Just as I had hoped and anticipated, the Banco de Mexico hiked its interest rate to 7.0% on June 22nd and kept pace with the U.S. Federal Reserve’s rate hike. Apparently, this rate hike was not a news flash. According to Reuters, the consensus opinion also anticipated a rate hike:

“Analysts expected Mexico would match the Fed’s quarter-point rate hike last week in a bid to maintain the appeal of peso-denominated debt to yield-hungry investors.”

Now the question is the future path for rate hikes. Banco de Mexico suggested that rates are now high enough to contain a spike in inflation that has risen to 6.3% (the highest since 2009) and guide the economy back down to the 3% target. Reuters quoted Governor Agustin Carstens from a Bloomberg article:

“‘We believe that where we are now will lead us to the 3 percent (inflation target) level at some point. We are ready to make the statement that up to today we think it is sufficient but we will be very vigilant.'”

The peso strengthened accordingly against the U.S. dollar but only after an initial intraday “sell the news” reaction. The resulting rise in USD/MXN allowed me a fresh opportunity to fade and get a cheaper starting point for taking advantage of the next round of peso strength. I locked in the profits during Friday’s continuation selling in USD/MXN.

The Mexican peso strengthened against the U.S. dollar in the wake of the seventh rate hike in a row from the Banco de Mexico. USD/MXN has not made a fresh low yet though.

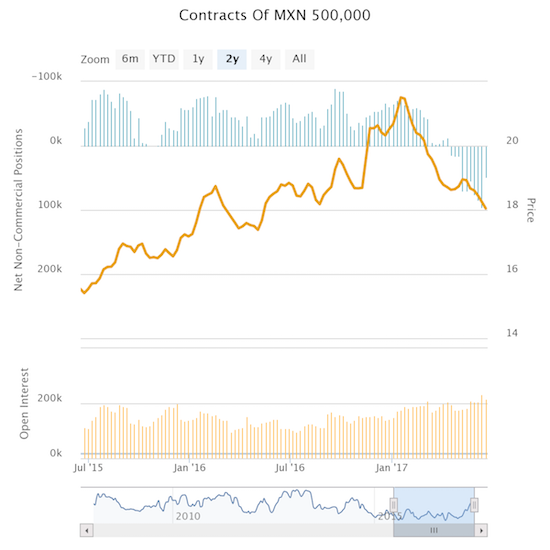

Interestingly, speculators harbored the same hesitation I had going into the Banco de Mexico statement on monetary policy. Mexican peso bulls significantly withdrew with net long contracts dropping from 95,814 to 48,985, a near 50% cut.

Speculators retreated on net shorts ahead of the Banco de Mexico’s statement on monetary policy. I expect these shorts to rebuild.

This retreat completes a sweet spot for USD/MXN that includes a clear downtrend, yields high enough to continue encouraging carry trades against a wobbly U.S. dollar, and fresh upside for speculators to rebuild net shorts. While I am content to fade bouts of strength in USD/MXN, I prefer USD/MXN to achieve a clear breakdown to a new low. At that point I will again feel very comfortable aggressively shorting USD/MXN. If the downtrending 20-day moving average (DMA) continues to provide overhead resistance, USD/MXN could set that new (13-month) low in another two weeks or so.

Be careful out there!

Full disclosure: no position