For the 24 hours to 23:00 GMT, the USD strengthened 0.27% against the JPY and closed at 114.84.

In the Asian session, at GMT0400, the pair is trading at 115.01, with the USD trading 0.14% higher from yesterday’s close.

Early morning data indicated that, Japan’s trade deficit narrowed more than expected to ¥714.5 billion in September, against market expectations of a trade deficit of ¥782.50 billion and following a deficit of ¥831.80 billion recorded in the previous month. Meanwhile, the nation’s adjusted current account surplus surprisingly widened to ¥414.40 billion in September, compared to a surplus of ¥130.80 billion registered in the previous month, while markets expected the nation to record an adjusted current account surplus of ¥36.90 billion.

Data just released showed that, Japan’s consumer confidence index unexpectedly dropped to a level of 38.9 in October, lower than market expectations for a rise to a reading of 40.5 and compare to 39.9 registered in the prior month.

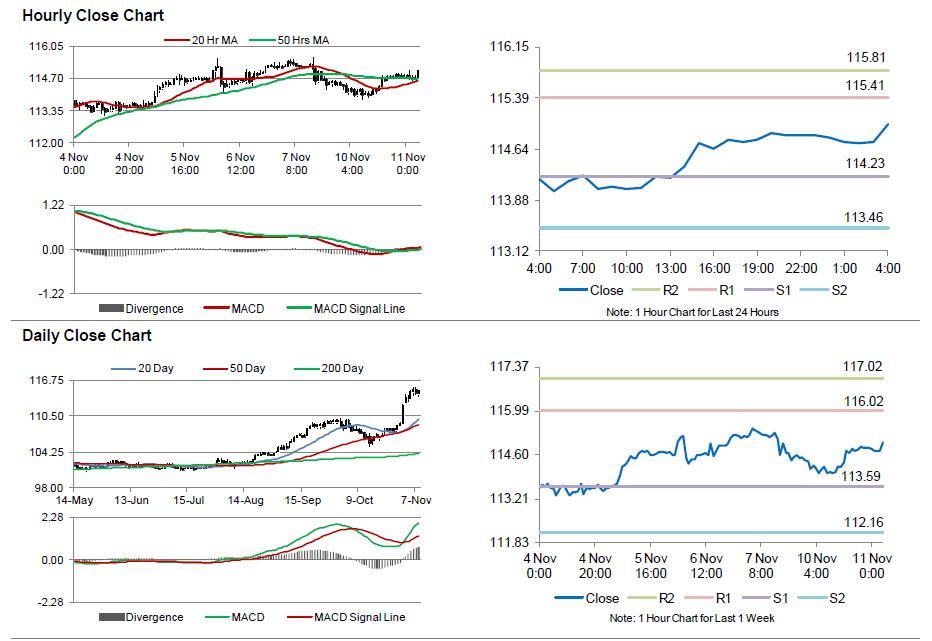

The pair is expected to find support at 114.23, and a fall through could take it to the next support level of 113.46. The pair is expected to find its first resistance at 115.41, and a rise through could take it to the next resistance level of 115.81.

Trading trends in the Yen today would be determined by Japan’s consumer confidence index as well as the Eco watchers survey data, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.