Chinese textile major Shandong Ruyi to take control of Victor Fung’s struggling menswear retailer Trinity

Victor Fung and his family’s holding in menswear retailer will fall below 20pc

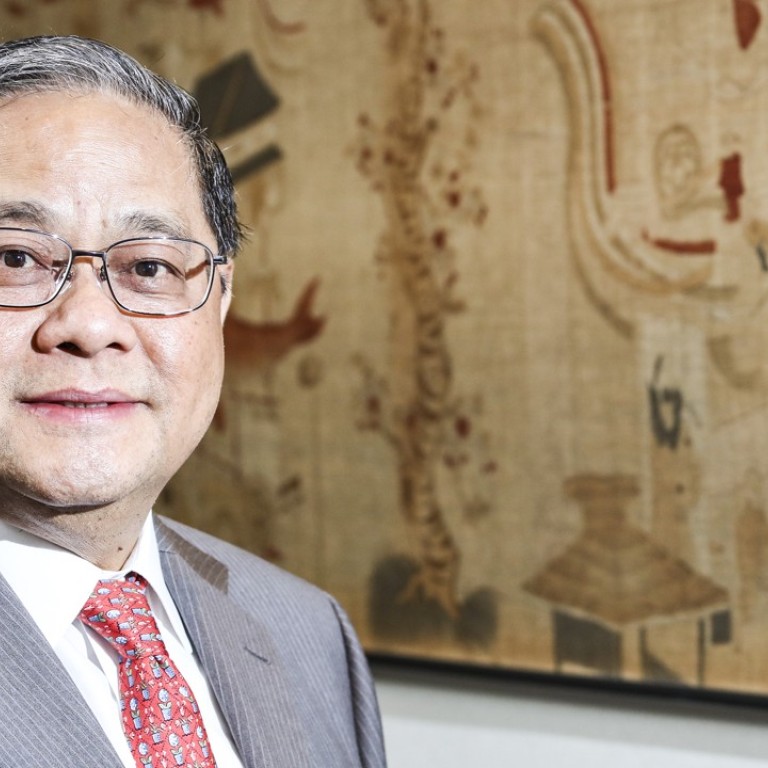

Shares of Hong Kong tycoon Victor Fung Kwok-king ’s menswear retail unit Trinity surged as much as 32 per cent after Shandong Ruyi Group, one of China’s largest textile firms, agreed to take control of the firm struggling to cope with fast shifting consumer behaviour.

Shandong Ruyi, 51 per cent owned by chairman Qiu Yafu, has agreed to buy 1.85 billion new Trinity shares at HK$1.2 each, totalling HK$2.22 billion.

The deal, when completed, will give Shandong Ruyi 51 per cent control over Trinity, while Fung and his family members will see their combined stake diluted from 40.95 per cent to 19.79 per cent.

“Our investment in Trinity will mark a significant milestone in our continued efforts to expand our business from being the leading upstream textile manufacturer in China to a long-term global player in the downstream global menswear market,” Qiu said in a statement late on Thursday.

“It will also mark a major step in further internationalising Ruyi Group’s business and brand portfolio.”

The selling price represented a 60 per cent premium to Trinity’s closing price of 75 cents on Wednesday before trading was suspended.

The stock was trading 16 per cent higher at 87 HK cents in morning trading on Friday, after reaching as high as 99 cents soon after market opening.

Trinity operates retailing and licensing businesses in Greater China and Europe selling menswear brands such as Cerruti 1881, Gieves & Kawkes and Kent & Curwen.

Just over two years ago Trinity signed soccer legend and fashion icon David Beckham in a five-year deal to be the face of the Kent & Curwen label.

It saw net loss widen to HK$257 million in the year’s first half from a loss of HK$200 million in the same period last year, amid what it called a “depressed retail environment” in the mainland - its biggest market.

Trinity is a sister firm of Li & Fung, the 111-year-old global merchandise sourcing and logistics services provider.

“Today’s consumer is very different from the customer we dressed and appealed to even five years ago,” Trinity said in its interim results filing. “All our brands … are responding to the increasingly casual way men are dressing around the world and this development will be crucial to our return to profitability.”

Shandong Ruyi has grown from a modest textile factory set up 45 years ago into a major integrated textile empire spanning raw material cultivation, textile processing and design, marketing of brands and apparel.

Operating 3,000 retail points of sale in Asia-Pacific, it has three listed subsidiaries in China, France and Japan.

Last year it acquired a majority stake in French fashion group SMCP - the parent company of Sandro, Maje and Claudie Pierlot.

Trinity said after the deal, it may have “possible cooperation” with Shandong Ruyi “to leverage on its wide range of operations globally”.

It plans to use the shares sale proceeds to retire debt, fund potential acquisitions and bolster working capital.