Comcast is attempting to gatecrash Rupert Murdoch’s takeover of Sky, submitting a rival offer to the UK broadcaster’s shareholders worth about £22bn.

The media and telecoms company, which owns NBC Universal and is the largest cable operator in the US, said its all-cash offer of £12.50 a share represented a 16% premium for Sky shareholders on the offer from Murdoch’s 21st Century Fox.

Fox owns 39% of Sky and submitted its bid to take full control in December 2016, but the deal has been held up by regulatory issues.

Q&AWhat is Comcast and what does it own?

Show

Comcast is the biggest cable company in the US and one of the world’s largest TV, film and entertainment businesses

Revenue (2017): $84.5bn

Profit (2017): $22.7bn

Market capitalisation (26 February 2018): $183.8bn

Employees (December 2017): 164,000

Subsidiaries

Xfinity

US cable business offering TV, broadband, wifi and phone services

Revenue (2017): $52.5bn

Customers (December 2017): 29.3 million – 27.2 million domestic, 2.2 million business

NBC Universal

TV, film and entertainment

Revenue (2017): $28.5bn

NBC

Oldest major US TV network, began broadcasting in 1926. Shows include Saturday Night Live, The Voice, This Is Us and The Good Place.

Cable channels

Include news services MSNBC and CNBC, The Weather Channel (joint venture), Syfy and E!.

Streaming

NBC Universal owns 30% of US on demand TV service Hulu

Universal Pictures

Hollywood studio founded in 1912. Titles include Jurassic World and the Fast and the Furious, Despicable Me and Fifty Shades franchises. Subsidiaries include Focus Features, the indie producer/distributor involved in recent releases including Atomic Blonde; and Working Title, the UK company behind Four Weddings and a Funeral, Baby Driver and Darkest Hour.

NBC Universal International

Production, distribution and channels business outside US. UK subsidiaries include Downton Abbey, The Hollow Crown and The Last Kingdom producer Carnival Films and Monkey, the company behind Made in Chelsea.

Universal Parks & Resorts

Operates theme parks in Los Angeles, Orlando, Japan and Singapore.

Comcast has reportedly been exploring a bid for 21st Century Fox’s entertainment assets, which include Sky and the 20th Century Fox film studio, since the company agreed a $66bn (£47bn) sale to its US rival Disney.

The company, which has 1,300 employees in the UK including the production company behind Downton Abbey, promised that Sky’s headquarters would remain at Osterley in south-west London.

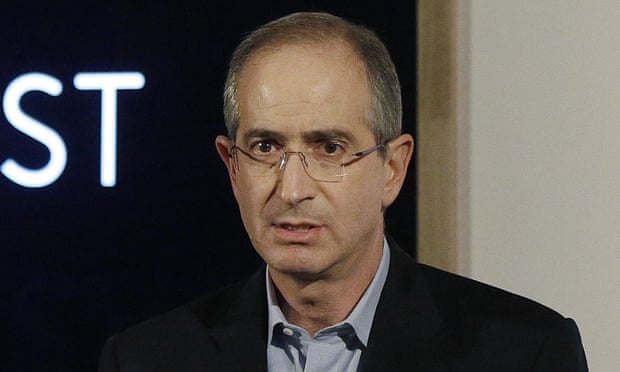

“Comcast intends to use Sky as a platform for growth in Europe. We already have a strong presence in London through our NBC Universal international operations, and we intend to maintain Sky’s UK headquarters,” the company’s chairman and chief executive, Brian Roberts, said.

“Adding Sky to the Comcast family of businesses will increase our international revenues from 9% to 25% of company revenues.

“We would like to own the whole of Sky and we will be looking to acquire over 50% of the Sky shares. We are confident that we will be able to receive the necessary regulatory approvals.”

Comcast would need approval from 82% of Sky’s non-Fox shareholders to achieve a 50% controlling stake.

Sky’s share price surged by 18% in early trading on Tuesday after Comcast’s announcement to more than £13. This is well above both the £12.50 a share Comcast offer and Fox’s initial £10.75 bid, suggesting investors believe Murdoch will make an improved offer to keep his Sky takeover on track.

Following Sky’s £3.57bn deal to secure the lion’s share of the Premier League rights at a 14% discount earlier this month, investors have already called for an increase of between 10% and 25%, up to £13.40 a share. Fox investors similarly believe Disney should also be paying more.

“To avoid the risk of shareholder holdouts, Comcast’s offer needs to be seen as a knockout/full and final offer, as any hint that it would pay more to squeeze out further down the line could result in under 50% acceptances,” said Wilton Fry, an analyst at RBC Europe.

“In our view, Fox will need to counter bid if it wants its offer to gain approval. The ‘wild card’ is whether Disney could make its own direct offer. We believe this unlikely as it is already bidding for Fox’s legacy assets.”

21st Century Fox said said in a statement that it remained committed to its December offer and noted that “no firm offer has been made by Comcast at this point … a further statement will be made as appropriate”.

Murdoch’s protracted bid to take full control of Sky remains mired in regulatory red tape. The UK competition regulator has said the bid raises media plurality concerns because taking full control of Sky News would give Murdoch’s family too much control over UK news media. The family trust controls Fox and News Corp, the publisher of the Sun and the Times.

ProfileHow a London cabbie helped spur Comcast boss's Sky bid

Show

How a London cabbie helped spur Comcast boss's Sky bid

If Comcast is successful in stealing Sky from under Rupert Murdoch’s nose, it appears a London cab driver can take some of the credit.

The Comcast chief executive, Brian Roberts, has admitted that a chat in a taxi in November provided a timely reminder of why Sky is worth the $31bn (£22bn) offer he has now tabled.

“I suggested [to a colleague] that we jump in a taxi and go to one of the malls and get a demo of Sky in one of their shops. And we had a fabulous experience,” Roberts told reporters on a call.

“The cab driver was incredibly knowledgeable about the difference between Virgin [Media] and Sky in every feature,” he said. “We were learning a lot there.

“Then when we to the Sky store, we spent at least an hour going through every feature and comparing it to our own … We were really terribly impressed.”

Roberts said that while it was not the deciding factor in going ahead with the bid, it was “another reminder for me how impressive Sky is”.

The 58-year-old inherited the top spot at Comcast thanks to his father, who founded it as a cable business in the 1960s, but he was made to prove himself before stepping into the boardroom in 2002.

Roberts’s first job was to sell TV subscriptions door to door and climb power poles to put up cables. These days he is worth almost $2bn, taking home about $30m annually.

Still, the Philadelphian has time to indulge in a love of sports (Comcast owns the Philadelphia Flyers ice hockey team), winning a gold and four silvers representing the US at squash at the Maccabiah Games in Israel.

Murdoch has offered to strengthen the independence of Sky News and fund it for 10 years to get approval for the takeover. Sky has previously told the Competition and Markets Authority that it could close Sky News if the deal is not cleared, which would eliminate the media plurality issue at a stroke.

Comcast, which owns the MSNBC and CBNC news networks, said it did not foresee any media plurality or regulatory issues and has pledged to keep Sky News.

“Sky News is an invaluable part of the UK news landscape,” Comcast said. “The company intends to maintain Sky News’s existing brand and culture, as well as its strong track record for high-quality impartial news and adherence to broadcasting standards.”

Tom Watson, the shadow culture and media secretary, said that any Comcast deal would need to be very carefully scrutinised on plurality and broadcasting standards grounds.

“Comcast must demonstrate its commitment to plurality by guaranteeing a properly funded Sky News for at least a decade as a key condition of the sale,” he said.

Disney has signalled to the UK’s Panel on Takeovers and Mergers that if Fox’s deal to take full control of Sky fails, it does not wish to be forced to pursue a full takeover.

Comcast is one of the world’s largest media and telecoms companies, with revenues of $84.5bn in 2017. The company’s US cable business, Xfinity, accounted for $52.5bn of those revenues with its TV, broadband and phone services. It has about 25 million high-speed internet customers.

Comcast moved into broadcasting and film in 2011 with the acquisition of NBC Universal, the owner of the US TV network and Hollywood film studio behind Jurassic World and the Fast and Furious franchise.

The company has said it will increase Sky’s spending on original shows such as Riviera and Fortitude.

NBC Universal has spent more than $1bn on TV and film productions in the UK over the last three years. It owns Carnival Films, the UK production company behind Downton Abbey and The Last Kingdom; the Made in Chelsea producer, Monkey; and Working Title, the British film producer responsible for Four Weddings and a Funeral, Baby Driver and Darkest Hour.

It also owns cable channels including Syfy and E!.

“We hold the management of Sky in high regard and would welcome the opportunity to meet with them and the independent directors of Sky to discuss our plans for the business,” said Roberts. “In due course, we very much hope that the independent directors will recommend our proposal.”

Comments (…)

Sign in or create your Guardian account to join the discussion