Woolworths Limited (ASX: WOW) and Wesfarmers Ltd (ASX: WES) are stable businesses, providing a service for millions of Australians. But should they be in your portfolio?

Woolworths V. Wesfarmers since the GFC

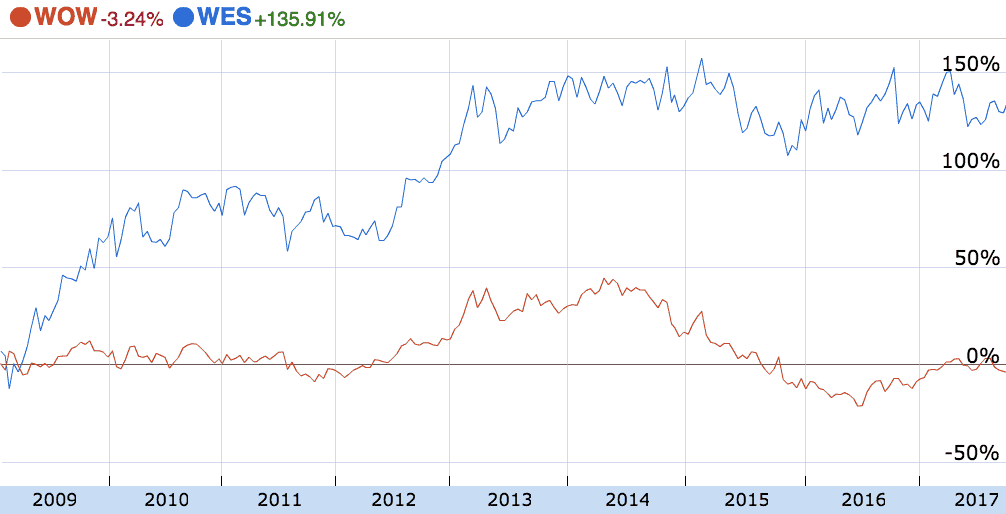

Since the depths of the Global Financial Crisis (GFC), the performance of Woolies and Wesfarmers has been at odds.

Wesfarmers, the owner of Kmart, Target, Coles, Bunnings and more, has more than doubled to become a near $50 billion company. Meanwhile, Woolworths, having failed at its attempt to break into the hardware market, hasn't done much at all.

Wesfarmers

Bunnings Warehouse is rapidly becoming the jewel in the crown for Wesfarmers. With its local dominance now almost set in stone thanks to the departure of Masters, Bunnings is taking to the Irish and UK markets. Coles, still the company's primary revenue generator, has thrived under Wesfarmers' guidance since 2007.

In the year ahead, Wesfarmers is tipped to pay dividends equivalent to 5% fully franked.

Woolworths

Having closed Masters and sold Home Timber and Hardware Woolworths is getting back to what it does best: supermarkets and liquor. Unfortunately, its Big W business continues to lag behind its key rival Kmart.

In recent years, profit from Woolworths' Australian supermarkets has fallen as it lowered profit margins in an attempt to stymie the growth of Coles and Aldi. In the year ahead it is forecast to pay dividends of 3.4% fully franked.

Foolish Takeaway

As I showed here, I do not think Woolworths shares are good value at current prices. And the same could said of Wesfarmers. While Wesfarmers is certainly my pick of the two, I can't get passed its current valuation. Not when there are plenty of other quality companies listed on the ASX and internationally.