Today's Exchange Rate Report for the Pound, the Euro and the US Dollar

The Pound Sterling to Euro exchange rate is trended in the region of 1.3561 GBPEUR having appreciated by around 0.3 per cent. The Pound Sterling to US Dollar exchange rate is currently trending narrowly in the region of 1.4146. As traders await British construction data, predicted to show a slight improvement, the Pound edged higher versus its peers. The Euro softened in response to the overnight US Dollar uptrend, but the US asset is holding steady in the early stages of Friday’s European session ahead of key US labour market data.

The British Pound gained against both the Euro and US Dollar in early European trading as UK productivity rose at the fastest rate in four years in the second quarter, as confirmed by the Office for National Statistics.

The news also coincided with two surveys which showed UK Manufacturing remains stuck in stagnation in September as factories were hit by both weak investment, sluggish export orders and slower consumer spending.

A quick foreign exchange market summary before we bring you the rest of the report:

On Friday the Euro to British Pound exchange rate (EUR/GBP) converts at 0.856

The GBP to EUR exchange rate converts at 1.168 today.

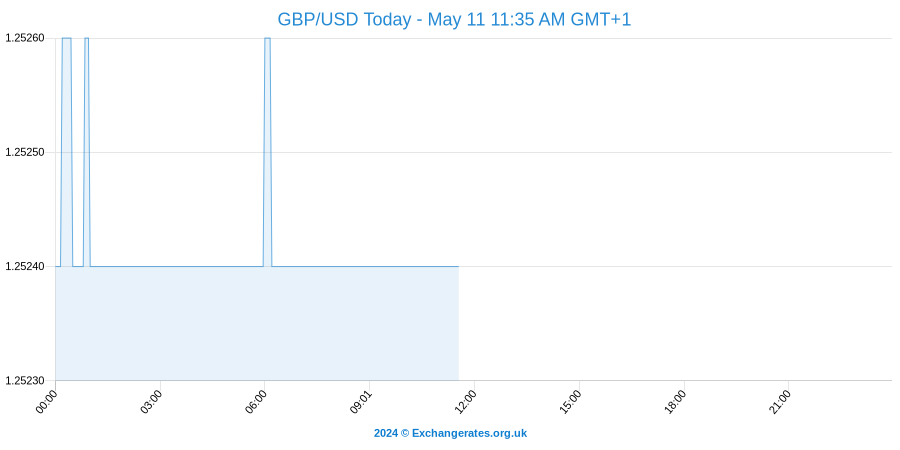

The GBP to USD exchange rate converts at 1.246 today.

The pound conversion rate (against australian dollar) is quoted at 1.941 AUD/GBP.

NB: the forex rates mentioned above, revised as of 19th Apr 2024, are inter-bank prices that will require a margin from your bank. Foreign exchange brokers can save up to 5% on international payments in comparison to the banks.

The Markit/CIPS manufacturing PMI stood at 51.5 in September, which was broadly unchanged from August's reading of 51.6. The reading was still above analysts’ expectations, however with the recent stagnation in Manufacturing in September, this causes further concern on the timing of an interest rate hike by the Bank of England.

"Despite unprecedented central bank stimulus and substantial currency depreciation, the manufacturing sector is failing to achieve significant growth momentum and even risks stalling again," said Chris Williamson, chief economist at Markit.

Markits overall purchasing managers' index for September is still above the critical 50 level but at 51.5, it has fallen 0.1 from August and is close to the two-year low that it hit in June.

"The industrial side of the economy is playing no role in the economic recovery at the moment. And looking ahead, the sector’s near-term prospects do not look much better, as bleak weak overseas demand and a stronger exchange rate are likely to continue to crimp growth," said Ruth Miller, an economist at Capital Economics.

The Pound gained against both the Euro and US Dollar following the release before slowing in late US trade. The GBP/EUR opened up at 1.3506, trading as high as 1.3594 before retracing back to reach 1.3532. The Pound Vs US Dollar also opened up higher, with a 0.5% gain to 1.5180 before correcting back to 1.5150