USD/JPY has posted slight losses in the Monday session. In North American trade, the pair is trading at 108.91, down 0.28% on the day. On the release front, it’s a quiet start to the trading week. Japanese All Industries Activity Index rebounded in June, posting a gain of 0.4%, just shy of the forecast of 0.5%. There are no US releases on the schedule.

The Japanese yen, a safe-haven asset, had a busy week in response to geopolitical events. The yen lost ground early in the week, as tensions between the US and North Korea eased after saber-rattling between the two countries raised fears of a military confrontation between the two foes. However, the yen was back in demand late in the week, following the deadly car-ramming attack in Barcelona, which killed 13 people and has set Europe on edge. The markets have settled down, but any escalation in tensions in the Korean peninsula or another terror attack in Western Europe could trigger heavy buying of the Japanese currency.

With the markets unsure about whether the Federal Reserve will raise rates once more this year, analysts will be carefully monitoring anything coming out of the Fed. They won’t have to wait long, as central bankers gather in Jackson Hole, Wyoming on Wednesday. The odds of a December hike are at just 44%, according to the CME Group (NASDAQ:CME). Aside from interest-rate policy, the markets will be looking for clues regarding the Fed’s balance sheet of $4.2 trillion. Policymakers have said they plan to start reducing the balance sheet this year, and the trimming could begin as early as next month. A reduction in the balance sheet should benefit the dollar, as a trim of $60 billion is equivalent to a rate increase of 25 basis points.

USD/JPY Fundamentals

Monday (August 21)

- 00:30 Japanese All Industries Activity. Estimate 0.5%. Actual 0.4%

*All release times are GMT

*Key events are in bold

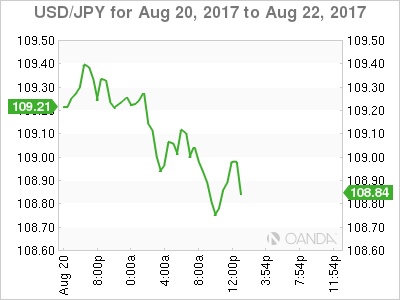

USD/JPY for Monday, August 21, 2017

USD/JPY August 21 at 12:20 EDT

Open: 109.21 High: 109.43 Low: 108.64 Close: 108.87

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 106.28 | 107.49 | 108.69 | 110.10 | 110.94 | 112.57 |

USD/JPY was flat in the Asian session. The pair edged lower in European trade and is showing little movement in the North American session

- 108.69 was tested earlier in support. It is a weak line

- 110.10 is the next resistance line

Current range: 108.69 to 110.10

Further levels in both directions:

- Below: 108.63, 107.49 and 106.28

- Above: 110.10, 110.94, 112.57 and 113.55

OANDA’s Open Positions Ratios

USD/JPY ratio is showing slight movement towards short positions. Currently, long positions have a majority (64%). This is indicative of trader bias towards USD/JPY reversing directions and moving upwards.