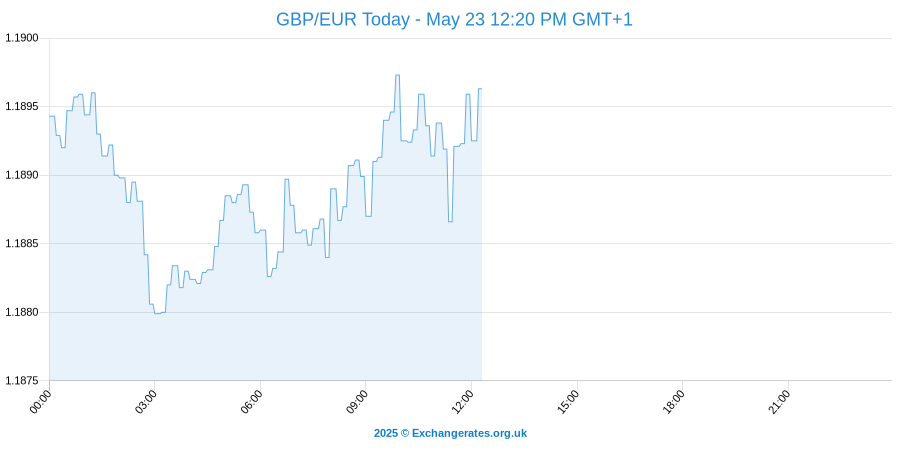

Today's Pound Sterling to Euro Exchange Rate Outlook, News and Forecasts With Live GBP to EUR Conversions

Foreign exchange markets saw a volatile week for the British pound to euro exchange rate, with the GBP Sterling declining early on as investors anticipated harsh austerity measures in the Autumn Statement, before experiencing a large uptrend once the implications of the Spending Review became clear.

The Euro complex, meanwhile, was hit by new difficulties in Greece, as a bomb attack on the headquarters of the business federation sparked fears that anarchists were planning a wave of anti-austerity violence across the country.

Next week is likely to see significant movement in the GBP/EUR exchange rate, with high impact data due out every day until Friday, including the Consumer Price Indexes for both Germany and the Eurozone.

Before we continue, here's a quick recap of the latest live forex rates:

On Friday the Pound to British Pound exchange rate (GBP/GBP) converts at 1

The live inter-bank GBP-GBP spot rate is quoted as 1 today.

FX markets see the pound vs swiss franc exchange rate converting at 1.135.

The live inter-bank GBP-USD spot rate is quoted as 1.244 today.

Please note: the FX rates above, updated 19th Apr 2024, will have a commission applied by your typical high street bank. Currency brokers specialise in these type of foreign currency transactions and can save you up to 5% on international payments compared to the banks.

Pound Exchange Rate Forecast vs the Euro This Week

GBP remained weak following the announcement of a £4 billion deficit in UK Public Finances, raising questions over George Osborne’s ability to meet his target budget surplus of £10 billion in the 2019/20 financial year.

The GBP momentarily regained ground against the EUR on Wednesday after George Osborne’s Autumn Statement measures seemed not to be as severe as investors feared, however after taking some time to crunch the data, Pound Sterling slowly declined

‘This is fixed four years out. The forecasts will change again, and by a lot more than they have over the past few months. If he is unlucky – and that’s almost a 50-50 shot – he will have either to revisit these spending decisions, raise taxes, or abandon the target.’

Geopolitical Tensions Could Weigh on EUR to GBP Exchange Rate Despite Upbeat Inflation Forecasts

The bomb attack in Athens early last week and the New Democracy being left leaderless after technical problems meant elections couldn’t take place, slowed the pace of Euro gains at the beginning of the week.

However, the Euro gradually advanced against several of the major currencies as polls showed improved consumer confidence and inflation expectations.

Economic sentiment for the Eurozone rose from 105.9 to 106.1, while consumer inflation expectations rose from 0.5 to 3.7 between October and November.

The European Commission have warned that the influx of refugees, the renewed threat of terrorism and the continuing conflicts in the Middle East could all have a significant impact upon the Eurozone economy, cautioning that the positive inflation expectation data was collected before the Paris attacks took place.

Pound / Euro 5-Day Exchange Rate Outlook: Important Eurozone Data Could Spark EUR/GBP Exchange Rate Uptrend

The UK has medium impact data due out every day until Friday, including Tuesday’s Bank of England (BoE) Stability Report, Wednesday’s Construction PMI and the Composite PMI on Thursday.

The releases are likely to be overshadowed by much more important Eurozone data, which could continue the Euro uptrend for the majority of the week unless further geopolitical troubles develop.

Of course, the big EUR-impacting event of the week is the ECB minimum bid rate and conference this Thursday.

"The European Central Bank will ease policy next week in some way or another, according to economists polled by Reuters, many of whom say the bank cannot pull back now after signalling its intentions so clearly over the past month." Reuters.com

The FX markets have to a certain extent priced-in the likelihood of a bid rate cut, but the euro exchange rates will face extreme volatility anyway.

Leading Institutions and the Euro to Pound Sterling Exchange Rates Forecast

Here's a recap of the Euro to Pound exchange rate below. Please note that any currency forecast provided below is indicative only and is not guaranteed in any way.

- HSBC see 1 EUR to GBP at 0.73 (Q4 2015), at 0.76 (Q1 2016) and 0.80 (Q2 2016).

- Commerzbank see 1 EUR to GBP at 0.70 (Q4 2015), at 0.67 EUR-GBP (Q1 2016) and at 0.66 (Q2 2016).

- ABN AMRO see 1 EUR to GBP at 0.70 (Q4 2015), at 0.70 (Q1 2016) and at 0.70 (Q2 2016).

British Pound Remains Flat Against the Euro Ahead of German Consumer Price Index

Monday morning sees the GBP/EUR is currently flat as traders await data from both the UK and EU economies which is due to be released later today.

Imminent UK Net Consumer Credit and Mortgage Approvals for October could see the Pound trend higher for the rest of the morning, with the German CPI figures potentially pushing the Euro up if Year-on-Year CPI rises to 0.4% as predicted.

British Pound Making Bullish Advances on the Euro

German Consumer Price Index figures have performed as expected, with the Month-on-Month CPI rising from 0.0% to 0.1%, and the Year-on-Year (YoY) Index increasing from 0.3% to 0.4%.

Despite this, the Euro has slumped against Pound Sterling, probably because the CPI figures have only managed to meet expectations.

With trader focus on the European Central Bank’s (ECB) December 3rd meeting to discuss interest rates and monetary stimulus policy, the otherwise high-impact German CPI figures have been largely ignored.