From Bloomie:

One of Australia’s biggest money managers is betting the Australian dollar will slide, just as hedge funds ratchet up bets on the currency appreciating.

The Aussie will drop to 73 US cents before the end of the year, according to Ilan Dekell, head of macro for global fixed income at AMP Capital Investors. That’s at odds with leveraged accounts – often hedge funds – that this year have increased bets that pay off if the Aussie strengthens.

Dekell says you need to expect a fall in the local currency for these reasons:

- Rate differentials – as the Reserve Bank holds interest rates at a record low level through the remainder of this year, the US Federal Reserve will hike rates at least three more times

- Australia’s terms of trade is declining

- Market volatility is at elevated levels, piling more pressure on the Aussie, which typically performs poorly during risk-off periods

“If I look at the positives for the Aussie dollar, they’re just not there any more,” Sydney-based Dekell, who oversees about $52 billion of AMP Capital’s $179 billion in funds management assets, said in an interview on Wednesday.

“We expect Australia to be an underperformer.”

Quite right. As yields spreads widen on the tightening Fed, and iron ore plus coking coal fall with a slowing China, the downside is obvious. My best guess is 70 cents by year end. Lower next year.

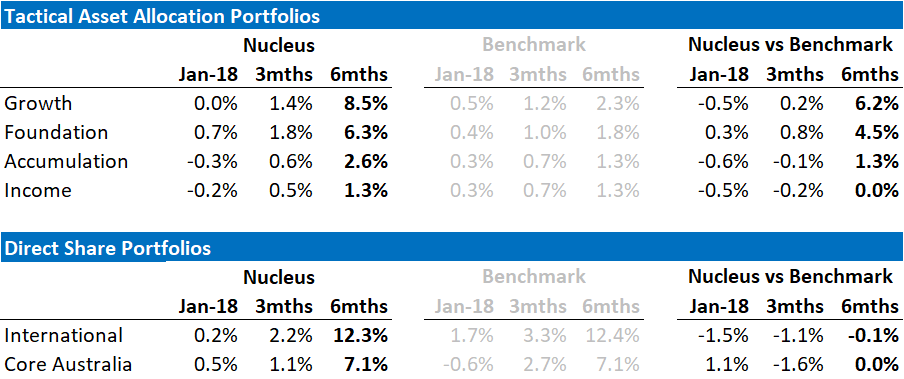

David Llewellyn-Smith is chief strategist at the MB Fund which is currently overweight international equities that will benefit from a weaker AUD so he definitely talking his book. Fund performance is below:

If these themes interest you then contact us below.

The information on this blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance.