Today's Pound Sterling to Euro Exchange Rate Forecast with Live GBP-EUR Predictions for 2015 and 2016

Foreign exchange markets saw the British Pound to Euro exchange rate improve on previous conversion levels this week after the UK's employment data exceeded expectations.

Last week began poorly for Sterling, seeing a lack of UK results on Monday being compounded by the day’s only Eurozone results, the Industrial Production figures, coming out positive.

This downtrend continued on Tuesday with the UK Inflation Rates for August all declining.

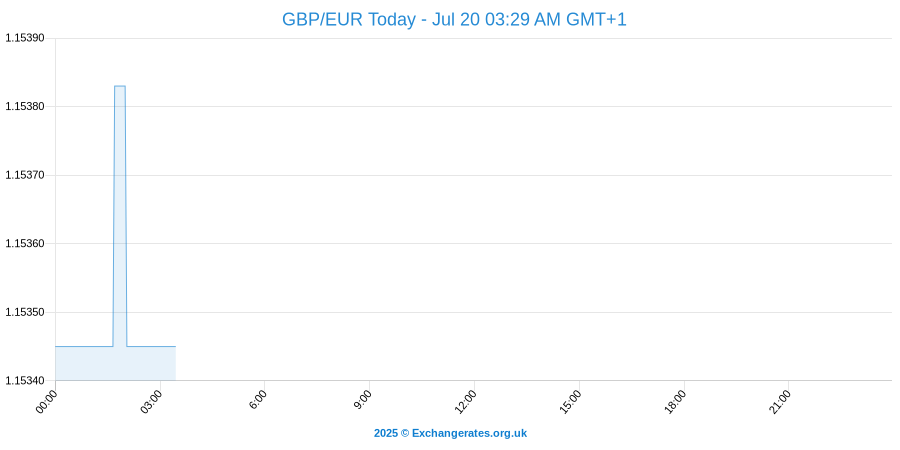

A mixed week for the two currencies saw the Pound to Euro (GBP/EUR) exchange rate rise from recent lows

A quick foreign exchange market summary before we bring you the rest of the report:

On Tuesday the Pound to British Pound exchange rate (GBP/GBP) converts at 1

FX markets see the pound vs pound exchange rate converting at 1.

At time of writing the pound to swiss franc exchange rate is quoted at 1.134.

At time of writing the pound to us dollar exchange rate is quoted at 1.243.

Please note: the FX rates above, updated 16th Apr 2024, will have a commission applied by your typical high street bank. Currency brokers specialise in these type of foreign currency transactions and can save you up to 5% on international payments compared to the banks.

Pound to Euro Exchange Rate Forecast

While this was initially met with complacency by investors and speculators due to the Bank of England (BoE) minutes predicting such an occurrence, the fact that the inflation rates had decreased meant that the mood progressively darkened over the day, seeing confidence in Sterling ebb away into Wednesday.

This saw major changes for the positive for the British Pound to Euro rate, however, as beneficial outcomes in the UK Earnings and Employment data sent the Pound jumping up from the region of 1.3589 to 1.3755, the best exchange rate of the week.

Sending large amounts of money abroad? Did you know you could save compared to using the high street banks? Get a free guide and start a chat with our team of foreign exchange experts.

Unfortunately, the subsequent UK Retail Sales figures published on Thursday disappointed once again, with declines exceeding forecasted drops in two of the four variants.

The week ended quietly, with the Pound Sterling to euro (GBP-EUR) exchange rate printing in the region of 1.3669.

Dramatic Last Week Saw mass decline of Euro towards the close of European Trading Session

The Euro had a virtually opposite performance to the Pound last week, reaching its high point on Wednesday of 0.7358 and crashing down to its weekly low of 0.7270 just hours later.

The biggest boost for the Euro last week came when with the Eurozone monthly and yearly Industrial Production figures for July; a previous -0.3% in the former result gave way to a posting of 0.6%, while with the latter, 1.5% was advanced upon to hit 1.9%. Less positive news came on Tuesday morning, however; while the German ZEW Survey of the Current Situation rose from 65.7 points to 67.5, the German and Eurozone Surveys of Economic Sentiment were less optimistic, printing declines from 25 to 12.1 and 47.6 to 33.3 respectively.

The Euro was also hit by inflation rate woes last week with the annual base and Core CPIs for August dropping against expectations of repeated gains.

Although it experienced a tremendous setback in the EUR-GBP pairing following the positive UK results on Wednesday, the Euro ended on Friday trending around the mark of 0.7336, matching the Pound somewhat in the conversion rate.

Pound to Euro 5-Day Forecast: UK Data Limited this Week, Eurozone in Focus

The UK has a fairly low number of economic releases due out this week, mostly focused around the government’s Borrowing and Public Finances figures for August on Tuesday.

By comparison, the Eurozone stands to benefit from the Consumer Confidence Score for September on Tuesday, a set of PMIs on Wednesday and several business assessments and economic climate estimations on Thursday.

Most immediately, however, the 2nd Greek election of 2015 is taking place today, and who wins (and by how much) is likely to be a key factor on the Euro’s faring into the start of the week.

It seems somewhat inevitable that a coalition will need to be formed by the majority party. Lefteris Farmakis, an analyst of Nomura International, has outlined three possibilities.

The ‘good’ option is ‘a New Democracy-led coalition of moderate parties’, the ‘bad’ outcome is ‘a highly fragmented parliament with Syriza and New Democracy getting very low shares of the vote, in which case more parties will be needed to form a government’.

In keeping with the theme, the ‘ugly’ scenario would see ‘Golden Dawn, and the anti-European parties getting a really high share of the vote’.

Greek Election Forecast to Cause GBP to EUR Exchange Rate Volatility

The new leaders of Greece are going to have to get their skates on, so to speak, with regard to economic policy, as Holger Schmieding, Chief Economist at the Berenberg Bank has recently said: ‘Greece has to act fast after the election. Fast progress is essential to gradually rebuild the trust in government and confidence in the future that is needed for some of the capital outflows to be reversed and for the slump in investment to end. Europe has handed Greece one last lifeline. If Greece does not grasp it, Europe won’t send any further money and Grexit would be back on the agenda before the year is out’

Euro News Today

The Euro to Pound exchange rate posted modest gains today as former Greek PM Alexis Tsipras secured enough votes for reelection during the second Greek election of 2015.

Today's German producer price index could prove to be a cause of some additional GBP/EUR volatility as the day continues