To receive Tyler’s analysis directly via email, please SIGN UP HERE

Canadian Dollar Talking Points:

- USD/CAD Price Forecast: upside favored toward 1.3000 above 1.2666

- Bank of Canada caution causes Loonie losses to pile up across the board

- Canadian Dollar falls over 1% vs. GBP, NOK, & USD after BoC announcement

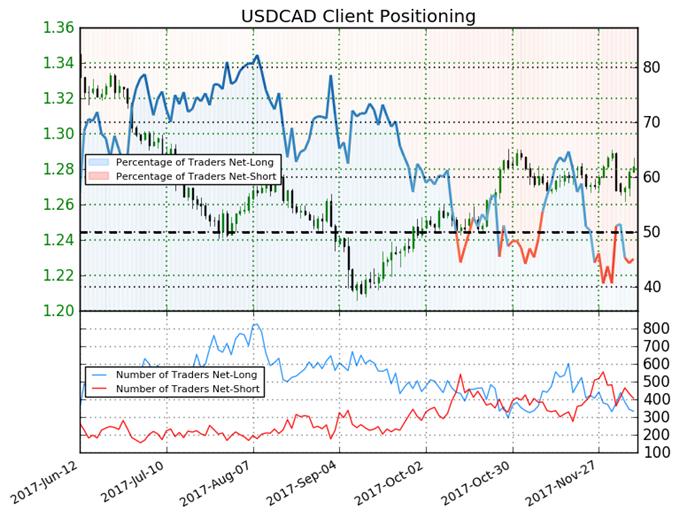

- Sentiment Highlight: net-bearish bias in retail positioning provides ST bullish outlook

The Canadian Dollar rate has fallen across the board after a cautious Bank of Canada aligned with multiple factors that could put further pressure on the CAD. Despite sharp gains last Friday in CAD due to impressive employment gains, the Canadian Dollar rate fell below 1.28 to the USD.

Canadian Dollar Losses Extend On Compounding Factors

Key drivers of Canadian Dollar weakness in global markets a day after the Bank of Canada left rates unchanged were commodities selling off led by metals like Gold and Copper and the spread between US Treasury 2 year yields and CA 2 year yields widened showing the market believes tightening in the coming years will favor the Federal Reserve. While small on absolute terms, the U.S.-Canada 2-year sovereign rate spread widened to32bps vs. 26bpsbefore Wednesday’s BOC rate decision showing a market forces favor USD for now.

Another persistent concern among Canadian Dollar rate traders are deteriorating NAFTA negotiations, which prompted Prime Minister Trudeau to suggest a Canada-U.S trade deal remains possible if NAFTA fails.

Unlock our Q4 forecast to learn what will drive trends for the US Dollar through year-end!

Canadian Dollar Forex Forecast

When analyzing the USD/CAD price chart, traders can see an erosion of sellers below 1.2650 where the price has found support since November. A short-term bullish target would be 1.2927, the 50% retracement of the 2017 range of 1.3793-1.20613. A break above 1.2927 would favor a move above the 200-DMA (1.2956) toward 1.3130, which is the 61.8% retracement of the previously mentioned range.

Only a breakdown below 1.2650 on a closing basis for USD/CAD would adjust the bullish forecast.

USD/CAD Chart: Multiple Fundamental Factors Weaken CAD and push USD/CAD Higher

Chart created by Tyler Yell, CMT. Tweet @ForexYell for comments, questions

Valuable Insight from IG Client Positioning for USD/CAD

Retail trader data shows 45.1% of traders are net-long with the ratio of traders short to long at 1.22 to 1. We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise.

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To attend Tyler's webinars where he covers influential stories driving marketrs, go here: Webinar Calendar

Contact and discuss markets with Tyler on Twitter: @ForexYell