Which Geography Is Working the Best for Schlumberger?

Schlumberger’s business model is diversified and not overly dependent on any particular line of business, catering to upstream companies’ needs.

Sep. 7 2016, Updated 8:04 a.m. ET

Schlumberger’s business model

Despite energy sector weakness, Schlumberger (SLB) remains a strong oilfield equipment and services (or OFS) company. Its business model is diversified and not overly dependent on any particular line of business, catering to upstream companies’ needs. Its operations are geographically spread to over 85 countries, and they’re therefore relatively insulated from an energy business cycle downturn in any particular geographic location.

In this article, we’ll take a look at which geography is working efficiently for Schlumberger. SLB makes up 7.5% of the iShares US Energy ETF (IYE). The energy sector accounts for 25% of IYE.

How’s Schlumberger North American performance?

Schlumberger believes that crude oil’s price weakness has hit tight oil drilling hard in North America. This has resulted in much lower pricing for OFS companies operating in US unconventional shales. This year, West Texas Intermediate crude oil has recovered handsomely from the oil price crash, which started in mid-2014.

The onshore rig count has risen in the past month, although OFS companies’ pricing and margins haven’t improved yet. Halliburton’s (HAL) revenue from North America accounted for 39.5% of its total revenue in 2Q16.

How’s Schlumberger’s international performance?

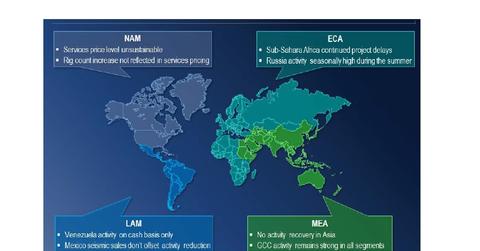

Latin America: Venezuela remains mired in financial trouble. Schlumberger reduced its activities in Venezuela in April 2016. SLB had ~$1.2 billion net receivable balances in Venezuela as of June 30. Its drilling activity in Mexico also remained low.

Europe/Commonwealth of Independent States/Africa: Various exploration and production projects continue to be delayed in sub-Saharan Africa. Russia, however, could benefit from high seasonal activity.

Middle East and Asia: Although this region saw lower upstream capital expenditure and project cuts, production activity remains high as OPEC (Organization of the Petroleum Exporting Countries) producers continue to produce at record levels. This could benefit OFS companies such as Schlumberger.