Energy XXI Gulf Coast releases Q1 results

Energy XXI Gulf Coast, Inc. (ticker: EXXI), the post-bankruptcy incarnation of Gulf of Mexico operator Energy XXI, reported operational and financial results for the first quarter of 2017.

Highlights:

- Produced an average of approximately 41,000 barrels of oil equivalent (“BOE”) per day in the first quarter of 2017, of which 71% was oil

- Reported cash and cash equivalents of $160.5 million at March 31, 2017

- Reestablished a commodity hedging program in February 2017 by entering into costless collars for 10,000 barrels of oil per day from March 2017 to December 2017

- Contracted a rig to begin development drilling program, spudding first well in early June

For the first quarter, Energy XXI Gulf Coast (EGC) reported a net loss of $65.3 million, or ($1.97) per diluted share while Adjusted EBITDA totaled $42.6 million. The first quarter loss includes a non-cash ceiling test impairment charge of $44.1 million primarily related to the decrease in SEC proved reserves and the present value of those SEC proved reserves discounted at 10% (“PV-10 Value”) relative to the estimated reserves prepared by EGC’s internal reservoir engineers as of year-end 2016. EGC recently received the final results of its independently engineered reserves report prepared by Netherland Sewell and Associates as of March 31, 2017.

“After over a year of minimal capital spending on drilling projects, we will soon spud our first development well in 2017 and remain confident in our strong, oil-weighted asset base,” EGC’s CEO and president Douglas E. Brooks said. Brooks was named the new CEO of the company last month.

Total revenues for the first quarter of 2017 were $157.9 million, which includes a $3.7 million gain on derivative financial instruments.

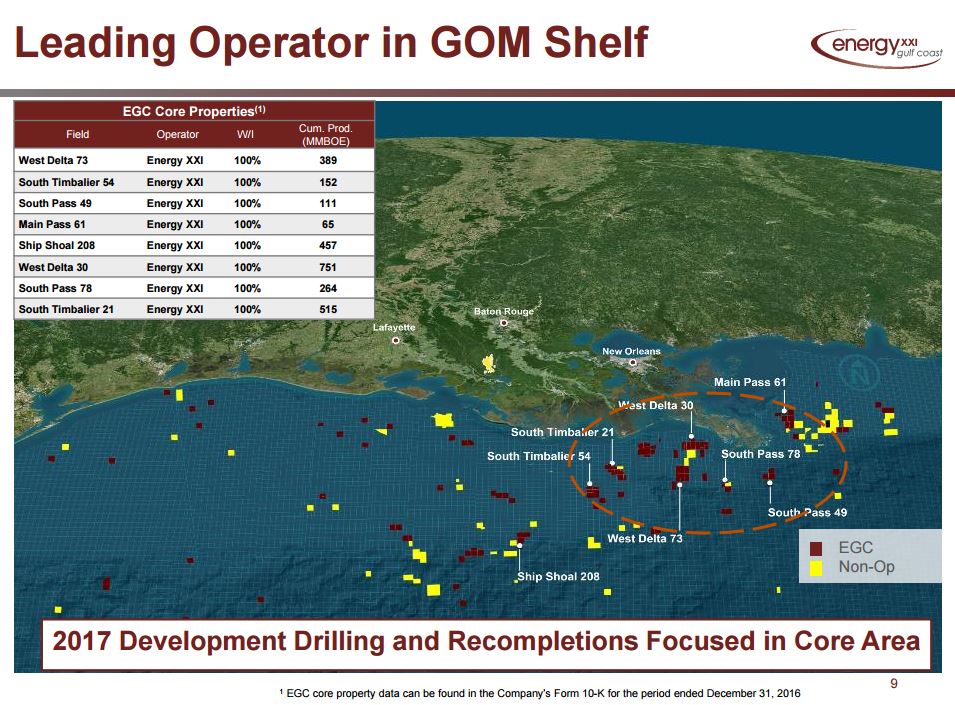

EGC said its 41,000 net BOE per day Q1 production which was comprised of 29,100 barrels of oil (“BBL”) at an average realized price of $51.04 per BBL (before the effect of derivatives), 900 barrels of natural gas liquids (NGL’s) at an average realized price of $27.52 per BBL, and 65.9 million cubic feet of gas (“MMCF”) at an average realized price of $3.10 per thousand cubic feet (“MCF”). EGC operates approximately 90% of its reserves, substantially all of which are located in the U.S. Gulf of Mexico.

Total lease operating expenses (“LOE”) were $75.2 million, or $20.39 per BOE, which consisted of $58.9 million in direct lease operating expense, $10 million in workover and maintenance and $6.3 million in insurance expense. The company continues to evaluate additional cost saving opportunities that will not impact health, safety or operational integrity. EGC successfully completed over 100 expense workover and maintenance projects during the quarter.

EGC did not have any commodity hedges in place prior to February 2017 when it entered into oil contracts (costless collars) benchmarked to Argus-LLS, to hedge 10,000 barrels of oil per day of production for the period from March 2017 to December 2017 with an average floor price of $52.30 and an average ceiling price of $57.43 per barrel. The company does not have any hedges in place on natural gas production. No additional hedges have been put in place since February but EGC expects to consider additional derivative arrangements in the future.

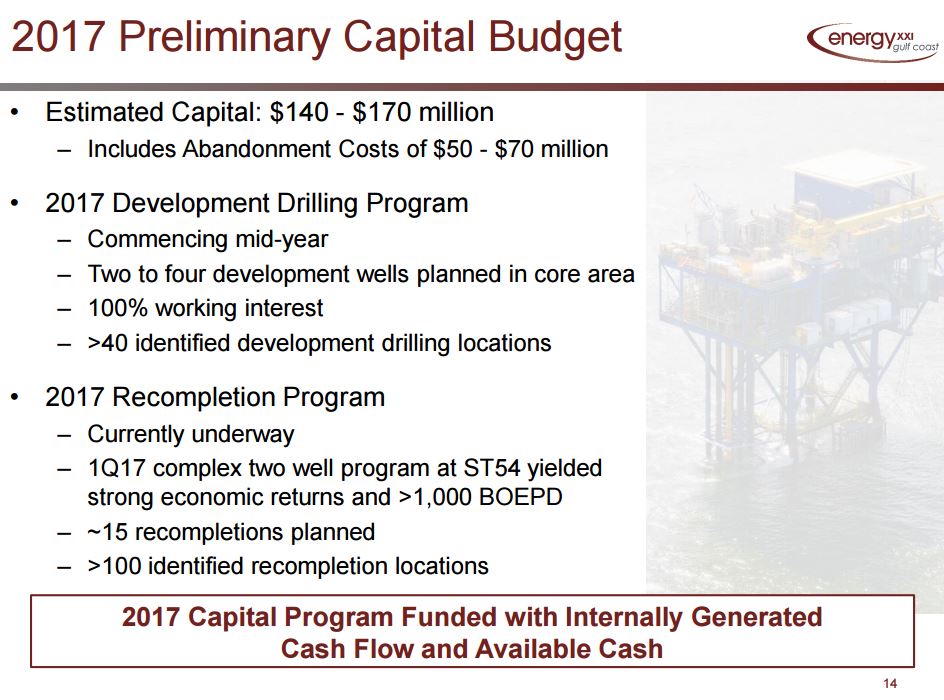

Capital costs, excluding acquisitions but including abandonment activities, totaling $19.4 million. The company did not drill any new wells during that period, but did incur capital expenditures for the successful execution of several well recompletions and facility improvements in the company’s core properties. EGC spent approximately $9.3 million related to abandonment activities.

EGC said it contracted a rig to drill its first 2017 development well beginning in early June. EGC continues to expect its capital expenditure program for 2017 to be in the range of $140 to $170 million, including $50 to $70 million for abandonment activities. The 2017 capital program is expected to be fully funded with available cash and internal cash flow.

The company’s estimate of its asset retirement obligations was revised downward by $135.4 million during the three months ended March 31, 2017, primarily due to changes in estimated timing of settlements for its plugging and abandonment liabilities. Asset retirement obligations totaled $623 million at the end of the first quarter 2017.

As of March 31, 2017, EGC had $74 million drawn on its three-year secured credit facility, the same amount drawn as of year-end 2016. At year-end 2016, the remaining $228 million under the $302 million facility was utilized to maintain outstanding letters of credit, primarily in favor of ExxonMobil to secure certain abandonment obligations. On March 10, 2017, the letters of credit issued in favor of ExxonMobil were reduced to $200 million. Under the terms of the credit facility, the commitments under the facility were permanently reduced by $12.5 million to $289.5 million.

At March 31, 2017, liquidity totaled $173 million which is comprised of cash and cash equivalents totaling $160.5 million and $12.5 million available for borrowing under its three-year credit facility.