USDJPY Movement

For the 24 hours to 23:00 GMT, the USD strengthened 0.60% against the JPY and closed at 119.97.

Yesterday, Japan’s Economy Minister, Akira Amar, urged that the BoJ’s QE programme has to be ramped up, as the Japanese economy requires an extra stimulus of ¥2.0 trillion in order to revive the condition of the nation’s economy and also to combat a slowdown in China’s economic growth.

On the macro front, Japan’s Eco Watchers Survey for the current situation unexpectedly slipped to a level of 49.30 in August, compared to market expectations of an advance to 52.00 and following a reading of 51.60 July. Additionally, the nation’s Eco Watchers Survey for the future outlook fell to 48.20 in August, compared to a reading of 51.90 in the prior month, while markets anticipated it to climb to a level of 52.40.

In the Asian session, at GMT0300, the pair is trading at 120.34, with the USD trading 0.31% higher from yesterday’s close.

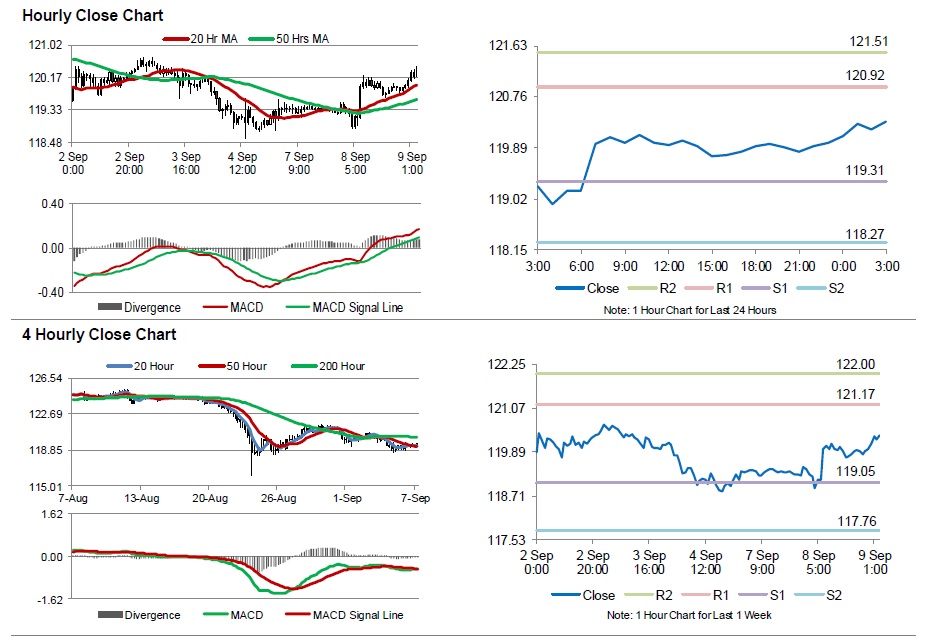

The pair is expected to find support at 119.31, and a fall through could take it to the next support level of 118.27. The pair is expected to find its first resistance at 120.92, and a rise through could take it to the next resistance level of 121.51.

Looking ahead, market participants would concentrate on Japan’s consumer confidence and machine tool orders data, set for release later in the day, for further cues in the Yen.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.