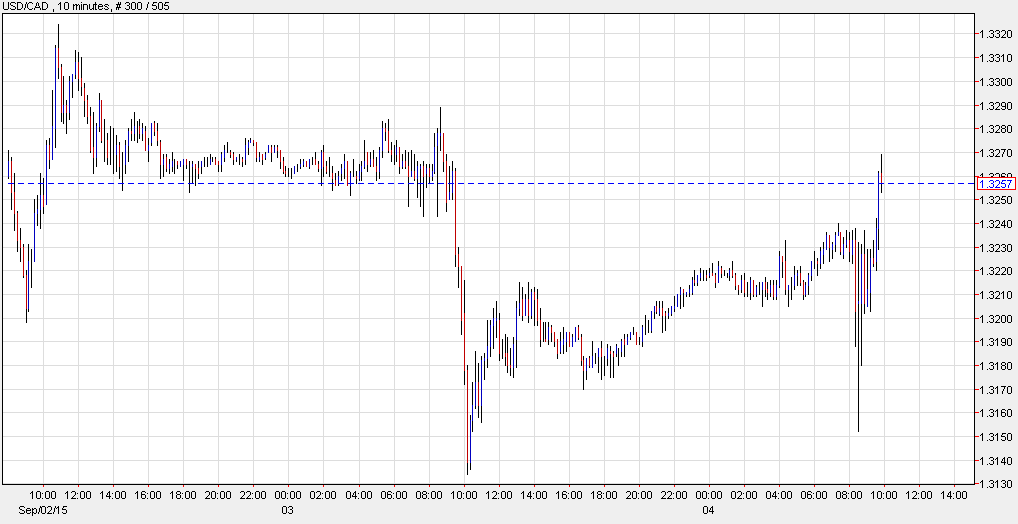

70 pip drop in USD/CAD erased in minutes

A strong Canadian jobs report featuring a surge in full-time hiring still wasn't enough to sustain any kind of Canadian dollar gains. That was followed by a strong Ivey PMI that did next-to-nothing.

Broad US dollar strength and risk aversion are weighing along with commodity weakness but it seems as though almost any kind of combination of news isn't the right mix for CAD.

The BOC meets next week and the OIS market shows a 14% chance of a cut, rising to 35% in October. The main focus will be on a signal about Oct or later in the year.

I have a strong bias towards selling the Canadian dollar. I think GBP/CAD longs are particularly attractive at the moment. So far the Canadian economy has remained resilient but with China slowing and commodities on life support, it's only a matter of time until the loonie cracks again.