Good-bye and have a good weekend. We’ll be back on Monday.

Pound dips to five-year low after weak UK industrial production data

Fri 10 Apr 2015 10.02 EDT

First published on Fri 10 Apr 2015 03.01 EDT- Closing summary

- FTSE 100 index near record high

- GE sells bulk of $30bn property portfolio to Blackstone, Wells Fargo

- Q1 GDP figures to show weaker growth, days before the general election?

- Could a hung Parliament leave UK markets swinging?

- US Treasury warns of hung parliament

- UK GDP growth likely to have slowed in first quarter

- Construction output down 0.9% in February

- UK industrial output weaker than expected

- EU draws up secret plans to kick Greece out of eurozone, Times reports

- European shares hit 15-year high

Live feed

- Closing summary

- FTSE 100 index near record high

- GE sells bulk of $30bn property portfolio to Blackstone, Wells Fargo

- Q1 GDP figures to show weaker growth, days before the general election?

- Could a hung Parliament leave UK markets swinging?

- US Treasury warns of hung parliament

- UK GDP growth likely to have slowed in first quarter

- Construction output down 0.9% in February

- UK industrial output weaker than expected

- EU draws up secret plans to kick Greece out of eurozone, Times reports

- European shares hit 15-year high

Closing summary

Disappointing industrial production and construction data have raised the prospect of slower economic growth in Britain, pushing the pound to five-year lows against the dollar. The currency is already under pressure amid concerns that the 7 May election will produce a hung parliament.

- The pound has lost more than a cent against the dollar to $1.4650, but is slightly down against the euro at €1.3791.

- The FTSE 100 index is on track for a new record closing high

- European shares have risen to their highest level since the millennium, helped by the weak euro which is benefiting exporters. The FTSEurofirst 300 index of top European shares is currently up 0.65% at 1640.14.

- French industrial output was flat in February while Spanish production rose 0.6%

FTSE 100 index near record high

The FTSE 100 index of leading shares is trading nearly 40 points higher at 7053.63, a 0.55% gain. It is inching closer to an intra-day record high of 7065.o8 points reached in March.

The FTSE is also on track to set a new all-time closing high, beating the 7,037.67 reached on 23 March. Last month the index finally broke through the 7,000 barrier – a level not seen since the dotcom boom of 1999.

Drugmaker Shire is still the biggest riser, up 5.2%, after positive news on its dry-disease treatment Liftegrast. Housebuilders Barratt and Taylor Wimpey were lifted by upgrades by broker Jefferies.

Meanwhile fellow pharmaceutical firm AstraZeneca is bucking the trend, with its shares down 2% at one stage, the top faller on the FTSE, after staff at the US top health regulator said its diabetes drug Onglyza appears to be associated with an increased rate of death. A clinical study in 2013 found that the drug might be linked to heart failure.

Some more thoughts on the slide in the pound. With inflation expected to be zero or negative in Tuesday’s data, and analysts expecting a prolonged undershoot of the 2% inflation target, a fall in sterling should be welcome from an inflation perspective.

It should also help exports, ease the pressure on Britain’s current account deficit and help rebalance the economy.

Some election pundits argue, however, that the fall in sterling is a bad thing, reflecting loss of faith in the UK. It’s also bad for holidaymakers, obviously.

GE sells bulk of $30bn property portfolio to Blackstone, Wells Fargo

Also on the corporate front, General Electric confirmed it plans to sell the bulk of its $30bn property portfolio over the next couple of years, as it returns to its industrial roots. GE shares jumped 7% in premarket trading after the company also unveiled a big share buyback plan.

GE is selling most of its property assets to private equity giant Blackstone and US bank Wells Fargo in a $23bn deal. It hopes to offload an additional $4bn of commercial real estate to unidentifed buyers.

On stock markets, the FTSE 100 index is about 24 points higher at 7039.44, a 0.3% rise. Germany’s Dax has climbed nearly 1.6% to 12,357.37 while France’s CAC is 0.4% ahead at 5232.

Drugmaker Shire has been leading shares higher in London all day, jumping more than 5% to £25.06, near all-time highs. The stock has been boosted by news that one of its drugs – Liftegrast for dry eye disease – would be fast-tracked by US regulators. The medicine has been granted a priority review to speed up the target time to market to eight months, rather than 12.

The pound has fallen even lower, hitting $1.4603 at one stage.

GBPUSD survives the first attempt on 1.4600 - http://t.co/xVtTk8qyNG

— ForexLive (@ForexLive) April 10, 2015

Looking ahead to next week, the European Central Bank will hold its first meeting on Thursday since its bond-purchase programme started.

Nick Kounis, head of macro and financial markets research, says:

President Draghi’s big challenge in the press conference will be to sound positive about the impact of QE and the outlook for the economy without sounding like it is going ‘too well’. He is likely to make it clear that the central bank plans to continue asset purchases to at least September 2016 and we think he is likely to successfully dismiss talk of tapering or exit. This task will become much more challenging later in the year, and certainly in 2016, as the economy continues to gain momentum.

Q1 GDP figures to show weaker growth, days before the general election?

The first-quarter GDP figures are out on 28 April, a week before the general election. Victoria Clarke, economist at Investec, has crunched today’s numbers.

The sogginess of construction sector output remains an ongoing puzzle. It has clearly been at odds with the PMI survey data. Furthermore, there is no one weak sector with the ONS numbers pointing to relatively broad based weakness... Hence we are left scratching our heads as to whether this is reflective of the true output of the sector. Even so, clearly it is these numbers which provide the construction sector’s contribution to first quarter output; even if construction output rebounds by 2½% in March, we would still be looking at a 2.5% decline over Q1 altogether, following on from the hefty 2.2% Q4 drop.

The ‘official’ story for the UK industrial sector is similarly disappointing news for the prospects for first quarter output. Indeed, allowing for a ½% rise in industrial output in March, we would still only see output of the sector standing around flat over Q1 overall. Note however that this is not due to weakness across the industrial sector overall but is led by a 3.8% m/m drop in oil and gas output. Indeed, the ONS points to the reduction in oil and gas output at some North Sea terminals compared to a year ago, with the contribution of crude/petroleum and natural gas to the February industrial sector figures at some -0.37ppts (i.e. sizeable drag). The picture for the UK’s manufacturing sector was a better one, with output meeting consensus expectations and recording growth of +0.4% month to month (Investec forecast +0.6%). With the UK manufacturing PMI having firmed into March, this leaves us optimistic that, oil and gas aside, the prospects for the UK’s manufacturing sector are far from grim.

What this all means, we suspect, is that whilst a softer Q1 GDP print than Q4’s +0.6% looks to be firmly on the cards now, short of some very heavy lifting from the UK’s dominant services sector in February and March, this isn’t necessarily a story of a UK recovery coming off the tracks. Indeed, the underlying position of UK manufacturers looks respectable and survey data on the strength of UK services output suggests the sector’s prospects have firmed as we have headed through the quarter.

For Mr Cameron however this may be of little comfort, with the first quarter UK GDP figures due just over a week before the general election; with a key strand of the Conservative’s policy case built on their economic performance the 28 April figures could prove to be important.

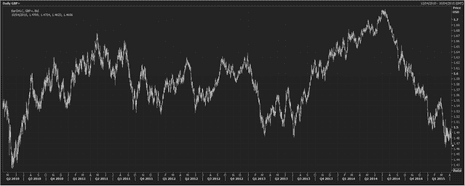

Here’s a chart showing the pound’s movements against the dollar over the last five years.

More reaction to today’s UK factory and industrial output data from the British Chambers of Commerce. David Kern, the lobby group’s chief economist, says:

February figures showed a modest improvement after last month’s declines but underlying industrial growth remains weak and so manufacturers will continue to face serious challenges. However, in the face of these difficult conditions our manufacturing sector has coped well with the rise in the pound against the euro over the past year and the sector has largely succeeded in maintaining its skills base during the recession. It is a credit to their strength and resilience.

While UK growth is likely to remain dependent on the healthy and dynamic services sector for the foreseeable future, there is no room for despondency. The manufacturing sector is in a good position to move forward when world circumstances improve, but only if low interest rates are maintained.

Could a hung Parliament leave UK markets swinging?

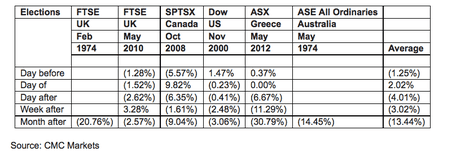

Ahead of the tightly fought UK general election on 7 May, Colin Cieszynski and Michael Hewson from CMC Markets look at how a hung parliament result could affect the markets.

The race to win the election looks like it could go right to the wire with both the Conservative and Labour party neck and neck in the polls, convincing just 35% of the electorate each.

Stock markets hate uncertainty, and the potential for an unstable government following a close race could impact the FTSE and the pound in the days and weeks following a close race until a workable solution is found, if indeed there is one. A scenario where one of Labour or the Conservatives wins the popular vote and one wins the most seats could add to the potential mess and uncertainty.

To get an idea of what a hung parliament could mean for the FTSE and the pound, the market strategists have taken a look at several previous close elections from around the world which ended up creating more questions than they answered.

Stock Market Performance following selected elections with contested results

For each of the elections in this century daily returns for the main local stock market index around the election date were analysed while for the two from the 1970s daily data was unavailable so monthly numbers around the election were used to approximate instead.

Regardless, the results speak for themselves. Elections from five different countries that ended in a muddle were followed by immediate selloffs that only deepened as it became clear that there was no easy or quick resolution to the problems. In all six cases, the local market was down a month later, and in half of them, the local market was down more than 10%.

The analysts conclude:

This suggests that should the UK election end in an indecisive result and wrangling over a coalition government drags, the FTSE and sterling could become increasingly vulnerable through May.

In Britain’s construction industry, activity slowed across all areas with the exception of new projects in the public housing sector, according to the ONS, which indicated that housing associations were among the few organisations to expand their output in February. The broader measure of ongoing activity showed that all parts of the construction industry declined, including public housebuilding , private housebuilding, civil engineering and infrastructure work.

More encouragingly, factory output improved, but mainly in the car industry, which recently reported its best production output this century. Nevertheless, factory output in the first quarter is so far running 0.2% below the fourth quarter of last year.

US Treasury warns of hung parliament

The BBC’s economics editor Robert Peston writes:

So the US Treasury has noticed there is a general election happening in Britain. This is what a report sent yesterday to Congress said about us:

“The potential for difficult coalition talks, and subsequently the design and implementation of economic policy, is broadly perceived as a material downside risk for businesses and investors.”

Or as I mentioned earlier this week, sterling will continue to take the strain (the pound will fall) if investors become more concerned that weak and directionless government will be the consequence of the poll on 7 May.

Broadly, however, the US Treasury paints a positive picture of trends in the British economy - except for the widening to a record level in the current account deficit, the huge imbalance between the money we make from the rest of the world and what we pay the rest of the world (which I’ve been banging on about for many months).

Chris Williamson, chief economist at economic survey compiler Markit, concurs.

Weaker than expected construction sector and industrial production numbers point to the economy having slowed at the start of the year. The data provide further evidence to support the case of interest rates to remain on hold, and will add to chatter that policy may even need to be loosened further.

However, more up-to-date survey data suggest the economy is showing signs of reviving again, which suggests that the next move in interest rates will be a rise, but that there’s little likelihood of rates being hiked this year.

Comments (…)

Sign in or create your Guardian account to join the discussion