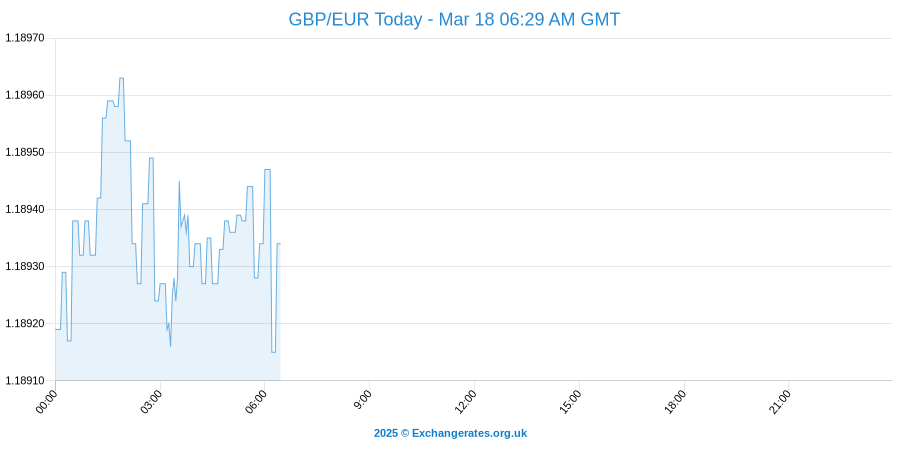

Today's Pound Sterling to Euro (GBP/EUR) Exchange Rate Forecast

The British Pound (GBP) suffered a mixed week of trading last week and closed down against the Euro (EUR) on Friday as the Sterling struggled to make any substantial gains following a week of light economic data.

With a positive start to the week for the Pound Euro exchange rate pair on Monday, Sterling dropped sharply on Wednesday even though Bank of England governor Mark Carney issued some positive comments with regards to interest rates.

A quick foreign exchange market summary before we bring you the rest of the report:

On Friday the Pound to British Pound exchange rate (GBP/GBP) converts at 1

The live inter-bank GBP-GBP spot rate is quoted as 1 today.

At time of writing the pound to us dollar exchange rate is quoted at 1.241.

The pound conversion rate (against swiss franc) is quoted at 1.126 CHF/GBP.

Please note: the FX rates above, updated 19th Apr 2024, will have a commission applied by your typical high street bank. Currency brokers specialise in these type of foreign currency transactions and can save you up to 5% on international payments compared to the banks.

Pound to Euro Exchange Rate Today

Carney stated “rates will have to rise at some point even though inflation is set to dip below 1% in the New Year. Following his comments, although its expected this would be Sterling positive, the Pound dropped to 1.2680 following the release.

The Pound to Euro rate also struggled to break market resistance following a disappointing UK economic report by the office for national statistics on Friday and closed down at 1.2592 following the release.

The Office for national statistics (ONS) said that British construction output shrunk 2.2% in October bringing the annual score down to a 17 month low of 0.8%.

Following the release the Pound dropped to end the week down at 1.2568 from a weekly high of 1.2748.

Today markets have been mixed and Sterling currently remains down against the euro by -0.30% reaching a daily low at 1.2540 and a daily high at 1.2644.

GBP/EUR Exchange Rate Forecast

This week is a big week for the British Pound with the potential for a big move with the GBP/Euro exchange rate.

Tuesday we have a run of top tier data due out of the UK, with Inflation headlining the economic calendar. House price data, the Producer price index and Retail sales will follow on Tuesday.

Average earnings, jobless claims and Unemployment headline the calendar on Wednesday whilst the year on year retail sales figure will dictate movement for the Pound on Thursday.

"We are heading into an eventful week for the pound with inflation, jobs data and retail sales due on Tuesday, Wednesday and Thursday respectively. Soft economic read is a risk for sterling bulls," said Ipek Ozkardeskaya, market analyst at Swiss quote.

UK annual inflation is forecast to decline to 1.2 percent from 1.3 percent in October.

The Unemployment rate is forecast to edge lower while wages could outperform inflation, giving a boost to the UK Pound on Wednesday.

Overall this week will be volatile for the Pound Sterling and Euro buyers should look to work protective Stop orders to avoid adverse fluctuations.

Update 17/12/2014: The UK CPI y/y came in below forecast at 1.0% compared to market expectations of 1.2%.