Game of numbers

The budget-making process and how PML-N has fared so far

Edited by: Ghazanfar Ali and Bilal Memon

Breaking down the budget

By Shahbaz Rana

Every year in June since 2013, Finance Minister Ishaq Dar presents the federal budget in Parliament, using the occasion for self-congratulation. After all, the government has spent just six months planning out expenditures that run into trillions of rupees.

What’s missing, however, is context.

The federal budget, once presented in Parliament, is essentially a law that lays out expenditure limits and where they are to be made. Over the years we have seen how easy it is to violate this law. But the question of why is linked to the making of that law itself.

In the words of former deputy chairman of the Planning Commission Dr Nadeemul Haque, policies are only as good as the process that backs them up.

His critique of the budget-making process reminds us of the importance and effects on every single member of the economy, days before the ruling Pakistan Muslim League-Nawaz (PML-N) announces its fourth budget – the second last of its term. Before discussing what’s in store, however, we look at how Nawaz Sharif’s government has fared so far since being elected in 2013.

In short, the PML-N’s ‘pro-business’ reputation has taken a hit. Here’s how:

While the budget is passed by the Lower House of Parliament in June, the budget making process begins as early as January. The finance ministry sends budget call notices to all respective ministries, departments and statutory institutions. The ministries and divisions raise their demands for current and development expenditures and a long process of negotiations and influences begin.

The Ministry of Finance, Federal Board of Revenue, Planning Commission, Economic Affairs Division and Statistics Division spends six months preparing the budget. If time is an indication, budget laws should be sacrosanct, ensuring full implementation.

Unfortunately, there is no scientific planning involved in making the budget and tax policies are changed without thoroughly studying their implications on jobs, growth and the industry. The targets are set in the air, without any vision or consideration of their macroeconomic effects. If the past three years are any indication, the government’s focus has been on how to increase revenue, and not on growth.

Expenditures always turn out to be larger than envisaged. But when it comes to development, expenditures are often less than what were originally planned.

Revenues recorded are always less than stated in the law (budget) but what’s worse is that some of the decrease happens because the finance minister and the Economic Coordination Committee (ECC) of the Cabinet hand out tax exemptions as protests and lobbying influence gather pace.

Article 77 of the Constitution says Parliament has the power to tax. However, it is the finance ministry that always violates the Constitution and the law with ease. Add to that, Parliament is indifferent to or unaware of its responsibility, or worse, both.

The ECC meets every so often to spend money that is not in the budget, following which the finance ministry approves supplementary budgets. The International Monetary Fund (IMF) recently demanded the finance ministry surrender its powers to impose supplementary budgets. Of course, the finance ministry refused. Accepting the demand would be tantamount to cutting its own hands.

Parliament’s hands are tied. The finance ministry provides supplementary budgets amounting to hundreds of billions of rupees and informs Parliament at the end of the fiscal year. Expenditure overruns and re-allocations during the year are all done whimsically by the finance ministry.

The ECC grants tax exemptions to various sectors on demand even though these have revenue implications for the original budget in place. These are gross violations of the budget law and no one notices. Experts argue that the ECC should not consider proposals that are not backed by the budget law.

Article 77 of the Constitution says Parliament has the power to tax. However, it is the finance ministry that always violates the Constitution and the law with ease. Add to that, Parliament is indifferent to or unaware of its responsibility, or worse, both.

Great power, no responsibility

The budget making process has become machinelike. While ignoring sectoral priorities, the finance ministry allots money for current expenses by lining it with inflation. There are no checks and balances. Subsidies are always understated.

Dr Haque says to please donors the finance ministry chases fiscal numbers that are not in sync with ground realities.

With this power, the ministry has made the entire budget process a showcase event that is twisted and turned throughout the year. Just look at the fiasco that unfolded after it imposed withholding tax on all banking transactions valued at over Rs50,000 in a single day last time.

Unaware of its importance, parliamentarians happily agree to a summary debate on the budget of about two weeks. In this short duration, no aspect of the budget is seriously discussed, let alone those supplementary grants that are announced.

The same case applies to the FBR. The tax machinery asks business associations and chambers to submit their proposals. But it never holistically reviews them. Industry proposals are like a lengthy wishlist, which includes every demand – sometimes absurd ones – under the sun. The government consults them just to proudly state that stakeholders’ point of view was considered.

The result is that the FBR ends up overburdening those who are already taxed. Estimated revenues from these additional taxes are also not accurate, as these are not based on any scientific working.

The worst element of the taxation part of the budget is that the annual collection target is set on flowery assumptions. The FBR does not bother to ask its field formations to conduct a survey to figure out whether businesses are doing well in their jurisdictions. Due to this faulty exercise, authorities end up levying new taxes to meet targets besides blocking taxpayers’ refunds.

The last three budgets from June 2013 to June 2015 are classic examples of a robotic budget-making exercise. The finance ministry and the FBR have failed to meet their targets in any of the years.

In the last three years, the FBR has imposed Rs940 billion in additional taxes. The impact of nominal GDP growth on the measures taken in the past is in addition to Rs940 billion. However, the actual tax collection grew far less than this figure, exposing the hollowness of the procedure.

There have been no major developments in the past three exercises. The finance minister will, each year, deliver hours-long speeches highlighting the government’s ‘achievements’ and making tall claims about the upcoming year. No one bothers to track the progress of these claims, which cannot be independently verified either.

There have been no major developments in the past three exercises. The finance minister will, each year, deliver hours-long speech highlighting the government’s ‘achievements’ and making tall claims about the upcoming year. No one bothers to track the progress of these claims, which cannot be independently verified either.

Living up to budget claims

What has remained constant in the past three budgets is the International Monetary Fund. For the IMF, the message has been that the government would adhere to fiscal consolidation and, to fulfill this promise, the government will not shy away from fudging some figures.

Two years ago, Finance Minister Ishaq Dar had announced to set up an Export-Import Bank of Pakistan with a paid-up capital of Rs100 billion, meant to give loans to exporters at reduced interest rates. He has yet to fulfill his promise. The government also announced a special textile package, which was never implemented despite the passage of two years. The end-result – exports are falling.

One of the highlights of the past three budgets has been the China-Pakistan Economic Corridor. It was a welcoming step and the credit largely goes to China. However, this strategic initiative has started meeting setbacks due to the usual bureaucratic inefficiency and the political leadership’s habit of performing groundbreaking ceremonies without doing any homework.

In the past three budgets, the government increased tax liabilities for non-registered persons on electricity bills, gas bills, cash withdrawals, purchase of properties and vehicles. It hoped that this would encourage the documentation of the economy. However, this strategy has also failed and instead of showing any increase, the tax base in 2015 shrank by over 18% to just under one million.

In 2014, the total numbers of income tax filers was 1.199 million, which in 2015 slipped to just 980,155. As many as 219,840 slipped from the FBR net in just one year, suggesting that the policy of broadening the tax base by increasing the cost of non-compliance has backfired.

The PML-N government had come into power on the promise of reducing the standard General Sales Tax (GST) rate, which at that time was 16%. However, immediately after assuming office, the government announced to increase the rate to 17%, suggesting it could not come up with any out-of-the-box solution.

Unlike its predecessor, the Pakistan Peoples Party (PPP), the PML-N government has been a disappointment for civil servants and pensioners. They received a nominal increase in their salaries and pensions, which has been insufficient to meet growing fiscal needs.

A love-hate relationship with Pakistan’s auto industry

By Farhan Zaheer

The economy has been on a growth trajectory, aided by falling oil prices that have led the central bank to lower the interest rate. This, in turn, has caused an uptick in car financing, which is exactly why budget measures related to the auto sector hold significance.

On one hand, there are external factors that are aiding the industry and should, ideally, be backed by a complimentary government policy. But has that really happened?

The government’s first budget of fiscal year 2013-14 was harsh. It increased general sales tax (GST) by one percentage point to 17% and imposed withholding tax on the purchase of new cars. It also levied advance tax on the registration of all new locally-manufactured vehicles, pushing up their prices and increasing the burden on consumers. The rates were higher for those who do not file their tax returns, but those who do came under the hammer as well.

Needless to say, some policies have been marred by confusion and a general lack of vision. So haphazard were the government’s policies that it first slapped 10% federal excise duty (FED) on locally-produced cars above the 1,800-cc engine category only to take it back in the next budget. Now, there was only one locally-produced vehicle (Toyota Fortuner) that fell under the stated engine capacity, but the development meant that consumers who bought the vehicle in the 12-month period paid a much higher price for it.

Similarly, GST on the sale of tractors was increased by 7% to 17% but when their sales dropped by half, the government had to revert to the earlier percentage of 10%. In both cases, instead of earning more revenue, the government, in fact, lost money.

While all these measures dented sales, the Punjab government’s Apna Rozgar scheme, which was announced in the last provincial budget, took volumes higher.

Auto policy

When the PPP-led government introduced its five-year auto policy in 2008, its target was to attain an annual sale volume of 500,000 units of cars, lights commercial vehicles (LCVs) and jeeps. How it envisaged that development and how it came to the said figure is another matter.

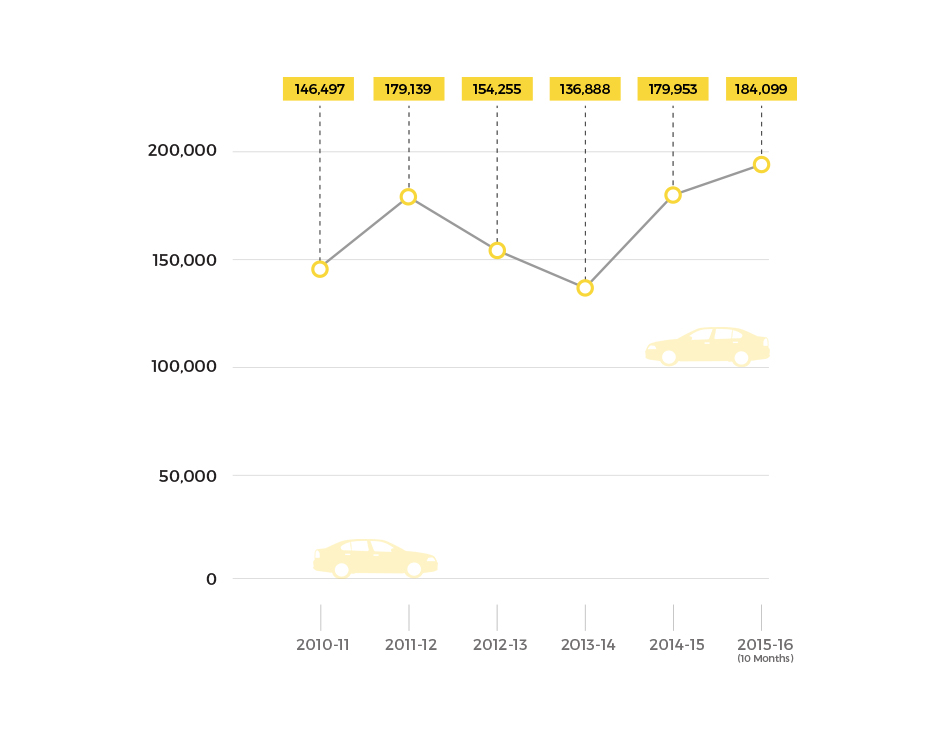

However, because of record-low economic growth and ill-conceived auto policies, the industry has failed to even attain a level of 204,212 units — the highest annual sales that were recorded in 2006-07.

Even after losing precious time of over eight years, the industry finds itself in a strong position again. Macroeconomic stability, an improved security situation, and 42-year record low interest rates have again put the local auto industry back into the limelight.

The PML-N also announced the much-awaited, and much-delayed, Automotive Development Policy 2016-21 in March this year after a lapse of more than two-and-a-half years. Despite all the uncertainty about government policies, the auto industry in the last fiscal year 2014-15 achieved five-year high sales and it may reach an all-time high of over 200,000 units by the end of June 2016.

“The situation is not too bad – you should give credit to the government where it is due,” says Parvez Ghias, the CEO of Indus Motor, a local affiliate of Toyota Japan.

Ghias seemed upbeat about the new auto policy but was quick to add that the government could have announced it three years ago if this is what it had in mind for the auto industry.

The government and the auto industry are also at loggerheads over various issues, including the used car import policy in Pakistan, quality issues of local cars and prices.

On its part, the government has been continuously pushing the local auto industry to reduce prices, improve quality and increase the percentage of locally-manufactured parts in cars. To keep local assemblers under pressure, it stuck with its strongest weapon and continued its liberal used car import policy (three-year-old used cars can be imported in Pakistan).

The power game continues and the local industry has still not reduced car prices – the government’s main aim. Meanwhile, prices of both locally produced and imported cars continue to surge. In short, there has been no winner in this tussle. The real sufferers have been consumers who rarely see either a reduction in prices or improvement in the quality of local cars.

But Ghias feels there is something to look forward to.

“Pakistan is among those few countries in Asia where the auto industry has a bright future.” According to him, economies of Europe, Japan and China are slowing down and there are only a few countries that have large populations to be categorised as potential markets. “The industry’s future is bright in Pakistan. Global auto players are taking an interest in the Pakistani market because they know the size of its population and growth potential,” he added.

Meanwhile, auto parts makers say they have once again started investing billions of rupees because they hope for persistent growth in auto sales over the next many years. They are particularly hopeful about the positive impact of the China-Pakistan Economic Corridor (CPEC) on the overall investment climate in Pakistan.

Set in cement: With steady growth, cement industry witnessing remarkable phase

By Farhan Zaheer

One of the few industries that deserves a pat on the back for its resolute performance over the past many years is cement.

The cement industry has shown a steady growth before and after the 2013 general elections which elected Pakistan Muslim League – Nawaz to power.

All Pakistan Cement Manufacturers Association Chairman Muhammad Ali Tabba’s recent comments perfectly sum up the situation. “The cement industry is passing through an extraordinary phase. Every industry experiences such a time; this patch for the cement industry is like what the banking industry enjoyed in the past decade,” he said.

From 2006 to 2009, cement prices moved in a wide band, ranging from Rs220 to Rs400 for a 50kg bag despite political upheaval in Pakistan and the global economic slowdown.

The price increase, which started in December 2009, continued until June 2013. Average cement prices reached Rs500 per bag in mid-2013, up from as low as Rs270 per bag at the end of 2009, an increase of 85% in three-and-a-half-years.

Since then, average prices have hovered in the range of Rs470 to Rs500 per bag, which is more than satisfactory for an industry that has never witnessed such price stability in the last one decade.

Aside from this, cement companies have immensely benefitted from the record-low international coal prices that plunged from $145 per tonne in June 2010 to $53 in April 2016, down a hefty 63%. Almost all Pakistani cement companies import coal, which makes up around 60% of their production cost, and the low prices have given them a once-in-a-lifetime opportunity.

“Cement companies are earning exceptionally well and their margins go up to 40%, which is massive. There have been few tax measures that the government took in the past three budgets, but interest in the industry is intact,” JS Research analyst Faizan Ahmed told The Express Tribune.

Duties and taxes

Analysts say the industry has been successfully passing the new taxes on to consumers because of rising demand for cement in the country.

“Whatever protests the cement industry has registered against new taxes and the rising cost of production are just lip-service. They do not take up the issues with the government like they do in media,” he added.

A body of cement manufacturers recently asked the government to cut taxes if it wanted to see a reduction in cement prices. The government collects up to Rs95 on a 50kg cement bag on account of 5% federal excise duty (FED) and 17% general sales tax (GST) at the maximum retail price.

The PPP-led government in fiscal year 2011-12 had reduced FED from Rs750 per tonne to Rs500. Later, it further slashed the duty to Rs400 to give a boost to construction activities in the country.

However, in its first budget for 2013-14,the PML-N government increased GST by one percentage point to 17%, which pushed cement prices up like other commodities.

It also started calculating GST on the maximum retail price and all these taxes contributed Rs10-15 per bag (depending on the geographical location).

In its second budget, the government introduced a new methodology according to which FED was fixed at 5% of the retail price. Moreover, 1% import duty was imposed on coal, a vital input for the industry. About 95% of the imported coal is consumed by cement manufacturers in Pakistan.

The third budget of the current government, however, was encouraging for the cement industry in that it brought various incentives for the construction sector, including tax reduction on housing loans, tax exemption on bricks sale and lower duty on import of construction machinery.

Demand a major strength

Analysts point out that the cement industry has braved all new taxes over time quite effortlessly mainly because of a single factor – rising demand. Because of this, the industry has successfully shifted the burden of these taxes onto consumers without compromising on its profits.

Owing to the construction boom, cement plants have been able to put more installed capacity to use that now stands close to 85%, the highest in a decade.

Of the total installed capacity of 45 million tonnes, the industry’s surplus capacity is just 5.87 million tonnes.

In anticipation of a further growth in demand, four companies will invest $700 million to $1 billion to add to their capacities over the next three years. This indicates that the industry is very much optimistic about its future, keeping in view the massive road, rail and hydroelectric power projects that are in the pipeline.

Banks, non-filers targeted in stream of tax measures

By Kazim Alam

“Real beneficiaries of the annual budget-making exercise are banks, not the people of Pakistan.” — Syed Shabbar Zaidi, former Sindh finance minister and senior partner at AF Ferguson & Company, an auditing and business advisory firm

GDP growth in Pakistan has largely remained stunted post-2008 with the private sector complaining untiringly about unfriendly government policies.

Major sectors of the economy, such as sugar, textile, leather, rice, livestock, fertiliser, asset management and brokerage, have at one point or another tried to lobby through newspaper ads and press statements for lower taxes and subsidies.

But the banking sector is one of the few exceptions in the sense that it is rarely critical of government policies in the media. And why would it be? Despite poor economic conditions in the country, earnings of the banking sector are growing while banks choke private-sector credit by investing heavily in risk-free government securities.

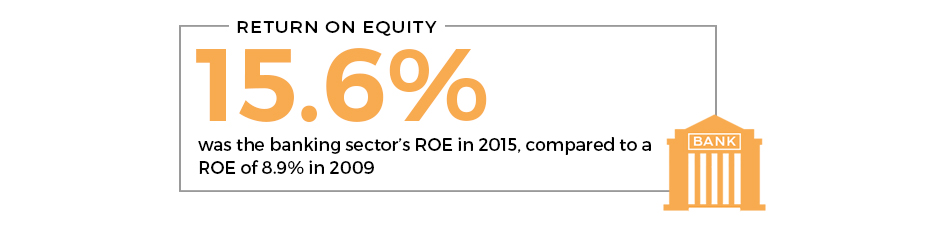

It’s been a fairly smooth ride for banks following 2009. The sector’s cumulative return on equity (ROE) has increased three-quarters following the financial crisis of 2008. Known as one of the best indicators of a lending institution’s profitability, ROE shows annual earnings as a percentage of the money its shareholders have invested in the bank. The ROE of the banking sector increased from 8.9% in 2009 to 15.6% in 2015.

Similarly, the industry-wide return on assets (ROA) rose from 0.9% to 1.5% over the same six-year period, which shows that banks have substantially grown their income as a percentage of their assets, i.e. loans and investments.

If ROE and ROA sound bank-speak to you, just consider the fact that the net profit of the entire banking sector rose from Rs54 billion in 2009 to Rs199 billion in 2015, an average growth rate of 24.3% per year between 2009 and 2015. Few other sectors of the economy have managed to increase their net profits by almost one-fourth every year for the last six years.

What the PML-N has done with banks

Immediately after coming into power in June 2013, the PML-N government announced a reduction of 1% in the corporate income tax to 34%. After lowering the rate by 1% in each of the two consecutive years, the corporate income tax now stands at 32% for 2015-16.

However, much to the chagrin of the banking sector, Finance Minister Ishaq Dar did not give it the cumulative cut of 3% in the corporate income tax rate that non-banking companies have received since June 2013. It’s no wonder that the Pakistan Bankers’ Association (PBA) has demanded that the tax rate for all sectors be “rationalised with uniformity” 2016-17 onwards.

While the PML-N government refrained from upsetting banks in the first two fiscal years in large measure, the 2015-16 budget proved to be rather eventful for them given drastic changes in the tax policy.

Higher taxes

The 2015-16 budget imposed a “one-time” levy of 4% on the income of banking companies whose annual earnings exceeded Rs500 million in 2014. Following the imposition of “super tax” to help rehabilitate internally displaced people in the aftermath of Operation Zarb-e-Azb, banks had to book a higher tax charge in April-June of 2015.

According to BMA Capital research analyst Jehanzaib Zafar, super tax wiped off 2.5%‐3% from the bottom lines of banks that earned in excess of Rs500 million in 2014.

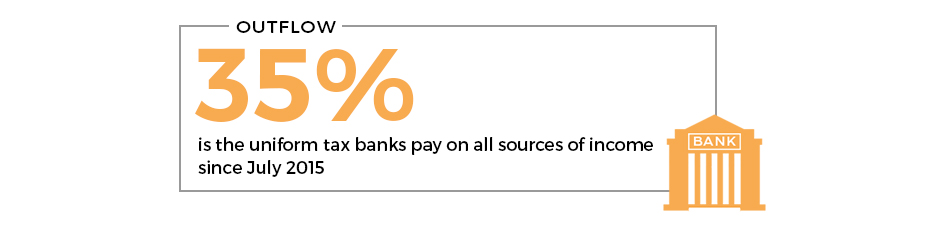

In addition, Dar streamlined tax rates that banks pay on different avenues of banking income. Instead of paying taxes at rates ranging from 10% to 25% on different sources of income – such as dividends and income from mutual funds – banks had to pay a uniform tax rate of 35% on all sources of banking incomes July 2015 onwards.

This increased the effective tax rate for banks and dented their bottom lines last year. According to Topline Securities senior research analyst Umair Naseer, listed banks’ effective tax rate clocked up at 40% in 2015 as opposed to 33% in 2014.

Levy on transactions

The last budget delivered another blow to the banking sector in the shape of a withholding tax on transactions and cash withdrawals by non-filers of income tax returns.

Aimed at encouraging people to file tax returns, the withholding tax on cash withdrawals and banking transactions of Rs50,000 or more by a non-filer in a day was imposed initially at 0.6%. It was later reduced to 0.3% and then revised up to 0.4%.

As a result, traders took to streets, demanding that the tax be eliminated. Bankers feared massive withdrawals of deposits before the levy became effective on July 1, 2015. Moreover, expectations that people would switch to non-banking channels for making payments unnerved bankers on end.

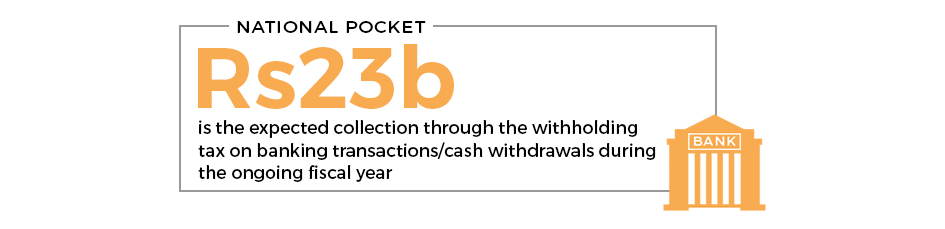

In view of half yearly figures, the government is expected to collect roughly Rs23 billion through the withholding tax on banking transactions/cash withdrawals in 2015-16. But the latest data shows that the levy has actually hurt the banking system.

For example, banking sector deposits registered an increase of 12.5% to Rs10.3 trillion in 2015. But a look at the pace of this increase shows most of the deposits originated in the first half of 2015. Deposits grew 8% in the first six months, but the growth rate fell to only 4.2% in the latter half of last year when the levy on banking transactions was in effect.

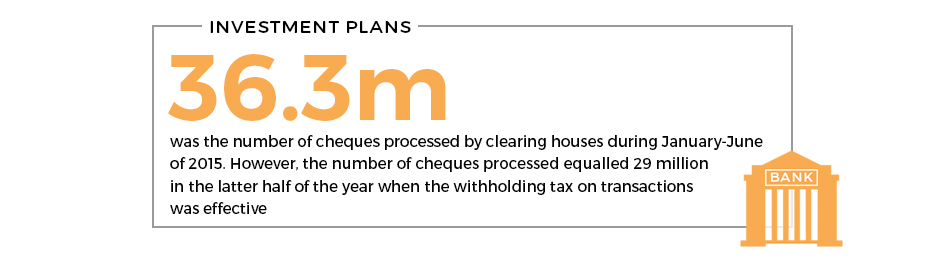

As for the impact of the withholding tax on the volume of banking transactions, data released by the State Bank of Pakistan (SBP) points to a similar trend. The SBP’s clearing house statistics show the public actually reduced its use of cheques and pay orders post-July 1 presumably to avoid the levy on banking transactions of more than Rs50,000 in a day.

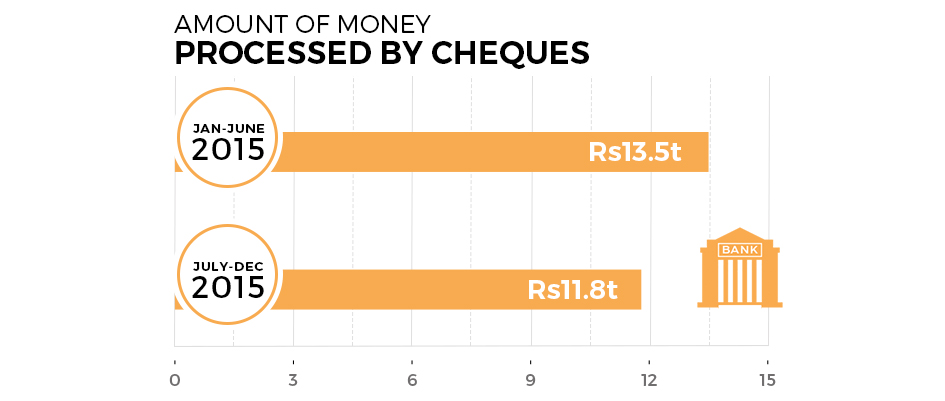

In the first six months of 2015 when there was no withholding tax on banking transactions, clearing houses processed as many as 36.3 million cheques. However, the number of cheques processed amounted to 29 million in the latter half of the year when the levy on transactions was effective. This translates into a decline of over one-fifth (20.1%) in the number of cheques processed nationwide over the six-month period.

Similarly, the amount of money passing through the SBP’s clearing houses in July-Dec 2015 was Rs11.8 trillion, down 12.6% from Rs13.5 trillion for the first six months of 2015.

Captive taxpayers

So why did the government turn on the banking sector in the last budget although it has traditionally left banks alone in exchange for annual deficit financing?

Analysts believe it is becoming increasingly difficult for the government to grow the number of taxpayers. Multiple amnesty schemes to lure people into the tax net have failed to yield desired results. No wonder the government is now bent on extracting maximum amount out of its “captive taxpayers” like commercial banks.

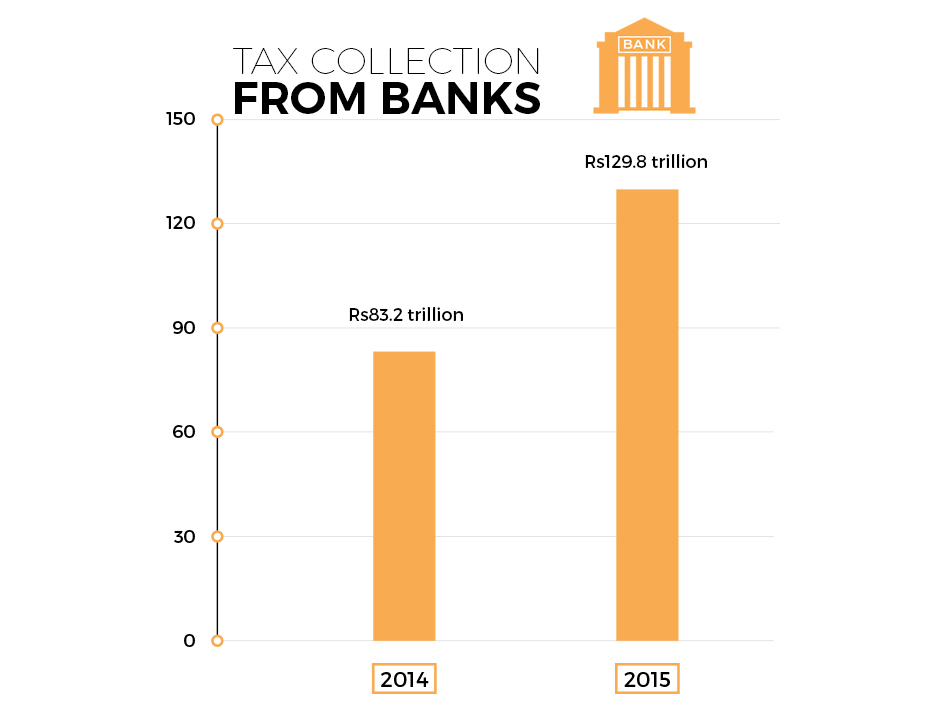

Statistics show the changed tax policy is working well for the government. It collected as much as Rs129.8 billion in taxes from the banking sector in 2015. Thanks to higher effective tax rates for banks following the last budget, total tax collection from the sector rose 56%, or Rs46.6 billion, in one year.

Dar had declared the 4% super tax a “one-time” levy while imposing it on the banking sector in the last budget. But he upset bankers recently by announcing his intention to keep the new tax effective for the next fiscal year as well.

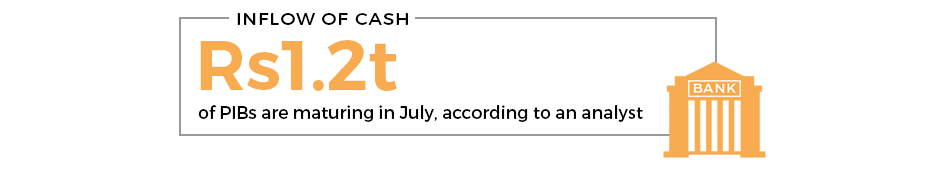

Things are not looking well for the banking sector in the current year. Banks had started accumulating Pakistan Investment Bonds (PIBs) after 2013. With the consistent decrease in the benchmark interest rate, their unrealised gains have gone up substantially from Rs121 billion in 2013 to Rs206 billion at the end of 2015.

Naseer says Rs1.2 trillion of PIBs are maturing in July. The massive maturity of long-term PIBs will result in a drop in the banks’ unrealised capital gains in 2016, he says.

“With the expected fall in capital gains and reinvestment risk once high-yielding PIBs mature, earnings of banks in 2016 are anticipated to remain under pressure,” Naseer added.

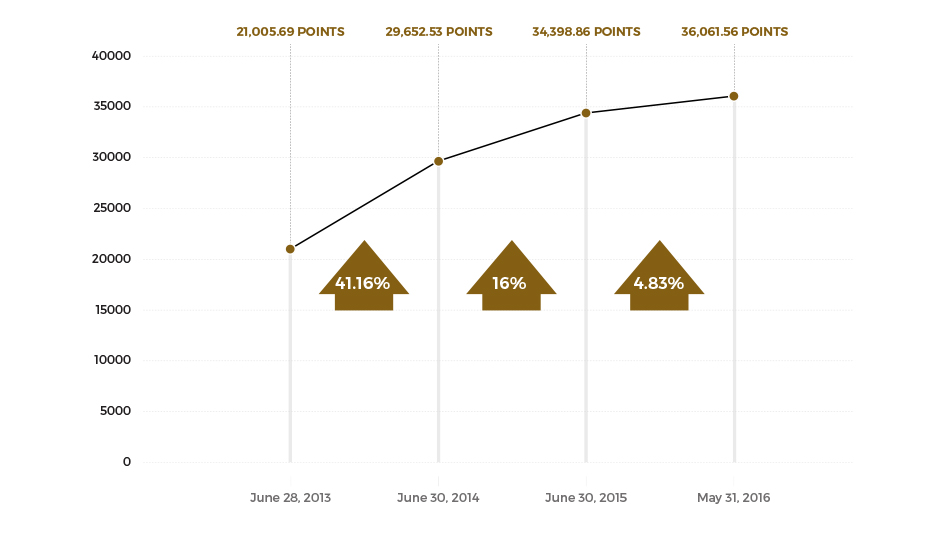

A mixed ride for stock market participants

By Kazim Alam

One thing Pakistani governments have done consistently over the years is taxing those sectors of the economy that have done well.

The stock market has been no different.

2013-14

The first budget of the PML-N could be seen as mostly positive for the capital markets.

The best news that came out of the 2013-14 budget was the reduction of the corporate income tax rate from 35% to 34% with the promise that it would fall 1% every year for the four consecutive years to an eventual 30%. The decision to lower the corporate income tax rate boosted investors optimism and reinforced the business-friendly credentials of the PML-N government.

However, Finance Minister Ishaq Dar announced that the minimum tax, also known as turnover tax, would be increased from 0.5% to 1%, something that created unease among businesses that run at lower margins. The increase in the minimum tax rate was unfavourable for listed companies like refineries and oil marketing companies whose margins fluctuate as well as small manufacturing companies that make small profits.

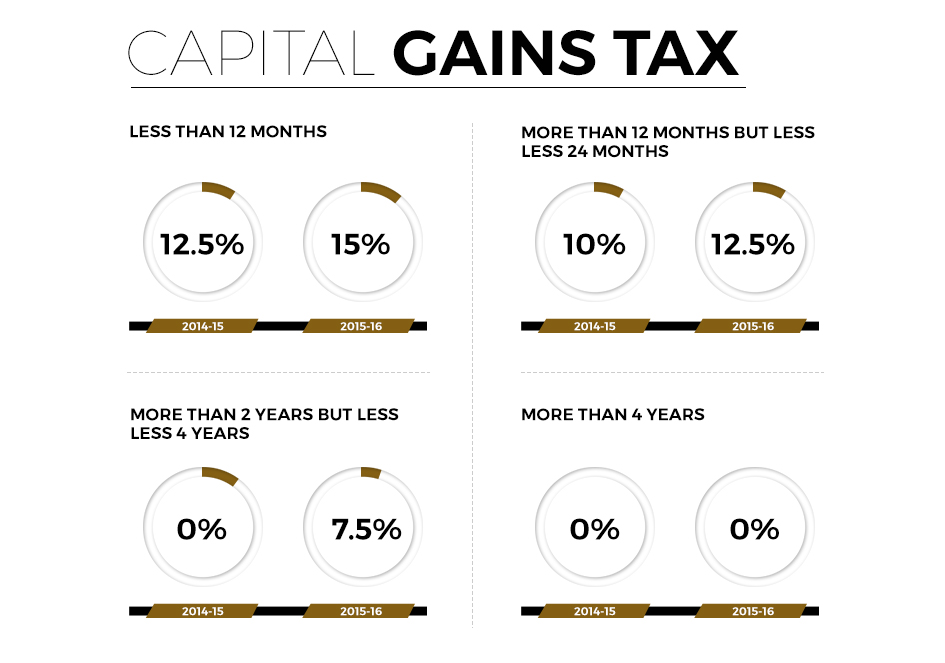

The budget did not change the capital gains tax rate, which remained 10% for a holding period of less than six months and 8% for a holding period between six months and 12 months. This is the cut the government takes when an investor starts making money off the stock market.

The budget also maintained the federal excise duty (FED) on the broker commission while withdrawing the FED exemption on the services rendered by asset management companies. The latter had a negative effect on the stock market. In addition, the government also introduced a 10% withholding tax on profit/interest earned on brokers’ margin financing, a measure that the capital market participants did not receive warmly.

2014-15

The highlight of the 2014-15 budget was the increased rate of capital gains tax (CGT) along with extended duration. However, market participants had anticipated the hike and factored it in their valuations in advance.

The CGT rate for the shortest duration (up to 12 months) was increased to 12.5% in the 2014-15 budget. Moreover, the CGT on a security held for at least 12 months but less than 24 months was revised to 10% in the 2014-15 budget, although no CGT was applicable previously. Effectively, the 2014-15 budget made securities exempt from CGT for a holding period of more than two years. Earlier, the exempt period was a year or more.

The 2014-15 budget also mandated that bonus shares be treated as dividend and a tax be applied at 5% of the ex-bonus price of shares – a measure that led to criticism from market participants.

National Clearing Company of Pakistan Limited (NCCPL) collected CGT in 2014-15 amounting to Rs6.1 billion, up 260% from Rs1.7 billion collected in 2013-14.

2015-16

It could be argued that the 2015-16 budget was the most disastrous one of the three budgets that Dar has presented since the PML-N came into power in June 2013.

First, CGT rates were enhanced besides a revision of the duration periods. The CGT on a security with a holding period of less than 12 months was increased from 12.5% to 15%. Similarly, the CGT on securities with a holding period between 12 months and 24 months was increased from 10% to 12.5%.

A 7.5% levy was introduced in the 2015-16 budget on capital gains on securities with holding period between 24 months and 48 months. That means the holding period must be at least 48 months in order to avoid paying any tax on capital gains under the new regime. The decision was criticised by analysts because it was expected to hurt trading volumes on the bourse – an expectation that proved right in later months of 2015-16.

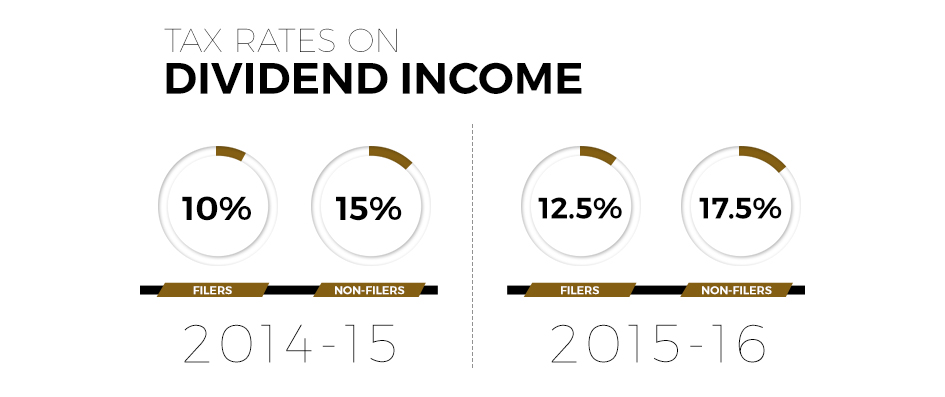

Another disastrous step for the equity market announced in the 2015-16 budget was the increase of tax rates on dividend income. From 10% for filers and 15% for non-filers, the tax rates on dividend income rose to 12.5% and 17.5%, respectively, with the onset of 2015-16.

The last budget also included a one-off super tax imposed at 4% for banks and 3% for other companies making an annual profit of Rs500 million or more.

Moreover, the government imposed a 10% tax on the “undistributed reserves” of a listed company in case it doesn’t pay dividends to an extent that its reserves exceed its paid-up capital after the distribution of dividends.

Later on, companies distributing an amount either equal to 40% of net profits or 50% of paid-up capital, whichever is less, within six months of the tax year were excluded from the ambit of this tax.

A CGT collection figure for the first 10 months of 2015-16 is not available because any capital loss is set off against capital gains recorded in the same fiscal year.

Incentives abound to support agriculture, the supposed mainstay of economy

By Peer Muhammad

Agriculture occupies a central place in Pakistan’s economy as it contributes more than 21% to the national output and employs nearly 45% of the labour force.

It also has great export potential but little has been done to this end, except for a few symbolic efforts to lend some support to the transport of farm produce.

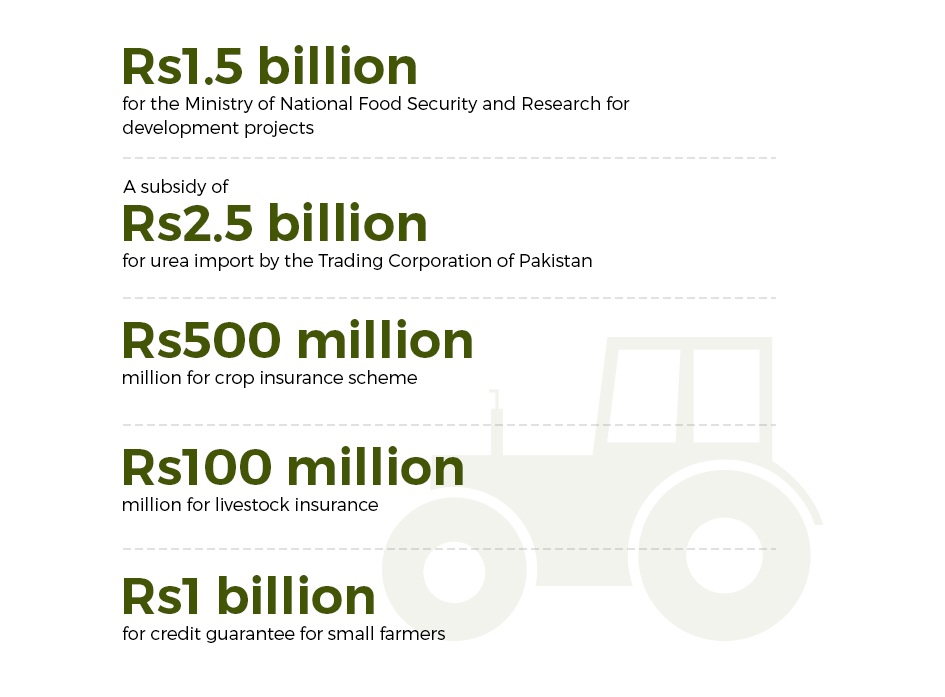

In the 2015-16 budget, the government allocated Rs1.5 billion for the Ministry of National Food Security and Research for development projects besides a subsidy of Rs2.5 billion for urea import by the Trading Corporation of Pakistan, Rs500 million for crop insurance scheme, Rs100 million for livestock insurance and Rs1 billion for credit guarantee for small farmers.

Pakistan Agriculture Storage and Services Corporation (Passco) got a subsidy of Rs10 billion for the sale and reserve-keeping of wheat, while Rs1.3 billion was earmarked for freight subsidy on sugar export.

Similarly, Rs303 million was set aside as subsidy on the sale of wheat to Fata. However, as opposed to the previous budget, no subsidy was announced on sale of wheat and salt to Gilgit-Baltistan.

Facilitation measures

Under the credit guarantee scheme, the government, through the State Bank of Pakistan, provided guarantees for commercial, specialised and microfinance banks for sharing loss up to 50%.

The scheme, designed for farmers having up to 5 acres of irrigated and 10 acres of unirrigated land, benefited 300,000 farmer families with loans of up to Rs100,000. The disbursement target was set at Rs30 billion with a contingent budget of Rs5 billion.

Apart from this, the livestock insurance scheme provided small farmers having up to 10 cattle with livestock insurance in case of calamity and disease.

In the agriculture credit scheme, the credit flow was fixed at Rs600 billion with an increase of 20% from the previous year’s target of Rs500 billion.

In another scheme for interest-free loans for solar tube wells, it was decided to provide loans for installing new solar tube wells or replacing the existing ones with solar tube wells at an estimated cost of up to Rs1.1 million. The government would pick up the mark-up cost and planned to extend loans for 30,000 tube wells over the next three years.

Farmers with landholdings of up to 12.5 acres were to benefit from the scheme as the cost of diesel and electricity-powered tube wells stood quite high. With the installation of solar tube wells, a farmer using diesel engine for five hours a day will save Rs1,660 per day and the one using electric pumps will save Rs466 per day in running costs.

In an attempt to bring down the input cost for farmers, the government announced a Rs20 billion subsidy on di-ammonium phosphate (DAP) sale with 50% contribution from provinces.

Statistics suggest that a subsidy of Rs500 is being given to the farmers on a 50kg bag of DAP fertiliser and more than Rs15 billion has been disbursed so far under the scheme.

Tax holiday for delivery chain

In a bid to stimulate new investment in Halal meat production and encourage the use of state-of-the-art machinery and equipment, companies that install Halal meat production plants and acquire certification by December 2016 were allowed exemption from income tax for four years.

Rice mills were also exempted from minimum tax for the tax year 2015 under the Relief to Rice Mills programme.

In addition to these, the agriculture produce including fresh milk, live chicken birds and eggs was exempted from withholding tax subject to certain conditions. It was proposed that the exemption may also be extended to the supply of fish.

To encourage the import and local supply of agricultural machinery and equipment, the government proposed an un-adjustable sales tax at a reduced rate of 7%, instead of the normal 17% to enhance agriculture productivity.

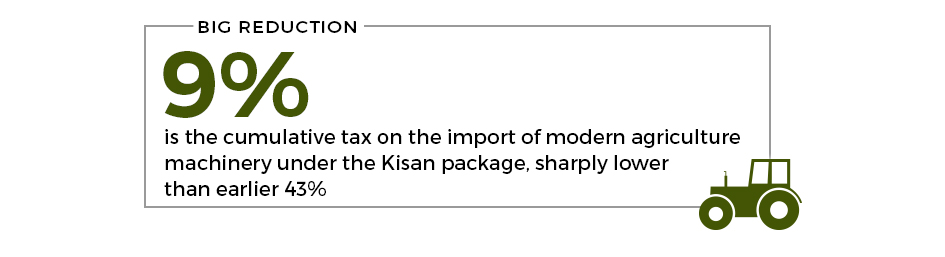

For the import of machinery, the customs duty, sales tax and withholding tax were reduced to a cumulative 9% – customs duty from 5-20% to 2%, sales tax from 17% to un-adjustable 7% and WHT from 6% to 0%.

Previously, the customs duty, sales tax and withholding tax on the import of machinery was a cumulative 28% to 43%.

Kisan Package

Later in September 2015, Prime Minister Nawaz Sharif announced a massive Kisan package worth Rs341 billion at a convention for farmers.

The scheme brought immediate cash grants for rice and cotton growers, subsidies on agriculture inputs worth Rs140 billion including reduction in fertiliser prices, loan advances valuing Rs185 billion, insurance premium to be borne by the government and other small grants. The grants were targeted primarily at the small farmers that have landholdings of up to 12.5 acres.

It also included collateral guarantees for loans and tax breaks for dairy, poultry and fish farming sectors.

The package brought down all taxes on the import of modern agriculture machinery from 43% to only 9%. Sales tax was reduced from 17% to only 7%, while turnover tax on rice was withdrawn.

However, there was overlapping of allocations in the Kisan package, which had already been announced by the federal or provincial governments under previous budgets.

Mobile users on the rise despite exorbitant taxes

By Salman Siddiqui

One sector that has persistently criticised the government over higher tax rates is the telecom and IT sector.

As the world evolves, the IT and telecom revolution has made it possible for most to keep pace. While innovations are leading to reduction in cost, our government is ensuring the impact remains unaltered.

Higher tax rates on mobile phone handsets and laptop imports have encouraged smuggling, meaning these gadgets have become more affordable for all. But measures to increase taxes through cellular mobile operators have ensured that the government pockets at least some of the gains.

A vendor at Techno City Mall in Karachi, who chose to remain anonymous, says, “If I had paid all the chargeable taxes on the import of laptops at Karachi airport, a new 10-inch wide screen hp notebook would have cost you Rs34,000 instead of the Rs18,000 I’m offering.”

He claimed to have paid only Rs2,100 per laptop to an FIA official to get them cleared from the port rather than pay higher taxes, amounting in the range of Rs15,000-17,000.

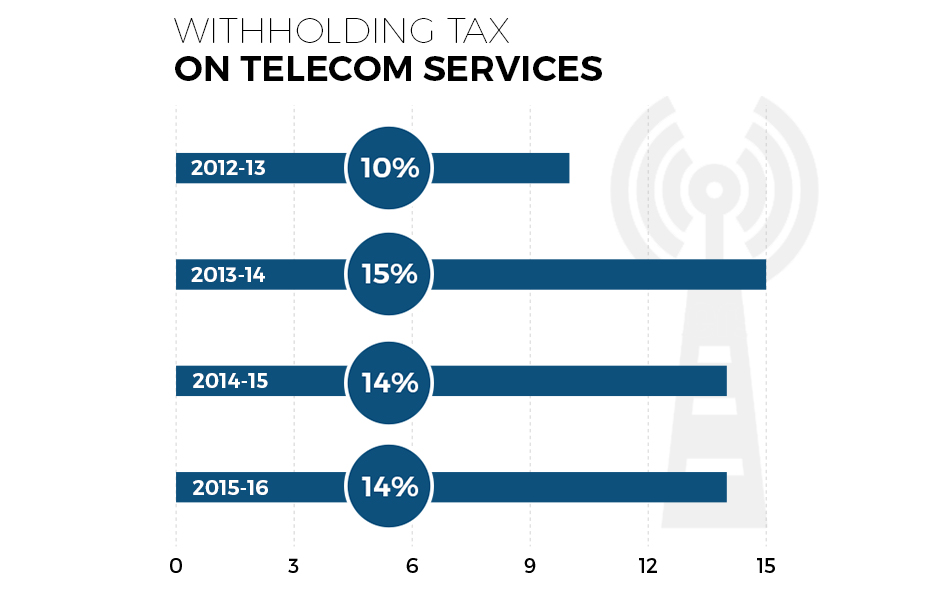

The present government in its first budget for 2013-2014 increased the rate of withholding tax on telecom services by five percentage points to 15%. In its next budget (for FY 2014-15), the government reduced the rate by one percentage point and kept it unchanged in last year’s (FY 2015-16) budget.

Deloitte’s study of February 2015 on ‘Digital inclusion and mobile sector taxation in Pakistan’ states, “The withholding tax for telecoms is higher than for most other sectors, for which it varies between one per cent and 12 per cent”.

Finance Minister Ishaq Dar admitted in February 2016 that telecom was paying the highest rate of withholding tax in Pakistan. The minister said because this was an adjustable tax, those who file their income tax returns may claim refunds.

Experts, however, argue that since a majority of telecom users earned less than Rs400,000 – the threshold that makes filing tax returns mandatory – claiming refunds was not an option.

It was learnt that the Federal Board of Revenue (FBR) collected Rs43 billion on account of withholding tax during 2014-15. Only 900,000 claimed refunds of less than Rs3 billion, meaning that the remaining amount was automatically confiscated by the government at the end of the financial year.

Similarly, mobile users pay in the range of 18.5-19.5% Provincial Sales Tax (PST) on phone calls and broadband usage. PST for other sectors of the economy, however, has remained constant at 17%.

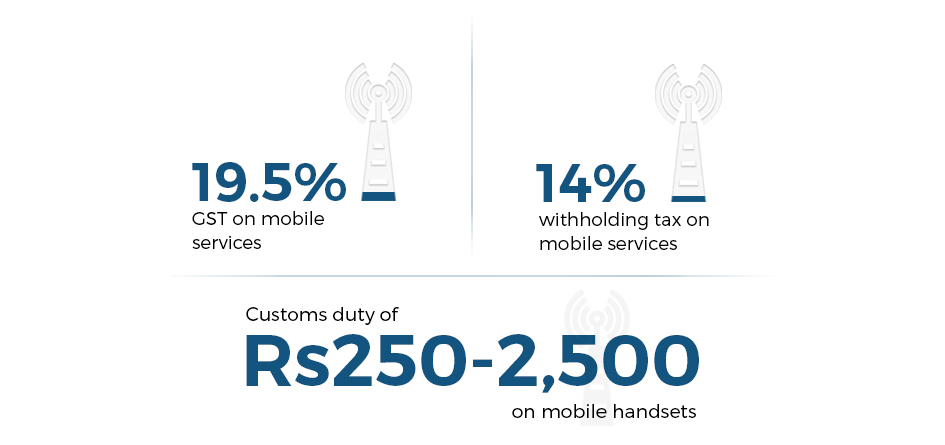

Other key taxes that directly impact mobile phone and internet users as well as service providing companies in Pakistan include: 19.5% GST on mobile services; 14% withholding tax on mobile services; Customs duty of Rs250-2,500 on mobile handsets. The tax rate for Broadband Internet Services is 19.5% in Punjab for more than 2mbps of internet speed. In Sindh, the tax is 18% if broadband bill exceeds Rs1,500; 10% duty on import of equipment used for voice reception, switching and routing of data and corporate tax of 32%.

The State Bank of Pakistan, in its quarterly July-September 2016 report, said, “The number of broadband users, though increased significantly, could not translate into increased number of data users due to price competition and high tax incidence in the telecom sector.”

Studies suggest some 41.5%-45% of the spending on acquisition of information and communications services goes into taxes in Pakistan which is excessive and unmatchable.

These exorbitant tax rates keep the use of ICT services low in the country. Pakistan Telecommunication Authority (PTA) has reported that an average spending by mobile phone services user stands at Rs203 per month.

Deloitte added that the average revenue per user in Pakistan was one of the lowest worldwide and the lowest in the region. Low spending on services compromised economic growth at large.

“The World Bank has found that in low- and middle-income countries, such as Pakistan, every 10% increase in broadband penetration accelerates economic growth by 1.38% … for every new job created in the Pakistani mobile sector, 11 are generated in the wider economy,” it said.

Despite exorbitant taxes, the number of mobile phone (voice) users and mobile data (broadband) are on the rise. The introduction of 3G/4G services has shot up the number of mobile phone users to 130.41 million as of March 2016 and broadband mobile internet users are now close to 31 million.

This growth can also help the central bank realise its dream of financial inclusion of unbanked people. Branchless banks have opened some 13 million accounts in the last two years and are likely to increase this number to 30 million by 2020 under the central bank’s financial inclusion plan.

However, PTA Chairman Dr Syed Ismail Shah says higher rate of taxation was one of the major hurdles in the way of branchless banking. “However, the finance minister has listened to us in detail this time. I hope for a meaningful outcome, as the government is considering [our budget proposals],” he said.

Actual amount Pakistan spends on defence every year is anybody’s guess

By Shahbaz Rana

One of the most crucial elements of the federal budget is defence spending – to be more precise, by exactly how much it has increased.

Over the years, the announcement for defence spending has come to be known as a mere formality; a certain amount is announced, while actual spending remains a mystery. This, experts say, is a global phenomenon.

Even before it is formally announced, the stated spending for the new financial year is predictable. For the last many years, the declared defence budget has almost been equivalent to 2.5% of the total national output. In absolute terms, the government has been increasing the defence budget by around 10% to 12% every year, while the overall size of the federal budget increases by 6% to 7%.

The declared defence budget is only, in principle, meant to pay salaries to the three armed forces – Pakistan Army, Air Force and Navy – meeting operating expenses and undertaking civil works. How much Pakistan spends every year on military hardware is anybody’s guess. Some of the expenses are camouflaged under the head of security-related expenditures and grants.

The reason Pakistan increases its defence spending every year is due to its historically tense relations with India. It tries to maintain equilibrium with a ratio of 1 to 6 (India’s defence budget is almost six times more than Pakistan’s).

Military and government officials and security analysts defend the increase, arguing that Pakistan’s military spending remains the lowest in the region, especially given the country’s volatile security environment.

The General Headquarter (GHQ) now wants the defense budget to be directly linked with “threat perception” instead of to a certain size of the country’s total national output.

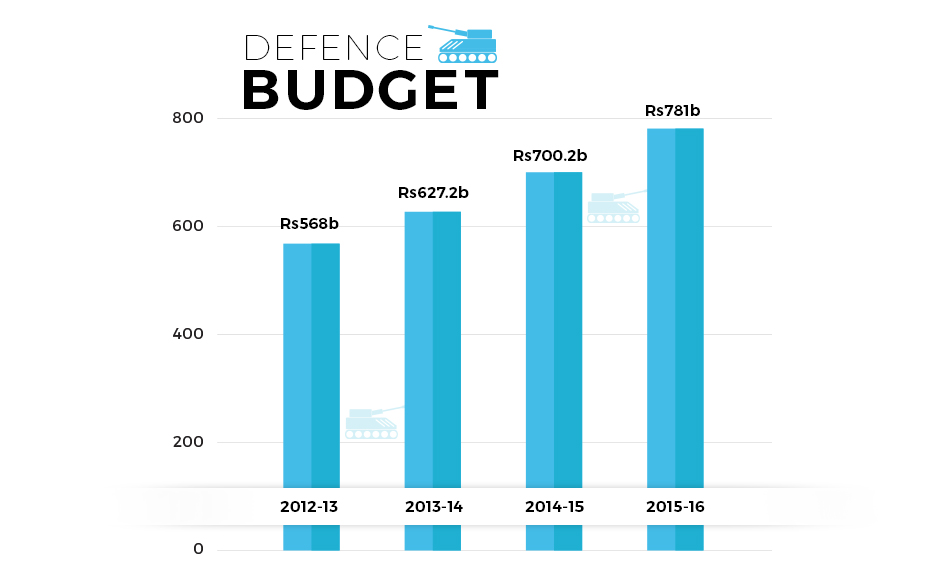

In the last three budgets, the PML-N government has allocated Rs2.108 trillion in declared defense budget to the armed forces. From June 2013 to June 2016, the defense budget has bumped up by 37.5% to Rs781 billion.

Three years and counting

For FY 2012-13, Rs568 billion was allocated to defense budget. In FY2013-14, it rose to Rs627.2 billion, 11.1% higher, and again by 11.1% to Rs700.2 billion the following year.

While presenting his government’s third budget in June last year, Finance Minister Ishaq Dar said, “The defense budget is being increased from Rs700 billion to Rs781 billion for 2015-16.

The GHQ, however, has been seeking an around 20% per annum increase in its budget, against an annual increase of about 11%. It’s important to note that out of the total budget, Pakistan Army gets the lion’s share while the remaining goes to Pakistan Air force and Pakistan Navy.

For the coming fiscal year, starting from today (July 1), the finance ministry has indicated Rs860 billion as a ballpark figure for defence, which is 10.1% higher than last year’s spending. The Ministry of Defence has termed the indicative budget insufficient and is seeking to link the budget with threat perception, which it says has been increasing “due to the current geo-political situation”.

The ministry is, instead, demanding Rs920 billion – Rs139 billion or roughly 18% higher than last year’s budget. Add to that the proposed amount is only for meeting the needs of the armed forces; the allocations for defense procurements are over and above this amount. The military also gets separate amounts for paying pensions to its retirees along with what the United Nation disburses each year in return for services that the Pakistan military renders in various UN-led peace keeping missions.

Further, the GHQ is also demanding it be given 100% of the Coalition Support Fund that the United States disburses in return for the country’s services against the war on terrorism. Currently, it gets 60% of the CSF fund, while 40% goes to the federal government.

Anemic economic conditions make it difficult for the government to absorb growing defence spending and allowing it to put extra burden on citizens through various tax measures.

On June 17, 2013, Finance Minister Ishaq Dar offered a near impossible barter – trading a 1% increase in sales tax with a Rs50 billion cut in military spending.

While presenting his first budget on June 11, 2013, Dar had announced an increase in the rate of General Sales Tax from 16% to 17%, contrary to PML-N’s election promise to reduce the GST rate.

In his third budget, Dar also announced a special tax to meet the expenditures being incurred by Temporary Displaced Persons and the security establishment. The move drew flak from the business community.

In his article Country needs a civil-military CoE (Charter of Economy), M Ziauddin argues that the security institution is in the driving seat when it comes to deciding the size of the defence budget. He wrote, “This strategy has from day one made the national economy subservient to security rather than security becoming subservient to the economy. It was always our security needs that had dictated our annual budgets irrespective of our ability to meet these security-related demands from our own resources”.

As threats from within and outside the country increase, Pakistan will only see an ever-increasing defence budget.

Three years up: Load-shedding continues to plague nation

By Zafar Bhutta

Long spells of power outages during its tenure became a major reason behind the Pakistan Peoples Party’s drubbing in the 2013 elections, and was taken advantage of by none other than the PML-N.

Nawaz Sharif’s party made it a launching pad for its election campaign, and eventually went on to claim victory. One of the biggest promises of the PML-N’s campaign was to get rid of outages within the next three years.

It’s been almost three years now, and there is no end in sight for load-shedding, which continues to plague the country, although with reduced intensity.

Energy policy

After coming into power, the PML-N government started working on a new energy policy, approved by the premier.

As part of the policy, the government vowed to end power outages in three years and phase out electricity subsidies for all but domestic consumers using up to 300 units a month. It also promised increase in power generation from 12,200 megawatts (MW) to 26,800MW and a reduction in average tariff from Rs14.70 to Rs10 per unit by switching from thermal to hydroelectric power and cheaper fuels, such as coal.

Among the policy proposals, only the one pertaining to restricting subsidy to consumers of up to 300 units per month was implemented. Rather, the government slapped two different surcharges – tariff rationalisation and financial cost – with an average impact of Rs1.97 per kilowatt-hour or about 17% of current tariff on consumers to clear debts of power distribution companies.

It has not even shifted the full impact of a sharp drop in world crude prices to consumers through monthly fuel price adjustment. The Ministry of Water and Power, however, claims that of the total benefit of Rs167 billion from lower oil prices, Rs157 billion has been passed on to the consumers.

Subsidy cover

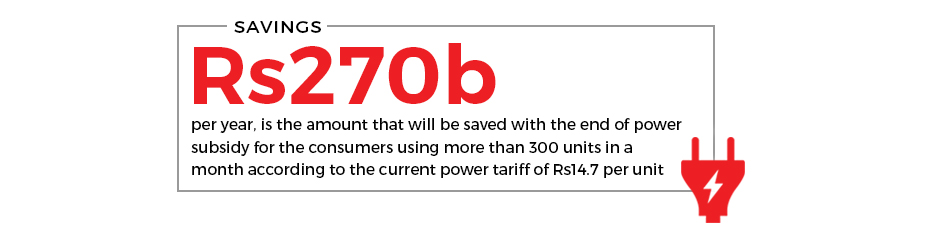

About 13.5 million power consumers of a total of 20.5 million consume up to 300 units per month, indicating that 40% of consumers will no longer receive subsidy cover. This will save the national purse Rs270 billion per year, according to the current power tariff of Rs14.7 per unit.

In a desperate bid to cut the fiscal deficit, particularly subsidy expenditure, the government is taking advantage of lower crude prices to reduce the subsidy for the upper middle-class.

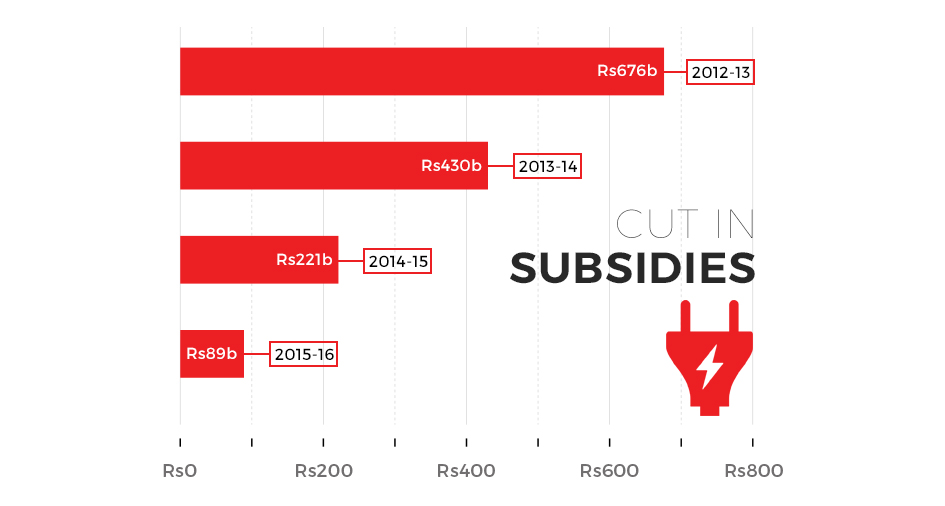

The subsidy that stood at Rs676 billion in 2012-13, accounting for 2.4% of the GDP, was cut to Rs430 billion (1.7% of the GDP) in 2013-14. In the following year, it was reduced to Rs221 billion (0.76% of the GDP) and a year after that the subsidy amounted to only Rs89 billion (0.3% of the GDP).

In the new policy, heads of power and gas distribution companies were tasked with reducing losses and improving operations. Those who failed would be replaced. Some heads of power distribution companies have already been removed by the Ministry of Water and Power.

The policy also outlined the target of reducing transmission and distribution losses from 36% to 16% by controlling power theft. Some improvement on this count has been noticed as the recovery of power bills has gone up from 86% to 93%.

However, the government has tried to push the regulator to allow an increase in permissible losses from theft and inefficiency from 12.5% of the power produced to 15.5%, which will still be below the actual loss of 19%.

A 1% loss means a loss of Rs12 billion in absolute terms, suggesting consumers are bearing a hefty cost of electricity theft.

Performance

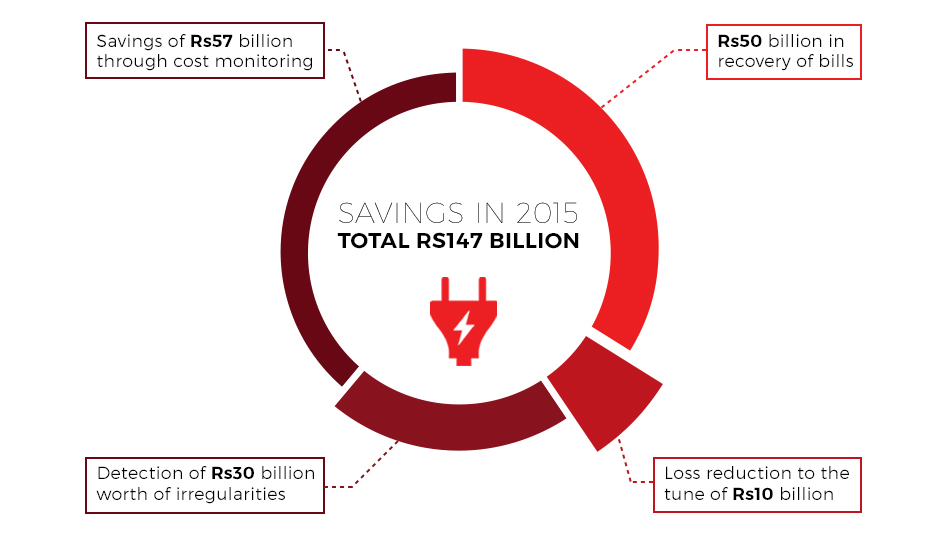

The government claims that the power sector saved Rs148 billion in 2015 due to various corrective measures. According to the power ministry, the sector benefited from an increase of Rs50 billion in recovery of bills, loss reduction to the tune of Rs10 billion, detection of Rs30 billion worth of irregularities and savings of Rs57 billion through cost monitoring.

Energy mix

In the new policy, the government is targeting to take the share of hydroelectric power, which currently stands at 30% the of energy mix, to 70% by building small and large dams and taking other initiatives.

New IPPs

Until 2013, independent power producers (IPPs) were generating 8,756 MW. Encouraged by the facilitation measures taken by the new government, some new IPPs emerged, adding 720MW to the generation capacity in 2013 and 590MW in 2014. At present, their capacity stands at 12,113MW.

In an effort to do away with the outages, there are plans to develop new power plants of 11,787MW capacity, including liquefied natural gas-based plants by the summer of 2018.

In the current summer, 865MW will be added to the national grid, including 630MW from wind and 200MW from solar energy. In winter, fresh capacity of 817MW will be brought – 680MW from Chashma-3 nuclear plant, 100MW from solar energy and 37MW from bagasse-based power plants.

In the summer of 2017, power production will go up by another 4,418MW with the help of 2,400MW LNG-based power plants, 937MW hydroelectric power, 31MW bagasse-based electricity, 600MW from solar and 450MW from wind resources. In winter, 5,817MW will be injected into the system through 1,980MW coal, 1,200MW LNG, 1,589MW hydel and 152MW bagasse-based plants.

In the summer of 2018, power production is expected to increase by another 660MW through coal-based plants.

Outages schedule for this summer

Preparing consumers for difficult days ahead, the government announced a load-shedding schedule at the end of April 2016, exempting only industrial units from the blackouts.

Domestic and commercial consumers will be facing the same hours-long outages that they endured last year. Industrial units will also face load-shedding at the time of peak demand.

According to the schedule, there will be six hours of outages in urban centres and eight hours of load-shedding in rural areas. However, areas where consumers are not paying their bills regularly will endure more outages.

Contrary to that, consumers face 12 to 16 hours per day of outages every summer due to mismanagement and bad governance in power distribution companies.

LNG, natural gas imports key to bridge energy deficit

By Zafar Bhutta

The government has made some headway through different oil and gas projects to bridge the energy shortfall such as liquefied natural gas (LNG) import, planned natural gas purchase from Iran and Turkmenistan through pipelines, and increase in domestic oil exploration.

In order to encourage refineries, the government has increased oil margins and given extension in the timeframe for upgrading their plants to produce Euro-II environment-friendly fuel. However, so far oil barons have continued to provide low-quality products.

Under the Petroleum Policy 2012, implemented by the current government but framed by the previous Pakistan Peoples Party administration, crude oil production has gone up from 64,000 to 100,000 barrels per day as the policy offers a higher wellhead price to exploration companies.

Fresh supplies of around 500 million cubic feet of gas per day have also been injected into the system, but almost the same quantity has been lost from the depleting existing fields.

As energy supplies are scarce in the face of growing demand, the government has eventually turned its focus to gas imports and the first LNG terminal started operations at Port Qasim in March 2015.

In an attempt to ensure uninterrupted supplies, it has struck a $15-billion LNG deal with Qatar and awarded an LNG supply tender to Gunvor company.

In the meantime, gas pipeline projects have also got under way including the Iran-Pakistan (IP) and Turkmenistan, Afghanistan, Pakistan and India (Tapi) pipeline projects.

The government has also embarked on the much-needed infrastructure development by conceiving the North-South gas pipeline, a new pipeline that will transport gas from the south to the north of Pakistan.

Gwadar-Nawabshah pipeline and LNG terminal is another strategic project in the infrastructure development plan.

IP pipeline

Despite an adverse international scenario and stringent sanctions on Iran, Pakistan took prudent and timely decisions to stave off any unwarranted situation that would lead to imposition of heavy penalties.

It presented and successfully defended its case in relation to the IP pipeline. Now with the easing of sanctions and Iran’s agreement with P+5 powers on the nuclear programme, Islamabad has re-engaged with Tehran for the critical project with high-level visits to and from Iran.

Both sides have shown their determination to press on with the project with mutual consensus and accord. They have agreed to make necessary amendments to the gas sale and purchase agreement and set a realistic timeline for the project’s realisation.

Tapi pipeline

This is yet another gas import project that will bring 3.2 billion cubic feet per day (bcfd) to Afghanistan, Pakistan and India from Turkmenistan.

Beset by time lapses, inordinate delays and daunting financial and security challenges for years, the project got a boost when a steering committee helped stakeholders arrive at a consensus on critical issues in February 2015. Another breakthrough was achieved in August of the same year when Turkmenistan designated itself as the consortium leader for project implementation.

Work on the project started in December 2015, while a feasibility study, the project’s design and route survey have been completed.

Pakistan is also looking to develop rail and road networks with Turkmenistan as bilateral relations pick up momentum with high-level visits from both sides.

Gwadar-Nawabshah pipeline

The Gwadar-Nawabshah LNG terminal and pipeline, which is considered an alternative to the IP pipeline and is a government-to-government venture with China, has the same route and technical specifications as the IP project.

The Chinese government has conveyed that China Petroleum Pipeline Bureau, a wholly owned subsidiary of China National Petroleum Corporation, will undertake the project alongside financing. From the Pakistan side, Inter State Gas Systems (ISGS) has been nominated to execute the project.

The first phase will supply up to 600 million cubic feet of re-gasified LNG per day (mmcfd) and is expected to be completed by December 2017. In the next phase, the capacity will be enhanced to 1.5bcfd by the end of December 2018.

The project – a major catalyst for diversifying the utilisation of Pakistan’s ports – has been put on a fast track with the use of studies conducted for the IP pipeline. This has saved time and financial resources.

North-South gas pipeline

The existing infrastructure lacks the capacity to transport additional gas volumes from the southern to the northern regions of the country.

Keeping in view the extra supplies after LNG imports, the Ministry of Petroleum and Natural Resources is laying a 1,100km-long pipeline from Karachi to Lahore under the North-South pipeline project that will carry 1.2bcfd of gas.

It will have the capacity to receive supplies from the Tapi pipeline in Multan besides accepting LNG that will come from the Karachi terminal.

ISGS, which has been nominated as the executing agency, is negotiating with RT Global of Russia, designated by the Russian Federation, for implementing the project under a government-to-government arrangement.

The project is being extensively pushed in the wake of high-level visits by oil ministers of Russia and Pakistan to each other’s country and it will prove to be a major Russian investment in Pakistan after decades.

LPG policy

In order to make liquefied petroleum gas (LPG) affordable for consumers, the Council of Common Interests – an inter-provincial body – has approved regulation of the market to bring down prices of the commodity, especially in peak-demand winter season.

Under a new regime, the producer price has been estimated at Rs895 per 11.8kg cylinder compared to the current price range of Rs1,150 to Rs2,000. Marketing and distribution margins have been proposed at Rs283 per cylinder with general sales tax at Rs130.

Upgrading of refineries

In the plant upgrading project, the government has again given an extension to oil refineries in the deadline for producing Euro-II specification products rather than penalising them for their failure.

With the fourth extension in the deadline, the consumers will continue to receive low-quality high-speed diesel. The refineries have been collecting a 7.5% deemed duty from the consumers since 2002 to finance the upgrading plan and have so far received over Rs200 billion. The Economic Coordination Committee has kept the duty rate unchanged.

No industrial policy despite decade-long efforts

By Zafar Bhutta

It is surprising that Pakistan has not framed an industrial policy in around 15 years, even though governments have made as many as five efforts to come up with a new document for propelling what is considered a vital segment of the national economy.

In a temporary arrangement, the industry is being governed through a tariff policy. At a time when nations around the world are looking for big investments to support their economies, Pakistan being no exception, a long-term and sustainable industry policy is critically needed.

Since 2002, five powerhouse politicians, Abdul Razak Dawood, Jehangir Tareen, Liaquat Ali Jatoi, Manzoor Ahmad Wattoo and Pervaiz Elahi, have held the portfolio of industries minister and tried to introduce an industrial policy but their efforts went in vain.

Earlier, successive governments had been issuing industrial policy orders like import policy since 1992 to achieve industrial growth, but this came to a halt later.

According to officials, during the tenure of governments led by Pervez Musharraf and Pakistan Peoples Party (PPP), some serious steps were taken, leading to the drafting of the industrial policy and industrial growth projections, but the process could not be pushed towards conclusion.

“Change of governments and ministers has been one of the reasons behind the delay in formulating an industrial policy,” an official remarked.

The present government, which came up with ‘Vision 2025’ comprising an industrial growth strategy after taking the reins of power in June 2013, has also failed to unveil an industrial policy. On the other hand, Pakistan’s neighbours have put in place a proper policy for the industrial sector.

Share in economy

The industry has been a major contributor to the economic growth of Pakistan. In fiscal year 2014-15, the government set the national output growth target at 5.1% on the back of 3.3% expansion in agriculture, 6.8% in industry and 5.2% in services.

According to the Economic Survey 2014-15, the GDP growth stood at 4.24% with agriculture expanding 2.9%, industry 3.6% and services 5%.

The PML-N government is believed to be pro-industry that has started providing uninterrupted power and gas supply to the industries, but so far its focus has primarily been building road infrastructure.

Its most powerful minister is Finance Minister Ishaq Dar whereas Industries Minister Ghulam Murtaza Khan Jatoi looks powerless. Jatoi even quit his office in protest against the hurdles put up by the bureaucracy.

However, after remaining away from office for several months, he once again took charge of the ministry but with clipped wings.

In the new auto policy, announced in March this year, Jatoi seemed to have no say. The entire task was entrusted to Water and Power Minister Khawaja Muhammad Asif and Privatisation Commission Chairman Mohammad Zubair. The policy was announced by Asif.

“This is the state of affairs of the industries ministry due to interference of top bureaucrats that are close to the government,” an official said and asked how the industries ministry could strive to introduce an industrial policy in such a situation.

K-P an exception

In Khyber-Pakhtunkhwa, however, the Pakistan Tehreek-e-Insaf (PTI) government has launched the Industrial Policy 2016, which that offers financial concessions, investment incentives, infrastructure and service facilities, as well as measures aimed at equipping manpower with necessary skills and promoting trade and industry.

The government has done away with the condition of seeking a no-objection certificate for establishing industrial units in the province. It has also decided to give a sizeable concessions on industrial loans and 25% subsidy on the purchase of land, machinery, transportation charges and electricity tariff for new industrial units.

Ill-planning

All Pakistan Sugar Mills Association Chairman Iskandar Khan remarked that Pakistan needed an industrial policy for sustainable development. “Investors need a clear framework for pouring capital into the country,” he said.

Pointing to the ill-planning, Khan said Pakistan had 84 sugar mills with annual production capacity of 7 million tonnes compared to the consumption of 4.8 million tonnes but new mills were being set up in spite of that.

He suggested that the Board of Investment (BOI), which had been virtually dysfunctional, should be activated and opposed sudden changes to tax policies that hurt investments in the industrial sector.

According to him, Pakistan’s industry is enjoying massive tax concessions in the European market, but it cannot reap the desired benefits because of lack of sustainable growth in the face of energy shortages, unfavourable tax policies and delay in tax refunds.

He asked the government to take a bold step and frame the industrial policy in order to enhance exports and boost economic growth. Higher exports could be a major source of dollar inflows, which may help the country avoid going to the IMF for loan bailouts.