The Trade Idea: After last week’s development in OIL’s Quantitative Gravity, I would avoid crude oil altogether and iPath S&P GSCI Crude Oil Total Return Index ETN for the time being, writes Landon Whaley of Focus Market Trader.

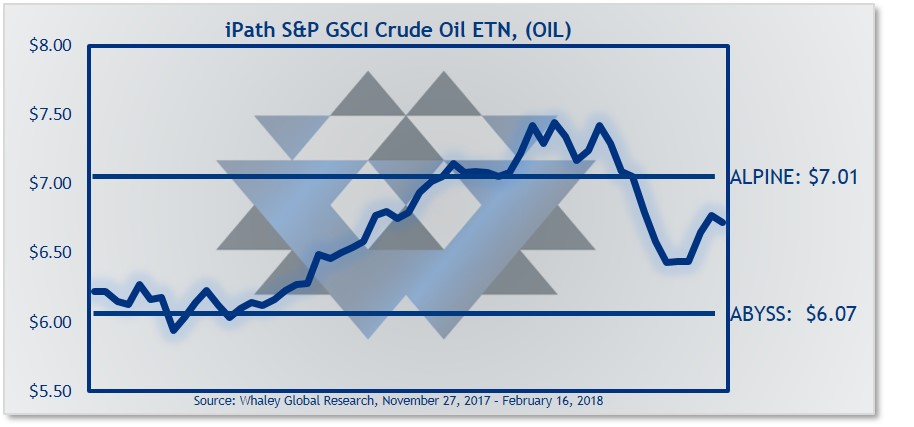

The iPath S&P GSCI Crude Oil Total Return Index ETN (OIL) gained 5.8% last in the week ending February 16 and has gained 3.98% to start 2018.

The Gravities

OIL’s Fundamental Gravity is leaning slightly bullish because of U.S. supply data and the current market structure, which makes it profitable to be long oil, even if price remains flat.

Quantitatively, I saw something last week that historically leads to lower prices. Specifically, while price went higher last week, OIL made a lower high for the first time in five months. Alongside the lower high in price, crude oil’s volatility made a higher lower and is trending bullish. To be clear, it doesn’t get more quantitatively bearish than when price rallies alongside volatility.

Behaviorally, retail investors have pulled $230MM from OIL during 2018 but institutional investors remain massively long oil futures.

The Bottom Line

OIL’s Fundamental Gravity is mildly bullish, the QG is shifting to a bearish stance and the Behavioral Gravity is bearish, because of investors’ overly bullish behavior.

When the three Gravities stack up this way, we shift to a neutral bias and head to the sidelines.

The Trade Idea

After last week’s development in OIL’s Quantitative Gravity, I would avoid crude oil altogether for the time being.