trusts (pREITs)

BFS-D, UMH-D, JCAP-B

REITs come in two flavors – property REITs and mortgage REITs. While property REITs make money by owning physical property and leasing it out, mortgage REITs make money by investing in residential and/or commercial mortgages (the idea being to borrow cash at a low rate and use that cash to buy mortgages that pay a higher rate).

BFS-D from Saul Centers (BFS), UMH-D from UMH Properties (UMH) and JCAP-B from Jernigan Capital (JCAP) are all perpetual preferred stocks offering fixed-rate dividends. “Perpetual” means that the issuer is not required to ever redeem your shares (i.e. the shares have no maturity date).

Saul Centers is using the proceeds from their new BFS-D (6.125 percent) to redeem 3 million of the outstanding 5 million shares of their older BFS-C (6.875 percent) on February 12. This maneuver saves the company about $560,000 per year in dividend expense.

UMH Properties is rather unique within the property REIT space, specializing in manufactured home communities. UMH-D is the company’s third preferred stock issue in as many years, none of which are as yet redeemable. UMH is a relatively small company (about $500 million market cap) and was founded in 1968.

Jernigan Capital is an odd duck. The company is incorporated as a REIT, but is not a mortgage REIT, so I have listed them here under property REITs. But that doesn’t quite fit either. Jernigan provides debt and equity financing to self-storage companies. Perhaps one of our readers can shed some historical light on how Jernigan Capital has ended up being incorporated as a REIT rather than as a BDC or something similar. JCAP-B, issued at 7.0 percent on January 19, is the company’s only preferred stock issue.

Mortgage Real Estate Investment Trusts (mREITs)

Mortgage REITs typically do not own physical property; rather, they raise capital (such as through a preferred stock offering) that is used to buy bundles of residential and/or commercial mortgages. If the cost of the raised capital is less than the bundled mortgage rate, mortgage REITs make money on the spread. The cost of investment capital that mortgage REITs are able to raise is determined by the prevailing interest rates at the time while the revenue coming from the mortgages, at least to some degree, remains fixed until the mortgages mature. So during a period of increasing interest rates, cost is rising while revenue remains relatively flat, squeezing the profitability of mortgage REITs.

NLY-G from Annaly Capital Management (NLY) is a tradition preferred stock paying cumulative dividends. This security offers a “fixed-to-float” dividend rate structure, paying a fixed 6.5 percent dividend until its March 31, 2023 call date. At that time, the dividend rate of this security becomes variable based on the three-month LIBOR rate (currently at 1.7734 percent) plus 4.172 percent.

Shipping

GLOP-B, TOO-E, CTMMF/CMRE-E

GLOP-B, issued by GasLog Partners LP (GLOP) also offers the fixed-to-float rate structure and pays a fixed 8.2 percent dividend until its March 15, 2023 call date. The rate becomes variable at that time, calculated by adding 5.839 percent to the then-current three-month LIBOR rate. GasLog, founded in 2014 and headquartered in Monaco, charters its fleet of nine LNG tankers. GLOP-B is the company’s second income security issued within the last seven months. With total 2016 gross revenue reported at $229 million, the $100 million raised by GLOP-B represents about half of this company’s annual sales volume. Note that GasLog is structured as a foreign limited partnership. Those considering buying GLOP-B shares should consult a tax specialist regarding the taxation and reporting requirements of income from such securities.

TOO-E from Teekay Offshore Partners (TOO) is the company’s third preferred stock currently trading and its first issue since April 2015. Founded in 2006 and headquartered in Bermuda, Teekay provides a variety of shipping and related services to the offshore oil industry. Interestingly, while interest rates have been going down for several years, the dividend rate that Teekay has had to offer on its three preferred stock issues since TOO-A was introduced in 2013 have gone up (7.25 percent for Series A in April 2013, 8.50 percent for its Series B in April 2015 and 8.875 percent from its Series C offered on January 16). TOO-E’s 8.875 percent dividend is fixed until its February 15, 2025 call date, then the rate will float based on the 3-month LIBOR plus 6.407 percent.

CTMMF/CMRE-E is from Costamare Inc. (CMRE), a container shipping company with 69 ships. Costamare was founded in 1974 and is headquartered in Monaco. CTMMF/CMRE-E offers a fixed dividend rate of 8.875 percent. Costamare now has four preferred stocks trading, with the oldest (CMRE-B) becoming redeemable in August of this year.

Utilities

SRE-A from Sempra Energy (SRE) is January’s only convertible preferred stock. There are two types of convertible preferred stock – mandatory convertibles, where the shares will be converted to some number of shares of the issuer’s common stock on a specific date and optionally convertibles, where shareholders have the option to convert their shares to the issuer’s common stock (or not). The various conversion ratios, limitations, timing and conditions are spelled out in the security’s prospectus. SRE-A is a mandatory convertible preferred stock, the proceeds from which are being used toward SRE’s acquisition of Texas-based Energy Future Holdings Corporation. Southern California Gas is a subsidiary of Pacific Enterprises which, in turn, is a subsidiary of Sempra Energy. Sempra has three preferred stocks trading, the other two being issued by Southern California Gas many years ago. SRE-A has a somewhat unusual par value of $100 per share.

Business Development Corporation

GECCM is an Exchange-Traded Debt Security from Great Elm Capital (GECC). ETDS’ are bonds recorded on the company’s books as debt (rather than as equity, as in the case of preferred stock). As debt, the obligation to pay the interest on these bonds is cumulative. As bonds, ETDS’ are often seen as having lower risk than the same company’s preferred stock shares. ETDS are very similar to preferred stocks and are often listed on brokerage statements as such. GECCM is Great Elm’s second income security, both of which have been issued within the last four months.

Sources: Preferred stock data - CDx3 Notification Service database, PreferredStockInvesting.com. Prospectuses SRE-A, NLY-G, GLOP-B, GECCM, BFS-D, TOO-E, UMH-D, JCAP-B, CTMMF/CMRE-E

Tax treatment

The tax treatment of the income you receive from income securities can be a bit confusing, but it really boils down to one question – Has the company already paid tax on the cash that is being used to pay you or not? If not, the IRS is going to collect the full tax from you; if so, you still have to pay tax, but at the special 15 percent rate.

With that rule in mind, here is how the tax treatment of January’s nine new issues plays out.

Companies incorporated as REITs (Annaly, Saul Centers, UMH, Jernigan) are required to distribute at least 90 percent of their pre-tax profits to shareholders. Doing so in the form of non-voting preferred stock dividends is the most common method of complying and because these dividend payments are made from pre-tax dollars, dividends received from REITs are taxed as regular income (i.e. they do not qualify for the special 15 percent dividend tax rate).

Interest that a company pays to those loaning the company money is a business expense to the company (tax deductible), so the company does not pay tax on the interest payments it makes to its lenders (i.e. interest payments made to lenders are paid with pre-tax dollars). Since Exchange-Traded Debt Securities are debt (GECCM), ETDS shareholders are on the hook for the taxes. Income received from ETDS’ is taxed as regular income.

Lastly, if a company pays your preferred stock dividends out of its after-tax profits, the dividend income you receive is taxed at the special 15 percent tax rate. Such dividends are referred to as “Qualified Dividend Income” or QDI. QDI preferred stocks are often seen as favorable for holding in a non-retirement account due to the favorable 15 percent tax treatment. Looking at the Status column in the above table, dividends received from SRE-A, GLOP-B, TOO-E and CTMMF/CMRE-E are a distribution of the company’s after-tax earnings and are therefore designated as being Qualified Dividend Income (see prospectus for exceptions and conditions).

In Context: The U.S. preferred stock marketplace

January 2018 was a pivotal month for preferred stock investors as prices finally started to fall, boosting the yields provided to today’s buyers. Remember that interest rates and the market prices of income securities typically move in opposite directions – rates up, prices down. The following chart illustrates how preferred stock investors all but ignore the Fed’s repeated interest rate hikes throughout 2017.

But take a look at what happens after the Tax Relief and Jobs Act was signed into law on December 20, 2017.

Many things affect the market prices of these securities such as the proximity to their call or maturity date, proximity to their next ex-dividend date, industry and/or overall health of the issuer, perceived direction of interest rates, pending government regulatory or policy changes, cumulative versus non-cumulative dividends and tax treatment of dividend payments. So what we really need to look at is current yield, which calculates the average annual dividend yield per dollar invested (without considering re-invested dividend return or any future capital gain or loss). Current yield is a “bang-for-your-buck” measure of value that normalizes differences in coupon rate and price to give us a single, comparable metric.

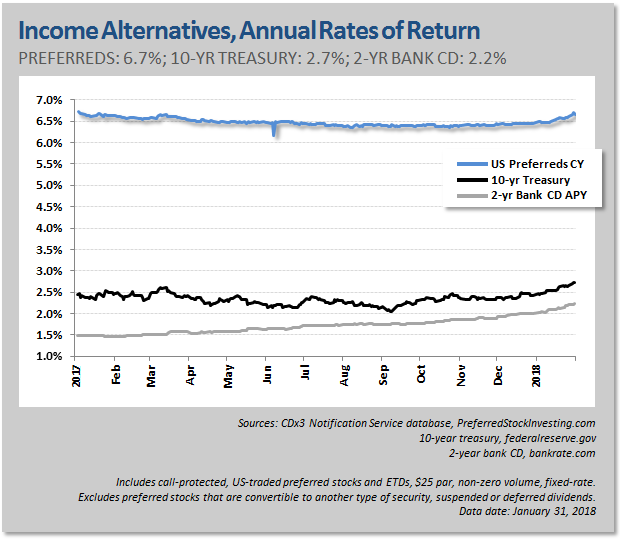

Moving down the risk scale, the next chart shows the dramatic increase in current yield realized by today’s preferred stock buyers when compared to the yield earned by those investing in the 10-year treasury note or 2-year bank Certificates of Deposit.

U.S.-traded preferred stocks are currently returning an average current yield of 6.7 percent (blue line) while the annual return being offered to income investors by the 10-year treasury is 2.7 percent and that of the 2-year bank CD is a meager 2.2 percent.

Because today’s preferred stock buyers are able to snap up dividend-paying shares for a lower price, the return on their investment goes up.

For comparison, I have set the Yield column in the first table above to show the current yield of the new January preferreds on January 31. It is into this marketplace that January’s nine new issues were introduced.