The British pound, building cause as capital migrates to the relative safety of the United States (US dollar) from economic, political, and social uncertainty stemming from controversial policies (1,2,3,4,5) and inclusion within the EU that many believe sacrifice national sovereignty for the pretense of prosperity, security, and normalcy (1,2,3) should resume mark down once the dollar jumps the creek. Continued participation in the EU and alignment to the failing euro will likely accentuate mark down as liquidation intensifies in 2017. Traders playing this transition should be following the cycle of accumulation and distribution not only in the pound but also the US Dollar Index.

Investors, largely driven by emotions rather than discipline, tend to focus on volatility rather than the message of the market. This tendency prevents them from recognizing better opportunities in quieter markets.

Summary

The BEAR (Price) and BEAR (Leverage) trends under Q2 accumulation after the seasonal high position the British pound as a focused bear opportunity since the second week of November.

Price

Interactive Charts: FXB, FXB PF

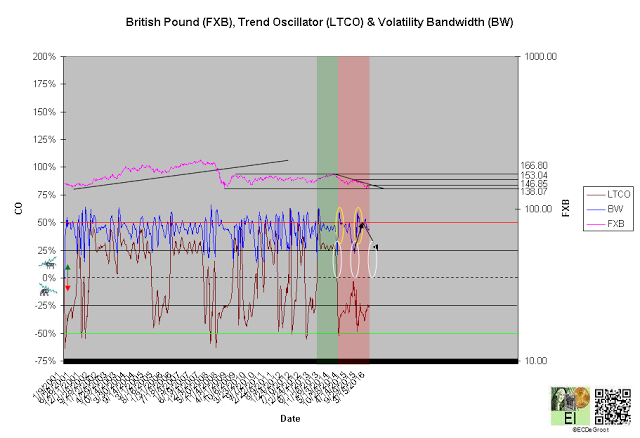

The long-term trend oscillator (LTCO) defines a down impulse from 159.85 to 140.99 since the second week of September 2014 (chart 1). The bears control the trend until reversed by a bullish crossover. Compression, the final phase of the CEC cycle, generally anticipates this change.

A close above 153.40 jumps the creek and transitions the trend from cause to mark up, while a close below 138.07 breaks the ice and transitions it to mark down.

Chart 1

Leverage

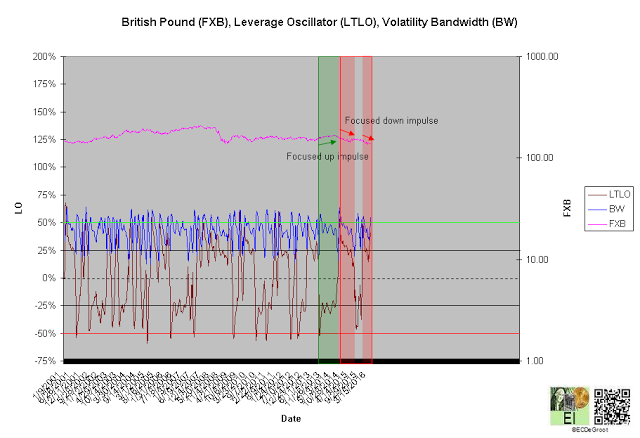

The long-term leverage oscillator (LTLO) defines a bear phase since the second week of November (chart 2). This focuses the down impulse (see price).

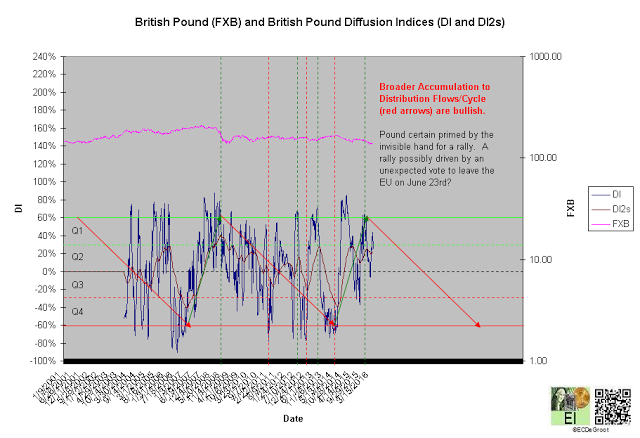

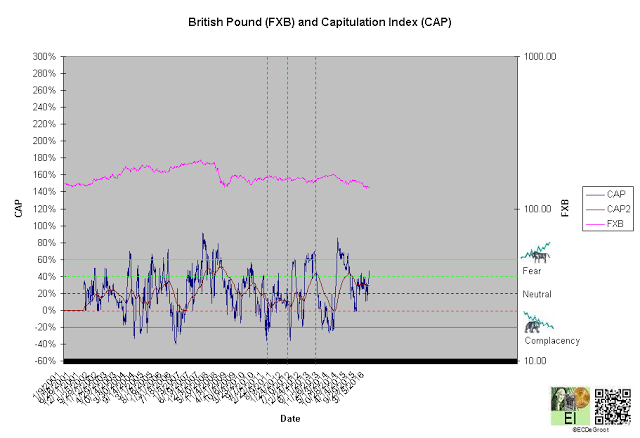

A diffusion index (DI) of 25% defines Q2 accumulation (chart 3). A capitulation index (CAP) of 47% supports this message (chart 4). DI and CAP's trends, broader flows of leverage and sentiment from accumulation to distribution and fear to complacency supporting the bulls (red arrows), should not only continue to extreme concentrations but also restrain downside expectations until reversed (see price). A decline under these trends, a sign of weakness (SOW), would be bearish for the pound longer-term.

Chart 2

Chart 3

Chart 4

Time/Cycle

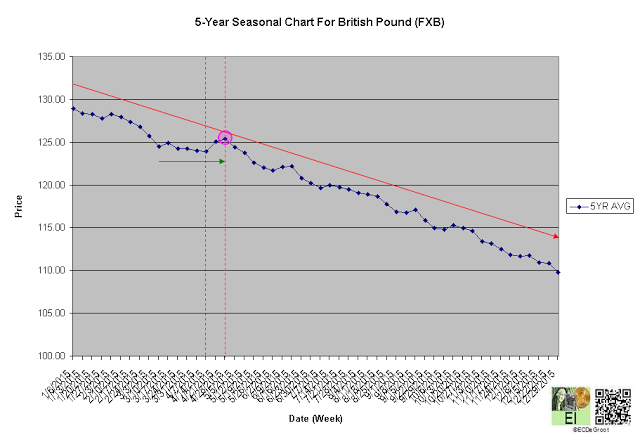

The 5-year seasonal cycle defines strength until the fourth week of April (chart 5). This path of least resistance restrains downside expectations (see price).

Chart 5