Pound Sterling to Euro (GBP/EUR) Exchange Rate Gains 0.9% on Greek Developments, BoE Minutes

After yesterday's UK retail sales flop, today's UK BBA Loans for Home Purchase number will need to be positive if the Pound is to claw back any of its recent losses. GBP/EUR trading will also be affected by the Eurozone's PMIs while US housing data is likely to cause some GBP/USD fluctuations.

Earlier...

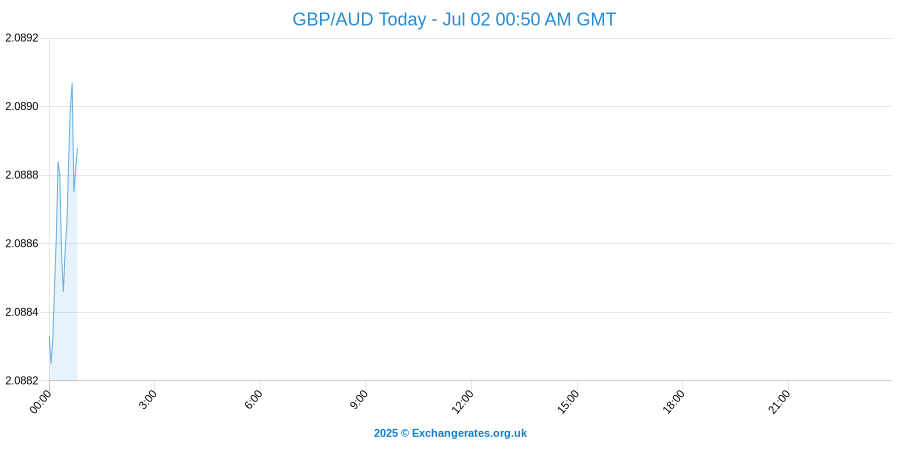

Sterling (GBP) continued its rise against the Euro yesterday, gaining 0.90% throughout the day as austerity woes for the Greek nation provided sufficient consternation within the Greek parliament that the Euro lost value. The Pound maintained its strength against the Australian Dollar (AUD) with trading remaining against the psychologically import 2.10 resistance levelOn Tuesday the Euro to British Pound exchange rate (EUR/GBP) converts at 0.854

At time of writing the pound to euro exchange rate is quoted at 1.17.

The live inter-bank GBP-CAD spot rate is quoted as 1.719 today.

The live inter-bank GBP-AUD spot rate is quoted as 1.942 today.

FX markets see the pound vs us dollar exchange rate converting at 1.243.

NB: the forex rates mentioned above, revised as of 16th Apr 2024, are inter-bank prices that will require a margin from your bank. Foreign exchange brokers can save up to 5% on international payments in comparison to the banks.

Current GBP, EUR

Sterling (GBP) values during the mid morning trading session on Thursday were 1.4248 (-0.29%) versus the Euro (EUR), at 1.5654 (+0.27%) versus the US Dollar (USD), at 1.4933 (-0.36%) versus the Swiss Franc (CHF), at 2.0361 (+0.00%) versus the Canadian Dollar (CAD), at 2.1162 (-0.05%) versus the Australian Dollar (AUD), at 2.3468 (-0.53%) versus the New Zealand Dollar (NZD), at 99.69 (+0.41%) versus the Indian Rupee (INR), at 19.4240 (+0.39%) versus South African Rand (ZAR), at 193.80 (+0.06%) versus the Japanese Yen (JPY), at 10.6310 (-0.29%) versus the Danish Kroner, at 13.4107 (-0.08%) versus the Swedish Kroner and at 12.7648 (+0.28%) versus the Norwegian Kroner.

Pound Sterling (GBP) Exchange Rate Trends Higher on BoE Meeting Minutes, GBP/EUR, GBP/USD Currency Pairs Advance

Sterling (GBP) strengthened against the majority of its 16 actively traded currency pairs yesterday, continuing to gain support from the improving prospects for a hike in the base rate of interest in the UK before the end of 2015. A report from the most recent Monetary Policy Committee (MPC) meeting showed that the decision between holding rates and increasing rates was becoming “finely balanced”. Data releases today which are of note include Retail Sales figures which are forecast to rise to 5.1% (YoY) from 4.4%, which would likely provide further support for Sterling.

Sending large amounts of money abroad? Did you know you could save compared to using the high street banks? Get a free guide and start a chat with our team of foreign exchange experts.

The Euro (EUR) sunk by around 0.90% versus the Pound yesterday as ‘long’ Sterling traders hoped that a vote in the Greek parliament to pass austerity measures and therefore secure bailout funds from creditors might be rejected. The austerity measures were successfully passed (eventually) after Greek Prime Minister Alexis Tsipras gained support from opposition MPs. A further reshuffle of Tsipras’ cabinet seems likely after his own MPs failed to support his measures and voted in defiance of party Whips.

Forex Forecasts: GBP/AUD Close to Best Rate Today

The Australian Dollar (AUD) lost value versus the Pound yesterday as Reserve Bank of Australia (RBA) Governor Glenn Stevens made comment that the there remains a possibility of further base rate cuts. Historically speaking the RBA has favoured applying downward pressure to the value of the Aussie Dollar in order to increase the international competitiveness of Australian exports. Whilst Governor Steven’s comments were taken in that context, they still had the desired effect, sending the value of AUD downwards. With the base rate of interest at 2% further scope does remain for the RBA to cut rates especially in the context of yesterday’s Australian Inflation report showing CPI (YoY) at 1.5%, below the forecast rate of 1.7%

The US Dollar (USD) continued to give back value to the Pound as investors weighed up the prospects that the Bank of England (BoE ) would act before the Federal Reserve (Fed) with regard to increasing the base rate of interest. MPC meeting minutes appeared to add further weight to this view with an upwards movement in the interest rate apparently being deemed more likely around the end of the year. Attention will be paid to the US employment data today, with Continuing Job Claims due for release at 12:30 today.