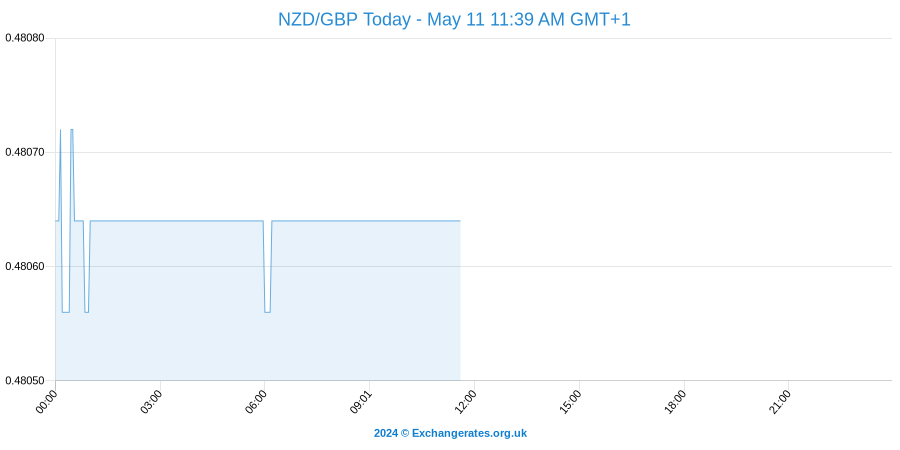

NZD-GBP Conversion Rate reaches Multi-Month Best as BoE Minutes Disappoint Sterling Supporters Today

Following on from Monday’s securing of the Trans-Pacific Partnership deal for New Zealand (along with 11 other nations), the New Zealand Dollar has been on a gradual uptrend which culminated in the ‘Kiwi’ reaching 0.4345 against the Pound yesterday.

A quick foreign exchange market summary before we bring you the rest of the report:

On Tuesday the Pound to British Pound exchange rate (GBP/GBP) converts at 1

The pound conversion rate (against pound) is quoted at 1 GBP/GBP.

At time of writing the pound to euro exchange rate is quoted at 1.17.

Today finds the pound to us dollar spot exchange rate priced at 1.243.

The pound conversion rate (against chinese yuan) is quoted at 8.998 CNY/GBP.

Please note: the FX rates above, updated 16th Apr 2024, will have a commission applied by your typical high street bank. Currency brokers specialise in these type of foreign currency transactions and can save you up to 5% on international payments compared to the banks.

The New Zealand currency has reached this result after passing through rough waters, however; the World Economic Outlook report from the International Monetary Fund (IMF) on Tuesday painted a bleak picture for commodity currencies such as the ‘Kiwi’ in the years to come, and the fluctuating price of milk has also failed to provide any solid anchor for New Zealand Dollar support to rest on.

The value of the Pound has taken a major hit today, owing to the Bank of England (BoE) minutes regarding their interest rate freeze revealing an overtly dovish attitude on the part of the policymakers. As is now routine, only one BoE Monetary Policy Committee (MPC) member, Ian McCafferty, voted in favour of an interest rate hike, but worse still was the fact that the policymakers made no indications of raising the UK interest rate anytime next year. This absence of hints prompted some economists to push their forecasts past Q2 next year, although others showed more reserve, seeing Q2 as the latest, not the earliest likely raise point.

Tomorrow, the Pound will be affected by the UK Trade Balance data for August; at the time of writing, forecasts had been negative across the board.

For the ‘Kiwi’, no further economic releases are planned, therefore the price of milk and other external factors will contribute to any movement before the weekend.

Small Dip Recorded in NZD-EUR Exchange Rate as ECB Minutes Worsen Common Currency’s Standing Today

Although the Pound Sterling has been knocked by its respective central bank results today, the Euro has been rocked by the European Central Bank (ECB) Account of the Monetary Policy Meeting, which took place at the beginning of September. Although partially obsolete thanks to the month-long gap, the weight of the minutes was still sufficient to drive the value of the Euro down against competitors, causing it to trend narrowly for the most part. This was reflected in the NZD-EUR exchange rate; while the ‘Kiwi’ did fall against the Euro today, it still posted 0.5873 in the pairing.

Sending large amounts of money abroad? Did you know you could save compared to using the high street banks? Get a free guide and start a chat with our team of foreign exchange experts.

The minutes were overly cautious over the future of global economies, citing that ‘Challenges facing emerging market economies were clouding the global outlook and were unlikely to recede quickly’.

Before the weekend, Euro movement is likely to be caused by the Italian Industrial Production result for August and the Greek Industrial Production figure for the same month, as well as the Hellenic nation’s Inflation Rate for September; declines have been predicted in all of the Greek fields, while 0% is forecast for the Italian monthly variant.

Numbed US Dollar Investors Braces for Potentially Obsolete Minutes Today, ‘Kiwi’ Edges Higher as US Data Comes in Poorly

Investors in the US Dollar will be forgiven for not being on the edge of their seats for this evening’s FOMC Meeting Minutes, as given how much has changed since the September 16th-17th meeting, many have shelved a US interest rate until next year at the very earliest

Foreign Exchange Predictions Now: Westpac’s Delbruck Foresees Hard Times for NZ Economy as TPP Elation Settles

Although New Zealand’s economic stability has apparently been assured by Monday’s TPP agreement finally being reached, Felix Delbruck, Senior Economist at Westpac (one of the largest banks in Australia and New Zealand) has painted a less jubilant picture for the future of New Zealand’s economy. Talking about the effects of increased migration on New Zealand, Delbruck said:

‘This is a double-edged sword for the economy. It will support growth across New Zealand’s regions, but will also limit migration’s ability to act as a ‘safety valve’ in an economic downturn. We expect unemployment to rise to above 6% over the coming year, and continued high population growth is one of the reasons’.

Adding that the current level of population growth ‘does look unsustainably high’, Delbruck went on to forecast:

‘Most recent offshore migrants have come to New Zealand on temporary visas, and many will return home over the next few years. For those that intend to settle in New Zealand long-term, doing so will depend on their ability to obtain work, affordable housing, and a residence visa – all of which are in limited supply’.

Despite this disheartening prediction, Delbruck was optimistic for the long term, as after estimating that net migration would slow to less than 15’000 by 2018, he stated:

‘By the standards of previous migration downturns – notably in 2011 – this is clearly a ‘soft landing’.

NZD NEWSFLASH: New Zealand Dollar Exchange Rate Fluctuates Today

The Pound Sterling to New Zealand Dollar fluctuated modestly on Friday, with the South Pacific currency edging slightly lower despite a solid increase in domestic card spending. Retail card spending climbed 0.9% on the month while general card spending advanced 0.7%.