Today's GBP to USD exchange rate outlook retains a negative bias despite sterling recouping some losses against the American currency on the foreign exchange markets. We examine the latest pound to dollar technical and fundamental analysis.

- The Pound to Euro exchange rate today: 1.18363 EUR.

- The Pound to Dollar exchange rate today: 1.32278 USD.

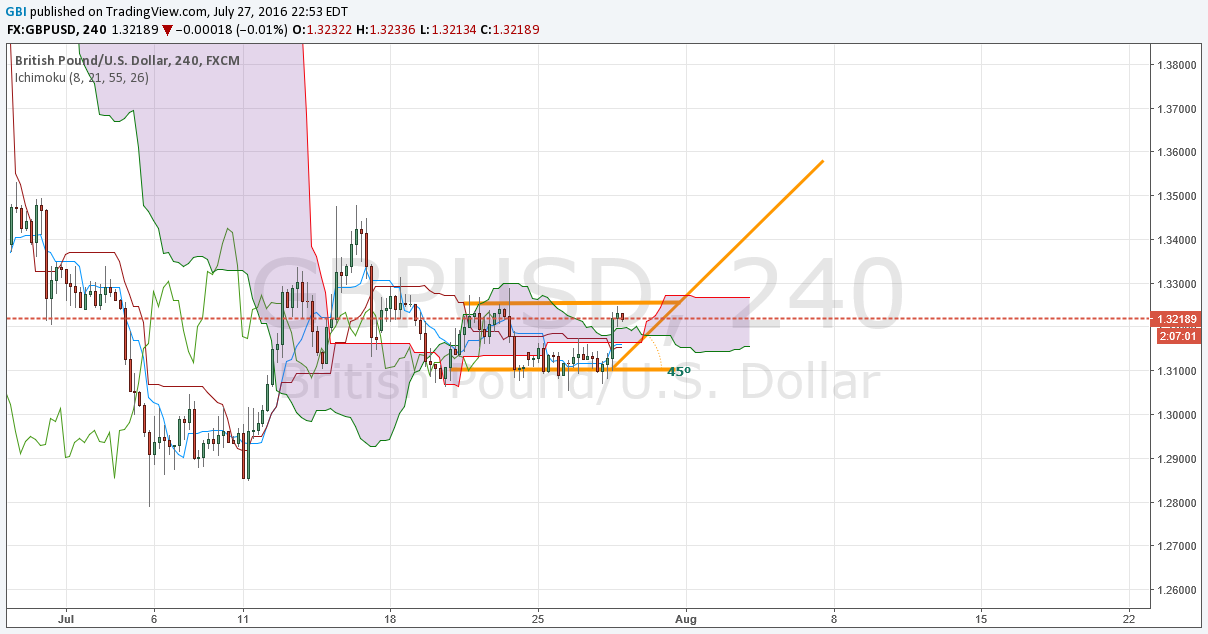

The way things look right now on the GBPUSD charts, the British pound has a slightly higher chance to appreciate against the US dollar, so long as it stays above the 1.3180 support level.

After the recent strong fall it suffered against the US Dollar, not managing to pass 1.3100 gave a sign of hope for the crying bullish sterling trader.

Latest Live Pound/Dollar Exchange Rates

On Friday the Pound to British Pound exchange rate (GBP/GBP) converts at

1

FX markets see the pound vs pound exchange rate converting at 1.

The GBP to EUR exchange rate converts at 1.168 today.

The GBP to CHF exchange rate converts at 1.135 today.

Please note: the FX rates above, updated 19th Apr 2024, will have a commission applied by your typical high street bank. Currency brokers specialise in these type of foreign currency transactions and can save you up to 5% on international payments compared to the banks.

Can the British Pound go 0 to 60 per hour?

We all have seen what the fundamentals can do to a currency in a matter of seconds, and even though some may hate me saying this, ladies and gentlemen, that move, was merely the beginning!

From a reason unknown to us simple folk, the GBP/USD chart shows consolidation, having a strong resistance level at 1.3250 and a support, about which I mentioned above, at 1.3100.

Between these two strong level we see a horizontal trend emerging, something like “a highway to … somewhere”.

As of yesterday we find ourselves once again in a Bullish area of the chart, where the British Pound is Queen and the US Dollar a mere pawn, and this may go on as long as the trend line will not get broken.

Of course it can, it’s electric “under the hood”!

We saw on the 4 HR chart that the British Pound still has some pulse, but if things do not turn to its’ advantage in the next hours, the price of the GBPUSD may flat line, or worse, turn back to the “dark side”, where the “Short” Traders have already prepared their cookie jars.

Chances for the break to happen above 1.3250 are around 66% based on my personal calculations but this may be possible only if the trend line is holding. If the price will get back into the cloud, we may find ourselves in a 50-50 chance once again.

The trend line has not been tested yet, but I have a feeling that by the New York opening Bell, or even earlier, the British Pound to US Dollar currency pair will share a little of its secrets to the world.

We’re not in Bear Country anymore?!

For the first time in a month, the price of the GBP/USD exchange rate gives us a hint that it may turn on the Daily chart into a Bullish trend, but, until 1.4000 won’t get broken; let’s just say that we find ourselves right at “the border”.

Based on how today will end, we will see if the price of this currency pair will manage to stay afloat or dive even further.

Because these are the last two days of the July, and to top things up, it is also the end of the week, volatility may be higher than usual which would mean a higher number of false breakouts in any direction.

A keen eye is needed in the next 48 hours so don’t be timid with your carrots, because you really must pay attention if the support, resistance and trend lines have the strength to keep the price in place.

I have my doubts about that!

Top Financial Institutional Forecasts for the Pound to Dollar Exchange Rate

Scotiabank's GBP/USD exchange rate forecast:

"Cable continues to consolidate (bearish, triangular continuation pattern after the sharp drop seen through late June/early July."

"We spot intraday resistance at 1.3230/40. Support is 1.3100 intraday."

"Major (bear break out) support is 1.3015."

Lloyds Bank note key pound to dollar rate levels to watch today:

"Long term, the decline through the 2009 lows at 1.35 is viewed as the last phase in the bear trend that started back in 2007 from the 2.1160 highs."

"We favour a multi-month bottoming process."

"What isn’t clear yet is whether the current rebound from the 1.2800 region is the start of this process."

"A decline through there sees next major support in the 1.22-1.18 region."

UPDATE 30/07/2016 08:00 GMT+1:

As FX markets approached the weekend, the pound to dollar rate found some relief after the latest US GDP failed to meet estimates.

The Advance GDP (source) printed at just 1.2%, in comparison to the predicted 2.6%.

The US dollar exchange rates fell sharply against rivals such as the British pound and the euro.