If you could invest in just one fund, what would it be?

22nd June 2017 10:43

A question we have been posing ourselves is if you could select just one equity fund, what would give you the best possible chance of receiving a decent risk-adjusted return?

After much thought and considerable debate, a strong contender was a global smaller companies fund. Smaller companies, which are typically those with a market cap between $300 million (£238 million) and $2 billion (£1.59 billion), can often grow their earnings faster than their larger-cap counterparts.

A recent study by broker Numis and the London Business School showed that UK smaller company shares, for example, have delivered better total returns than larger companies over more than 60 years.

Small companies are inherently more nimble, dynamic and innovative, so can more easily expand into new geographies, launch new products or services, or venture overseas, which can make a huge difference to the bottom line.

Small-caps also offer a wide opportunity set – there are more than 4,000 small-cap companies globally. In addition, because fewer equity analysts cover these companies, they are less efficiently researched. That can lead to greater market inefficiencies and greater scope for active fund managers to spot anomalies and identify undervalued stocks.

One could describe small-cap investing as like parenting. When companies are at a very early stage, they are problematic. Likewise, any parent will tell you the 'terrible twos' is a difficult time. And once companies get too big, they are then like teenagers, becoming potentially hard to manage. But in between these two phases is a potential sweet-spot for parents and investors alike.

A lack of liquidity in smaller company shares can also deter larger investors and make it a fertile hunting ground for those stock pickers. Smaller companies are also often merger and acquisition targets.

These returns typically go hand in hand with greater volatility, but if you're adopting a long-term horizon it seems a reasonable approach.

Smaller companies in the US and UK, for example, are dependent on the domestic economy, and those in emerging economies such as China, Brazil and India are affected by the strength of the US dollar and commodity prices, so the global nature of these funds goes a long way to eliminating regional risk, allowing investors to participate in global growth of smaller companies via a diversified portfolio.

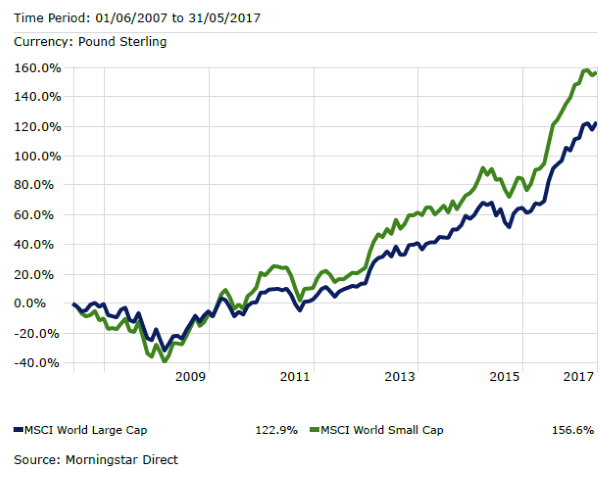

MSCI World Large Cap vs MSCI World Small Cap 10-year performance

Funds such as and tap into a broad range of these exciting global opportunities, gaining exposure to some of the world's fastest-growing companies.

The Invesco Perpetual fund has its asset allocation set by manager Nick Mustoe, with each of six underlying portfolios managed by a regional team. The underlying managers have total discretion over stock selection, investment style and portfolio construction.

The fund is typically highly diversified, with between 350 and 450 stocks. Currently it has a 33% allocation to the US, 13% in Japan, 11% UK, 5% France and a 4% weighting to China.

Overseen by Peter Ewins, director of F&C's smaller company division, the F&C fund is the UK's largest specialist global smaller companies investment trust.

During 2016 the portfolio's exposure to North America rose to 45%, mainly at the expense of its UK holdings, which fell to 25%. This has since been pared back to 40%. The trust has a slightly lower-than-average weighting to Europe at 12%, but higher exposure to Japan at 8%, with the rest spread across other Asian markets. It is well diversified, with nearly 200 holdings.

Global smaller companies markets ended May in positive territory as strong company earnings growth supported optimism in the global economy.

All the main regions reported their strongest first quarter earnings growth in nearly six years, helped by a rebound in global activity. Some potential headwinds to the global growth story remain, with Brexit negotiations beginning here and US President Donald Trump's ability to implement spending and tax-cut plans far from certain.

But with the US economy growing more strongly in the first quarter than previously thought, and the US Federal Reserve raising interest rates in June, the US could once again be poised to lead a global recovery and a boost for global small companies.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks