The Japanese yen traded a lot lower recently not only against the US dollar, but also against the Euro and the British pound. However, the forex market sentiment is still favoring for more gains in the USD/JPY pair in the near term. The Japanese yen managed to post gains earlier during the Asian session, but later lost most of it as the US dollar buyers came into action again.

There were a few releases lined up today, including the Leading Economic Index, Japanese Coincident Index, All Industry Activity Index and Merchandise Trade Balance. The first one was the Japanese Merchandise Trade Balance Total, which was released by the Ministry of Finance. The market was expecting it to register a trade deficit of ¥-1,691.0B in January 2015, compared to the preceding month. However, the outcome was better than forecast with a reading of ¥-1,177.5B. Moreover, the Japanese Adjusted Merchandise Trade Balance came in at ¥-406.124B, up from the previous revised reading of ¥-620.667B. The Japanese yen was seen gaining ground after the release.

Japan’s Leading Economic Index

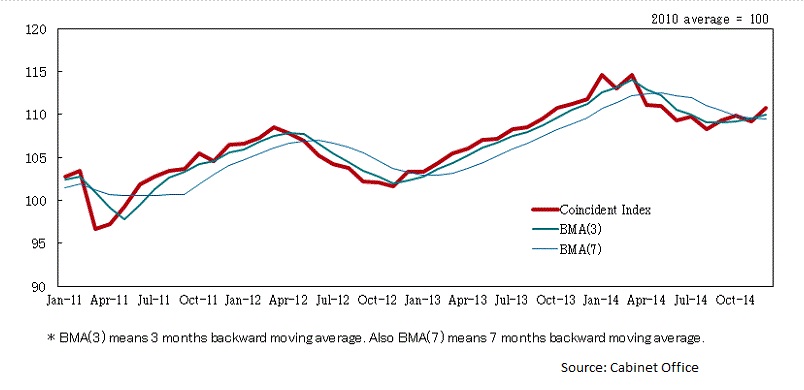

There were some other releases as well like the Leading Economic Index, which was released by the Cabinet Office. The end result was on the higher side, as the index climbed from the last reading of 103.7 to 105.6 in December 2014. Furthermore, the Japanese Coincident Index was also published around the same time, which rose from the previous reading of 109.2 to 110.7.

One more key release was scheduled as the All Industry Activity Index was released by the Ministry of Economy, Trade and Industry. The forecast was not expecting a major decline this time, but the end result was lower, as the All Industry Activity Index declined by 0.3% in December 2014, compared to a month ago. The preceding reading was also revised down from 0.1% to 0%.

Technically, the USD/JPY pair dropped towards the 118.40 level recently where the US dollar buyers managed to hold the downside. The pair broke the 100 hour moving average, but later managed to climb back higher above the same. As of writing, the pair is testing a major resistance area around 118.80-119.00 where the US dollar sellers might fight to protect the upside in the near term. A break higher could take it towards the 119.50 level.