The weekly forecast roundup for the Pound Sterling (currency:GBP), the US Dollar (currency:USD) and Euro (currency:EUR) exchange rates.

A quick forex market overview before we bring you the report:

On Tuesday the Euro to British Pound exchange rate (EUR/GBP) converts at 0.854

The live inter-bank GBP-EUR spot rate is quoted as 1.171 today.

At time of writing the pound to us dollar exchange rate is quoted at 1.243.

Today finds the pound to swiss franc spot exchange rate priced at 1.135.

At time of writing the pound to canadian dollar exchange rate is quoted at 1.716.

Please note: the FX rates above, updated 16th Apr 2024, will have a commission applied by your typical high street bank. Currency brokers specialise in these type of foreign currency transactions and can save you up to 5% on international payments compared to the banks.

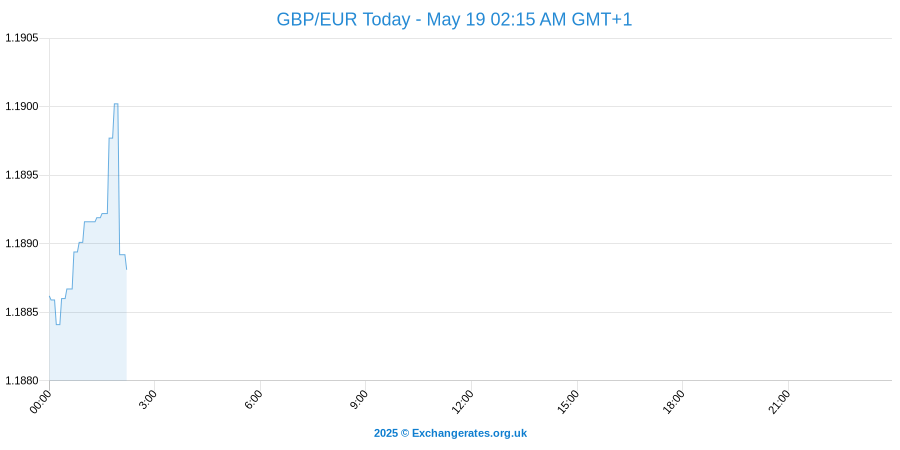

Pound Euro Exchange Rate Forecast: GBP/EUR Ends Week Stronger

After a volatile week of trading, the Pound Sterling to Euro (GBP/EUR) exchange rate was able to close out the week trending in a stronger position as a dovish statement from European Central Bank (ECB) President Mario Draghi caused Euro declines. The widespread weakness of the Euro meant that the GBP/EUR exchange rate was able to gain even as Sterling came under political pressure. The currency pair advanced from a low of 1.24 to push back above the 1.26 level before the close of the European session.

Pound to Dollar Exchange Rate Forecast: GBP/USD Softer as UKIP Victory Weighs

Although demand for the US Dollar was slightly undermined on Thursday by below-forecast Markit Manufacturing PMI for the US, the North American currency was able to maintain the upper hand as the Pound tumbled in response to UK political uncertainty.

While the Pound fell dramatically against peers like the Australian Dollar and Canadian Dollar, a lack of US data left the GBP/USD pairing trending around the day’s opening levels

Pound Sterling Forecast

The Pound posted widespread declines on Friday in response to the news that UKIP won the Rochester by-election and secured its second parliamentary seat.

Sending large amounts of money abroad? Did you know you could save compared to using the high street banks? Get a free guide and start a chat with our team of foreign exchange experts.

As analysts have forecast that the value of the Pound would be significantly undermined if the UK left the EU, the rise of an anti-EU party took its toll on the British currency.

The winner of the position in Parliament was Mark Reckless, a defector from the Conservative party. He said of the victory; ‘The result was closer than the forecasters predicted. I am absolutely determined to win this seat back because absolutely anything other than a Conservative government will put our recovery at risk and mean Ed Miliband in Downing Street. I am more determined than ever that we deliver security for Britain.’

Given that the party incites such controversy, industry experts and political officials were ready with a barrage of opinions once the results of the election were announced.

UKIP leader Nigel Farage stated; ‘My guess is this: I think there’ll be a lot of sucking of teeth over the course of the next few weeks. There will be MPs who will work out actually they’ve got a better chance standing as UKIP. If they join us I’ll be delighted. If they don’t, frankly that doesn’t really matter.’

Prime Minster David Cameron then commented; ‘I’m determined to win back Rochester and Strood at the election – anything other than a Conservative Govt would put our recovery at risk.’

Meanwhile, industry expert Janan Ganesh asserted; ‘Both main parties have themselves to blame for their agonies last night. The Tories’ folly is not losing MPs such as Mark Reckless, the defector who now represents Rochester for Ukip, but admitting them in the first place. Their benches are peppered with cranks, zealots and the flamboyantly disloyal. A serious party must have a selection process that screens out candidates who are plausible defectors, as Mr Reckless always was. Mr Cameron began his tenure as leader by trying to recruit moderates – it helped if they were women or ethnic minorities – as parliamentary candidates. Traditionalists fought back and, as ever, he relented for the sake of quiet life.’

Pound Exchange Rates to Fall if UK Exits EU

In reference to the Pound Sterling exchange rate, strategist Kit Juckes; ‘A swing toward a party which is committed to leaving Europe and which could conceivably represent the balance of power is immensely significant. It will be perceived as adding to uncertainty about the UK’s membership of the EU. If the UK were to leave the EU, our view is that would be negative for Sterling.’

Similarly, industry expert John Stopford noted; ‘We have a bias to play Sterling from a short side against other currencies to look for an opportunity to run an underweight position. We will also be looking at option strategies to buy insurance against a market surprise in May – an option to sell Sterling in terms of currencies.’

Although the general election is several months away, both the Pound Sterling to Euro (GBP/EUR) and Pound Sterling to US Dollar (GBP/USD) exchange rates are likely to be influenced by any political developments in the run up to May.

Signs that UKIP are gathering more supporters would be Pound-negative.