Form 8-K CODEXIS INC For: Mar 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 8-K

_________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 12, 2018

_________________________________

Codexis, Inc.

(Exact name of Registrant as Specified in its Charter)

_________________________________

Delaware | 001-34705 | 71-0872999 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

200 Penobscot Drive

Redwood City, CA 94063

(Address of Principal Executive Offices) (Zip Code)

(650) 421-8100

(Registrant's telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 | Regulation FD Disclosure. |

On March 12, 2018, Codexis, Inc. (the “Company”) updated its corporate presentation (the “Corporate Presentation”) in connection with upcoming investor conferences. A copy of the Corporate Presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K, and incorporated by reference herein.

The information furnished in this Current Report on Form 8-K pursuant to Item 7.01 (including Exhibit 99.1) shall not be deemed to be “filed” under the Securities Exchange Act of 1934, as amended, nor shall it be incorporated into any future filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended, unless the Company expressly sets forth in such future filing that such information is to be considered “filed” or incorporated by reference therein.

Item 9.01 | Financial Statements and Exhibits. |

(d) | Exhibits. |

Exhibit No. | Description | |

99.1 | Corporate presentation of Codexis, Inc. | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 12, 2018 | CODEXIS, INC. By: /s/ Gordon Sangster Name: Gordon Sangster Title: Senior Vice President and Chief Financial Officer | |

EXHIBIT INDEX

Exhibit No. | Exhibit Description | |

99.1 | ||

March 2018 Codexis Corporate Presentation

Nasdaq: CDXS

TM

Forward-Looking Statements

• These slides and the accompanying oral presentation contain forward-looking statements that involve risks and uncertainties. These statements relate to

future events or our future financial or operational performance and involve known and unknown risks, uncertainties and other factors that could cause

our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking

statements. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements

by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” or

the negative of these terms, and similar expressions and comparable terminology intended to identify forward-looking statements. These forward-

looking statements represent our estimates and assumptions only as of the date hereof, and, except as required by law, we undertake no obligation to

update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

• Other factors that could materially affect actual results, levels of activity, performance or achievement can be found in Codexis’ Form 10-K for the period

ended December 31, 2016 filed with the SEC on March 9, 2017 and Form 10-Qs filed with the SEC on May 9, 2017, August 9, 2017 and November 9,

2017, including under the caption “Risk Factors.” If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect,

actual results, levels of activity, performance or achievement may vary significantly from what we projected.

• Our logo, “Codexis,” “CodeEvolver®,” and other trademarks or service marks of Codexis, Inc. appearing in this presentation are the property of Codexis,

Inc. This presentation contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other

companies’ trade names, trademarks or service marks to imply relationships with, or endorsement or sponsorship of us by, these other companies.

2

Employees

~120 (70 in R&D)

Company History

16+ Years

Cumulative Investments

> $500m

2018 Revenues (Forecast)

Total = $60-63 million

5Yr CAGR: 13-15%

Patents & Applications

> 1100 worldwide

Codexis – Unlocking the Power of ProteinsTM

3

4

Proteins – Infinite Source of New Value Creating Materials

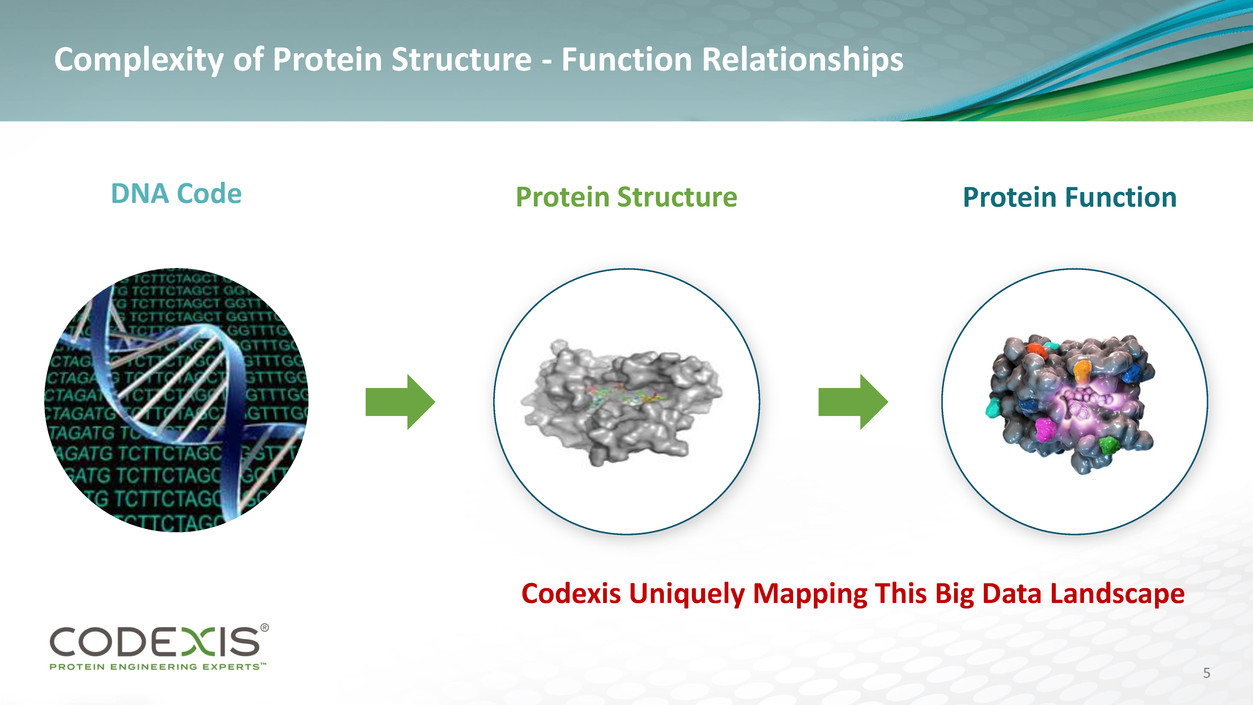

Complexity of Protein Structure - Function Relationships

DNA Code Protein Function Protein Structure

Codexis Uniquely Mapping This Big Data Landscape

5

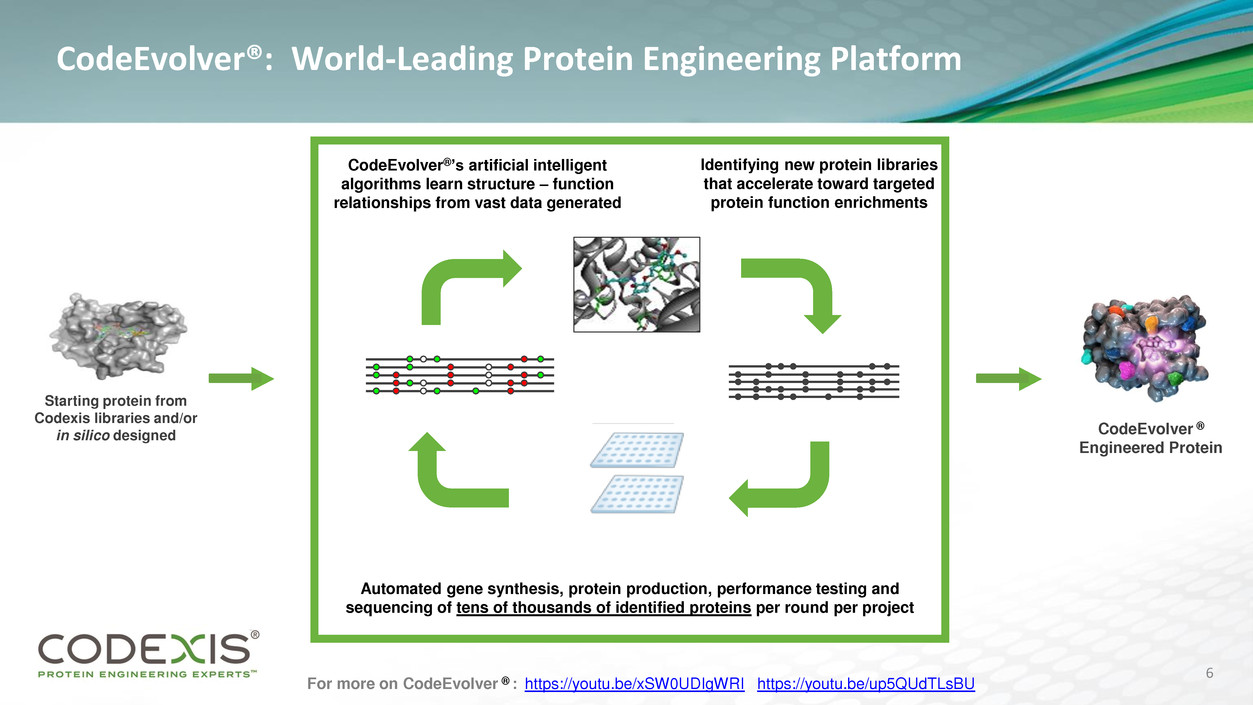

CodeEvolver®: World-Leading Protein Engineering Platform

Starting protein from

Codexis libraries and/or

in silico designed

Identifying new protein libraries

that accelerate toward targeted

protein function enrichments

Automated gene synthesis, protein production, performance testing and

sequencing of tens of thousands of identified proteins per round per project

CodeEvolver®’s artificial intelligent

algorithms learn structure – function

relationships from vast data generated

CodeEvolver ®

Engineered Protein

For more on CodeEvolver ® : https://youtu.be/xSW0UDIgWRI https://youtu.be/up5QUdTLsBU

6

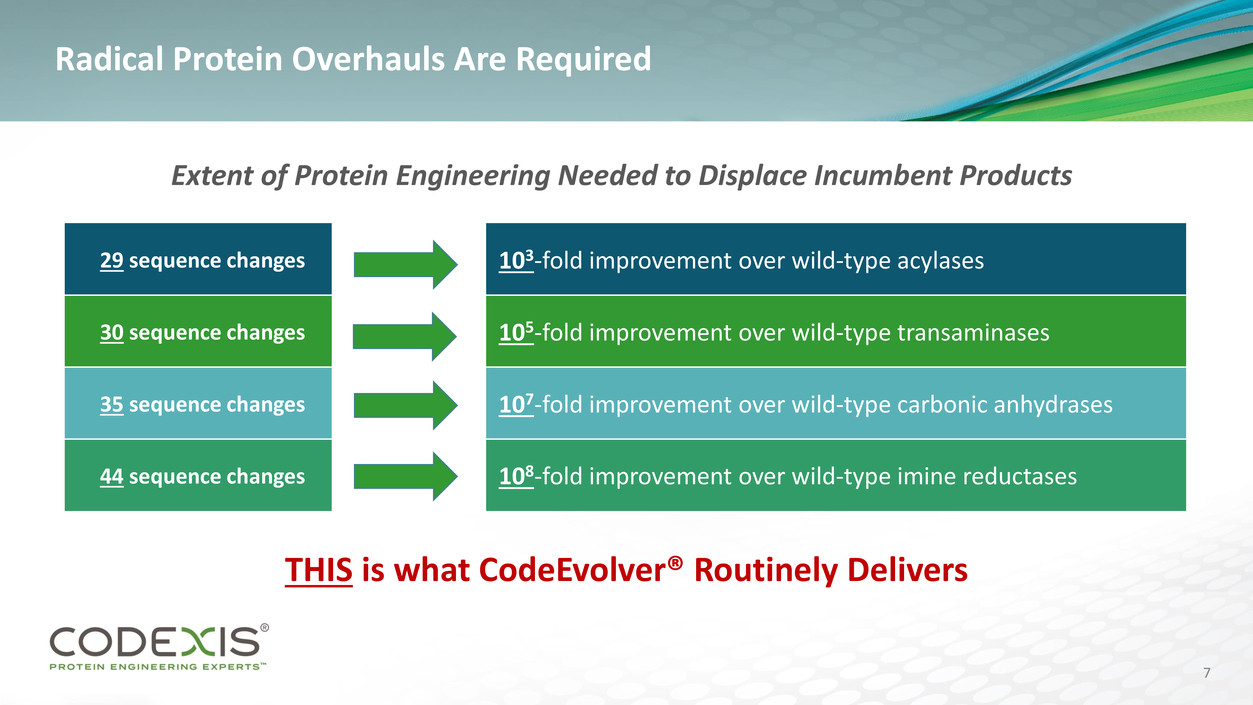

Radical Protein Overhauls Are Required

THIS is what CodeEvolver® Routinely Delivers

Extent of Protein Engineering Needed to Displace Incumbent Products

29 sequence changes 103-fold improvement over wild-type acylases

30 sequence changes 105-fold improvement over wild-type transaminases

35 sequence changes 107-fold improvement over wild-type carbonic anhydrases

44 sequence changes 108-fold improvement over wild-type imine reductases

7

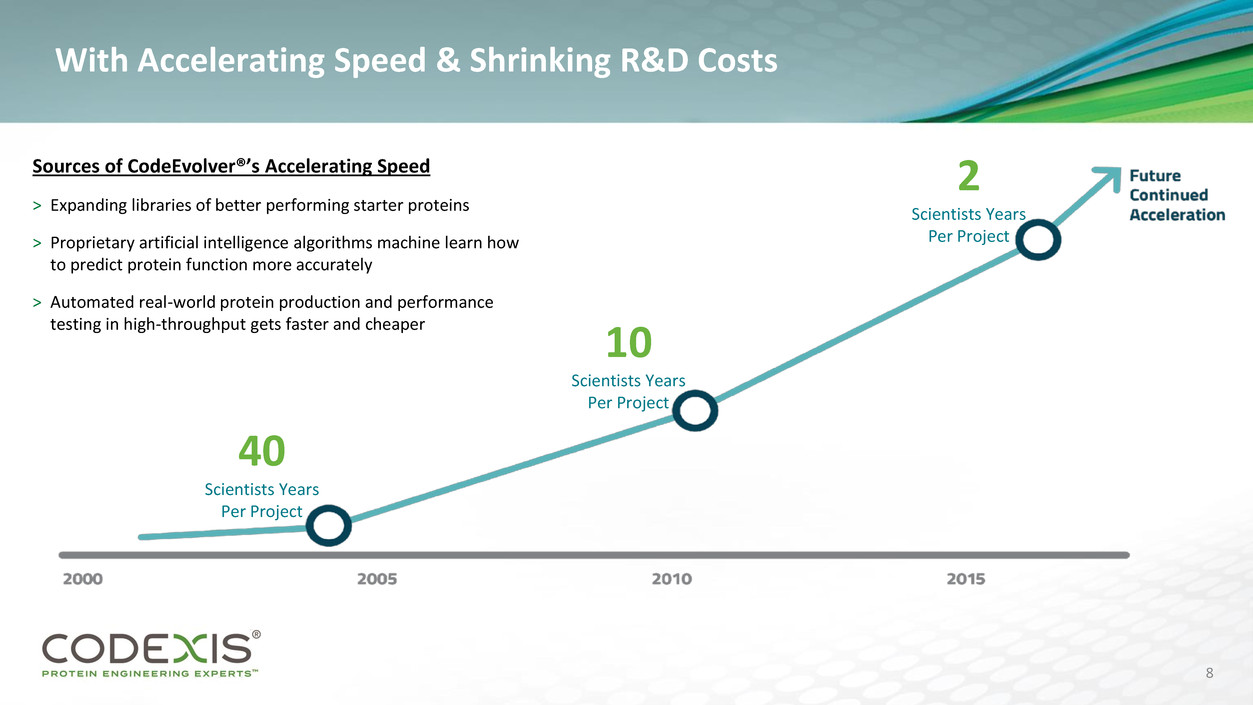

With Accelerating Speed & Shrinking R&D Costs

40

Scientists Years

Per Project

10

Scientists Years

Per Project

2

Scientists Years

Per Project

Sources of CodeEvolver®’s Accelerating Speed

> Expanding libraries of better performing starter proteins

> Proprietary artificial intelligence algorithms machine learn how

to predict protein function more accurately

> Automated real-world protein production and performance

testing in high-throughput gets faster and cheaper

8

9

Accelerating Protein Targets Leveraging CodeEvolver®

Novel, High Performing Industrial Enzymes

Biotherapeutics

Protein Catalysts for Pharma Manufacturing

History: First non-pharma project 2014

Status: Food 10+% of 2017 sales Diagnostics …

TAM: $4+ bn2 industrial enzymes

Comps: Novozymes, Dupont, DSM, Amano

History: 1st target starts 2014; expanded 2017

Status: Pipeline six deep; lead in phase 1 in 2018

TAM: $5+ bn3 enzyme therapeutics

Comps: Biomarin, Shire, Sanofi-Genzyme, Ultragenyx

History: Codexis making the market for 16+ yrs

Status: Accelerating and deepening penetration

TAM: $1+ bn1 can improve > ⅓ of all small molecule drugs

Comps: Limited direct; some in-house big pharma R&D

1) Codexis estimates

2) Markets and Markets Report FB2277, Oct 2016

3) Mordor Intelligence, https://goo.gl/3867rV, Sep 2016

10

Codexis Protein Businesses Leveraging CodeEvolver®

Solid, Accelerating

Financial Base

Protein Catalysts for Pharma Manufacturing

Codexis: A Leader in Pharma Protein Catalysts

Hazardous

Chemicals

Waste

Protein Catalyst Processes

• Lower impurities

• Higher yields

• Fewer process steps

• Less waste

• Energy efficient

Traditional Chemical Process

Hi Pressure

Reactors

Minimal

Waste

Codexis Protein Catalyst Process

Lo Pressure

CSTR

Engineered

Protein

Catalyst

ZERO activity from all starter protein sources

> 10%: higher yield / lower waste & energy

> 50% higher volumetric productivity

Stable in high temp + high organic solvent load

Expensive, toxic chemo-catalyst replaced

No new factory needed to support growth

Merck’s Januvia®

Codexis’ Award Winning Pharma Process Commercialization

“ …[Codexis] helped avoid the cost of

building a 2nd factory to meet the rising

demand for Januvia®.”

Skip Volante, Merck VP R&D

11

Protein Catalyst Pharma Penetration Metrics 2016 2017

2018

(forecast)

Product Sales ($m/yr) 1 ~ $15 ~ $24m

+

Gross Margin on Product Sales (%) 2 36% 46%

# Pharma Customer’s Products Using > $500k of Product 1 4 12

# API’s Commercially Using Codexis 3 7 7

Pre-commercial (phase 2 or later) Pipeline Projects 3 10 15

# Pharma Customers w/ Dedicated Protein Engineer Teams 1 3

# Pharma Customers w/ CodeEvolver® Platform License 2 2

# CodeEvolver® Licensees Generating > $1m Backends 0 0 1

Pharma Protein Catalyst Business: Solid, Accelerating Financial Base

1) Excludes product sales into food application

2) Gross margin on all product sales (includes sales into food)

3) See pipeline snapshot appendix; first three pharmaceutical manufacturing rows only

Platform deals’ 100% margin backends kick in

Deeper R&D access deals with elite customers

Momentum of Codexis catalyst installations

Acceleration of core P&L measures

12

13

Codexis Protein Businesses Leveraging CodeEvolver®

Novel, High Performing Industrial Enzymes

Protein Catalysts for Pharma Manufacturing

History: First non-pharma catalyst project 2013

Status: Food 10+% of 2017 sales Diagnostics …

TAM: $4+ bn 2 industrial enzymes

Comps: Novozymes, Dupont, DSM, Amano

Faster Commercializing,

Larger Protein Targets

Solid, Accelerating

Financial Base

~ $5 Billion

Industrial Enzyme

Sectors

Chemicals & Energy Animal Feed & Health Flavors and Fragrances

Detergents Molecular Diagnostics & Biology

Food and Nutrition

Bring CodeEvolver® Improved Enzymes To Large Existing Markets

14

Codexis Novel Enzymes Enabling

Enhanced Molecular Diagnostics & Biology

Fast Enzyme Commercializations in New Industrial Verticals

2016: Identified opportunity to bring CodeEvolver®

engineered enzymes for the ~ $100m genomic

diagnostic workflow market

2017: First enzyme, a DNA Ligase, engineered and

scaled. Demonstrates 90+% conversions in 3min

vs competitive enzyme at < 50% conversion in >

10 min

2018: DNA Ligase set for market penetration and sales

2018: Second, in a stream of planned enzymes being

engineered and prepped for beta testing

Expect another significant new deal in another

industrial enzyme vertical to be executed in 2018

Codexis Novel Enzymes Enable

Tate & Lyle’s Food Ingredient Innovations

2014: 7 months of CodeEvolver® protein engineering

drove 10-fold reduction in catalyst cost

2015: Lower cost enables Tate & Lyle to launch its

new food ingredient

2017: Sales to T&L for this application are Codexis

2nd largest product sale

2017: Codexis and Tate & Lyle strike second deal to

enable a second, larger new food ingredient

2018: 2nd project’s enzymes scaling for GRAS

affirmations and T&L commercial scale trials

> 10% of Codexis sales to food industry in 2017

15

16

Proving our Capabilities to

Monetize the World’s Highest

Value Proteins

Novel, High Performing Industrial Enzymes

Biotherapeutics

Protein Catalysts for Pharma Manufacturing

Faster Commercializing,

Larger Protein Targets

Solid, Accelerating

Financial Base

Codexis Protein Businesses Leveraging CodeEvolver®

The Opportunity for CodeEvolver® in Biotherapeutics

Stability

Enhanced half-life in plasma and

lysosome, stable in GI-tract

Safety Reduced immunogenicity

Manufacturability

Optimized biophysical properties

for manufacturing

Convenience

Reduced dosing frequency, more

desirable delivery (ie, oral)

Efficacy Enhanced, tissue-specific activity

CodeEvolver ® Targetable BioTx Characteristics

Enzyme deficiencies: 147

Known

prevalence

655

Bibliographic

data 2,019

Known rare

diseases

~7,000

Substantial Rare Disease Enzyme Targets*

* http://sid.usal.es/idocs/F8/FDO26770/Prevalencia_ER_lista.pdf 17

Oral Enzyme For PKU Successfully Developed & Partnered

Nestlé & Codexis Therapeutic Development Platform Access Partnership Deal (Oct 2017):

Purchased rights to commercialize the oral PKU drug candidate

Up to $357 million in upfront + milestones, plus up to low double digit % royalty on sales

First look rights for Nestlé for other IEAAM programs in Codexis pipeline

CodeEvolver® R&D capacity newly dedicated to novel breakthrough protein targets

“We have partnered with Codexis to accelerate enzyme

innovation for multiple health conditions.”

—Nestlé Health Science

18

Codexis phase 1

trials in 2018

NHSc option

early 2019

Setting Up For More Success From Pipeline

CodeEvolver® Generated in vitro

Candidate Discovery

Preclinical Research IND Enabling Human Trials

19

CDX-6114: Inborn Error of Amino Acid Metabolism Disease, PKU

IEAAM - 3

LSD-2

DT4 Discovery Partnership

Drug Target 1 (DT1) Lysosomal Storage Disease LSD-1

IEAAM - 2

Two Add’l Partnerable Assets in 2019

+ Prospects of other significant new discovery partnering

deals working CodeEvolver® into new biotherapeutic

modalities (outside enzyme therapeutics)

Codexis in 2017: Building Momentum Again

20

2017 Product Sales

+74% vs 2016

$26.7m

2017 Total Revenue

Growth Despite $22.5m in

Non-recurring 2016 Revenues

$50.0m

Performance vs Annual Guidance

Fourth Consecutive Year

2017 Product Margin

Up From 36% in 2016

46%

13 Customer Products Each Use > $500k Codexis Protein Catalysts

Food Industry Generates Greater Than 10% of Revenues

Three Pharma Customers Secure Dedicated Teams (up from one)

Breakout New Partnering Deals Executed:

• Biotherapeutics Partnership with Nestlé Health Science

• Second Major Food Ingredient Partnership with Tate & Lyle

MDx/NGS Enzymes Setup For Successful Market Entry

Capably Building Biotherapeutic Development Capabilities:

• Accelerated CDX-6114 for PKU Towards Phase 1 Trials

• Four More Discovery Programs Move Towards Partnerable Status

Completed $25 Million Financing to Support Growth

2017 Strategic Deliverables

Met

21

Codexis 2018 Financial Outlook

$32

$35

$42

$49

$50

$60

$20

$25

$30

$35

$40

$45

$50

$55

$60

$65

$70

2013 2014 2015 2016 2017 2018F

Total Revenue ($ million)

$63

Total Revenues: $60 - 63m (+20-26% vs 2017)

Product Sales: $25 - 28m (2017 = $26.7m)

Product Gross Margin: 45 - 48% (2017 = 46%)

Revenues: ~35% in 1H’18 / ~65% in 2H’18

R&D + GS&A Expenses: Similar To 2017; ~ Smooth Quarterly

Additional Insights Into 2018 Financial Outlook

2018 Annual Guidance Introduced

22

Codexis Strategic Objectives for 2018

Relentless Focus on CodeEvolver® technology platform, AI-Driven Acceleration of Protein Discoveries

Reinforce our powerful, product-commercializing uniqueness in the world’s growing synthetic biology landscape

Continue Profitable Penetration of Protein Catalysis in Pharmaceutical Manufacturing

Continue expansion of the number of our late-stage installations (Phase 2 to commercial) in our pipeline (22 as of 6/30/17)

Deepen deployment by account: Lightly engaged Project Dedicated team CodeEvolver® deal ( 100% margin backends)

At least one significant new deal executed in 2018

Continue to Broaden our Industrial Enzyme Capabilities Outside Pharma Manufacturing

Food: approach commercialization of the second (larger peak rev) project with Tate & Lyle; again > 10% of total revenues

Diagnostics/NGS: penetration / sales established with our DNA Ligase; launch at least one new product into field

At least one significant new deal in another industrial enzyme vertical executed in 2018

Establish the Significance of our Biotherapeutics Business

CDX-6114 For PKU: start phase 1 trial (mid-2018 - $4m cash); Nestlé Health Science option exercise (early 2019 - $3m); advances from there

Pipeline: at least two additional lead candidates (beyond PKU) are “partnerable” (locked and on way to IND) by 2019

At least one significant new deal working CodeEvolver® platform into new biotherapeutic modalities (outside enzyme therapeutics)

Unlock the power

of proteinsTM

23

Contact Us

John Nicols

President & Chief Executive Officer

• [email protected]

• (650) 421-2388

Gordon Sangster

Senior Vice President & Chief Financial Officer

• [email protected]

• (650) 421-8115

Jody Cain

Lippert Heilshorn & Associates

• Codexis Investor Relations Partner

• [email protected]

• (310) 691-7100

Corporate Headquarters

200 Penobscot Drive

Redwood City, CA 94063

USA

Nasdaq: CDXS

24

Appendix – Most Recent Pipeline Snapshot

25

Codexis Pipeline Snapshot

26

Type of Protein & Target Market

Pre-Commercial Commercial

Pipeline Total

6/30/17

vs. prior pipeline

6/30/16

Codexis Driven

Sustaining

Revenues

Codexis

Self-funded

Customer

Partnered

Product Sales and/or

Licensing

Protein Catalysts Improving Pharmaceutical Manufacturing:

Developmental Drugs in Clinical Phase II or later 10 n.a. 10 + 3

Patented On-the-Market Drugs 1 2 3 -

Generic On-the-Market Drugs 1 3 5 9 + 2

Expanding Industrial Enzyme Verticals:

Protein Catalysts For Food Ingredient Manufacturing 3 1 4 -

Enzymes Enabling Molecular Diagnostic & Biology 1 1 -

Novel Biotherapeutics Discovery & Development 5 1 6 + 2

Pipeline Total as of June 30, 2017 7 18 8 33 + 7

Appendix – Success Stories & Customer Testimonials

27

Capital & Yield Efficiencies Unlocked For Merck’s Januvia®

Capacity constraints in existing sitagliptin

(active ingredient in Januvia) supply chain

• Protein engineered from zero activity to

commercial targets in less than 12 months

• 53% higher productivity

• 19% reduction in energy usage

• Expensive, toxic chemo-catalyst replaced

• No new factory needed to support growth

CHALLENGE SOLUTION

“ …[Codexis] helped avoid the cost of building a 2nd factory to meet the rising demand for Januvia®.”

Skip Volante, Merck VP R&D

28

Major PharmaCo Patented Drug Process Overhaul

Inefficient patented drug

manufacturing process

affecting Top-10 global

pharma company’s profit

margins

• Prior protein libraries: zero activity

• 43 sequence variations required

• Engineered protein results in > 3x lower

cost than customer’s target

• Engineered protein’s temperature

stability to fit reaction conditions

• Expensive, toxic chemo-catalyst replaced

CHALLENGE SOLUTION

Aspirational ‘BLUE SKY’ goal

100,000-fold improvement

Minimum target

2700-fold improvement

Engineered Protein Improvements

Phase II+ Drug Processes Overhauled By Codexis Protein Catalysts: 22 & counting

29

CodeEvolver® Licensing Creates Value Across GSK’s Portfolio

“We chose the Codexis platform after a thorough evaluation of the enzyme evolution landscape...”

Doug Fuerst, GSK Technology Development Lead, Synthetic Biology

CHALLENGE SOLUTION

How to effectively leverage protein

engineering widely across

GSK’s portfolio?

• Licensed the CodeEvolver® platform

• Deeply embedded the technology in house

• Applications from discovery to post launch

• Codexis earns front end and back end economics

• Partnership created around shared vision for proteins

and mutual success of CodeEvolver®

30

Healthier food ingredient requires a

lower cost process to enable the

product launch

• Protein catalyst system engineered to meet commercial

targets in less than 7 months

• 20-fold catalyst stability improvement

• 90+% reduction in catalyst system cost

• Enabled commercial production of the healthy

ingredient < 2 years after 1st project discussion

Tate & Lyle’s New Food Ingredient Launch Enabled

CHALLENGE SOLUTION

“We view Codexis as an extension of our internal R&D programs at Tate & Lyle...”

Michael Harrison, Tate & Lyle SVP, New Product Development

31

Create more sensitive, fluid-based

diagnostic tests: earlier, less

invasive cancer detection

• Codexis DNA ligase converts more input DNA to

double-ligated library fragments than T4 DNA ligase

across a range of sample input concentrations

• Exceptional conversion of low concentration (10 ng)

DNA inputs, ideal for liquid biopsy applications

• Codexis DNA ligase achieves maximal substrate

conversion within 5 minutes, enabling streamlined

NGS workflows

Improving Sensitivity and Precision in Molecular Diagnostics

CHALLENGE SOLUTION

Our DNA Ligase is currently being beta tested by selected customers

Other Molecular Diagnostics enzyme candidates are currently being engineered

32

Besides aggressive dietary control,

no available drug treatment

for > 80% of PKU patients

In the USA ~1:15,000

newborns have PKU, causing

lifelong neurocognitive

symptoms

Therapeutic Enzyme to Treat Phenylketonuria (PKU)

CHALLENGE SOLUTION

“Many individuals with PKU are eagerly awaiting new therapeutic options. CDX-6114 holds the

potential of being an attractive treatment for PKU.”

Dr. Gregory Enns, Professor of Pediatrics, Division of Medical Genetics, Stanford University Hospital

• First CodeEvolver® drug discovery breakthrough

• Stability in GI tract enables convenient oral dosage

• > 50-fold stability improvement, in vitro

• Efficacy demonstrated in four preclinical models

• Human trials targeted to start in early 2018

33

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Codexis to Report First Quarter 2024 Financial Results on May 2

- Skyhigh Security Named a Visionary in the 2024 Gartner® Magic Quadrant™ for Security Service Edge

- Mativ Announces Conference Call to Discuss First Quarter 2024 Results

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share