How the Medical Expense Tax Deduction Affects the Healthcare Industry

According to AARP, around 75% the population claiming these medical expense deductions from their income are 50 years or older.

Dec. 13 2017, Updated 2:10 a.m. ET

Medical deductions

Currently, taxpayers can deduct medical expenses on their income tax returns, potentially reducing their tax burden. However, the tax reform bill passed by the House of Representatives in November 2017 would eliminate this tax deduction.

However, the Senate bill passed on December 2, 2017, broadens this deduction for the 2017 and 2018 tax years. The bill allows medical expense deductions on total medical bills exceeding 7.5% of the taxpayer’s adjusted gross income compared with the current 10.0% threshold.

The differences in the two bills need to be reconciled for preparation of the final bill. This bill would be passed by the Senate and the House of Representatives before being presented to the President Trump for his signature.

Industry impact

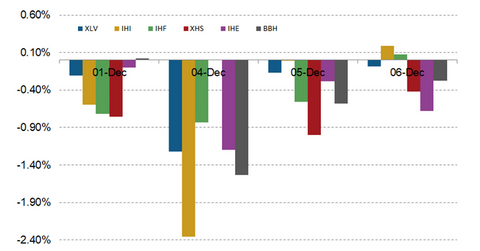

These events could trigger share price movement for the iShares US Healthcare ETF (IYH), which tracks the Dow Jones U.S. Health Care Index. As of December 9, 2017, IYH has returned approximately -0.43% since the tax reform bill was passed in the Senate on December 2, 2017.

In case of absence of these tax deductions, people are expected to reduce spending on deductible medical care, which could impact the medical technology companies such as Medtronic (MDT) and Intuitive Surgical (ISRG), as well as pharmaceuticals giants such as Pfizer (PFE) and Merck (MRK).

Tax deduction repeal savings

The tax deduction currently available to people with medical expenses exceeding 10.0% of their adjusted gross income is only available to those who itemize their deduction. For those taxpayers who don’t itemize or whose medical expenses don’t meet the threshold, the potential repeal of this deduction may not have a wide-ranging effect.

According to the IRS, around 8.8 million people claimed medical expense deductions on their income tax returns in 2015. However, the total amount of deductions came in at ~$87 billion. In the absence of these deductions, increase tax revenues could help the federal government offset the corporate tax cuts.

Population profile claiming these deductions

According to AARP, around 75% the population claiming these medical expense deductions from their income are 50 years or older. More than 70% of taxpayers claiming these deductions are in the income group earning less than $75,000.

Most of these expenditures are estimated to be for long-term care, which can be costly and may not be covered by health insurance.