NEW YORK (REUTERS) - Alibaba Group Holding's shares are expected to surge in their first day of trading on Friday as many investors that received fewer shares than hoped lined up orders to buy what looks likely to be the largest IPO in history.

Floor traders at the New York Stock Exchange were getting set for the stock to begin trading.

Indications were for the stock to begin trading between US$87 and US$89 a share, more than 25 per cent increase from its US$68 initial public offering price.

The US$68 pricing on Thursday initially raised US$21.8 billion (S$27.6 billion) for the Chinese e-commerce company.

Scott Cutler, head of the New York Stock Exchange's global listing business, told CNBC that underwriters would exercise their option for an additional 48 million shares, to bring the IPO's size to about US$25 billion, making it the largest IPO in history.

"This is the biggest IPO the world has ever seen, so there's a celebratory mood on the floor, whether you like it or not,"said Benedict Willis, director of floor operations at Sunrise Securities Corp on the NYSE floor.

Alibaba is nearly unknown to most Americans but is ubiquitous in China, where it is responsible for 80 per cent of online sales. The company earned US$3.7 billion in the 12 months ended March 31, 2014, up about US$2 billion from the prior 12-month period.

The sale values the company at about US$168 billion, more than American icons such as Walt Disney and Coca-Cola.

Jack Ma, a former English teacher, founded Alibaba in 1999 in his apartment. His personal fortune is more than US$14 billion on paper, vaulting him into the ranks of such tech billionaires as Bill Gates and Jeff Bezos.

The deal is also expected to make millionaires out of a substantial chunk of the company's managers, software engineers and other staff.

Alibaba's shares met with intense demand from investors, with 35 and 40 institutions placing orders for US$1 billion or more in shares each.

Mark Hawtin, portfolio manager of the GAM Star Technology Strategy, a portfolio for offshore investors, said he was excited about how Alibaba priced and was hoping to buy more shares at the open. However, he said he will not pay more than US$90. A number of other investors suggested their threshold was about US$90 as well.

One institutional investor who had been told he was going to get one of the top allocations only received one-third of his order, and said he planned on buying more as long as the stock was trading below US$90 a share.

"I was told everyone is disappointed," he said. "I have cooled off now."

J.J. Kinahan, chief market strategist at retail brokerage TD Ameritrade, said the firm is seeing customer orders amounting to about 70 per cent of what it saw for Facebook, and about three times the customer orders it had for Twitter's IPO.

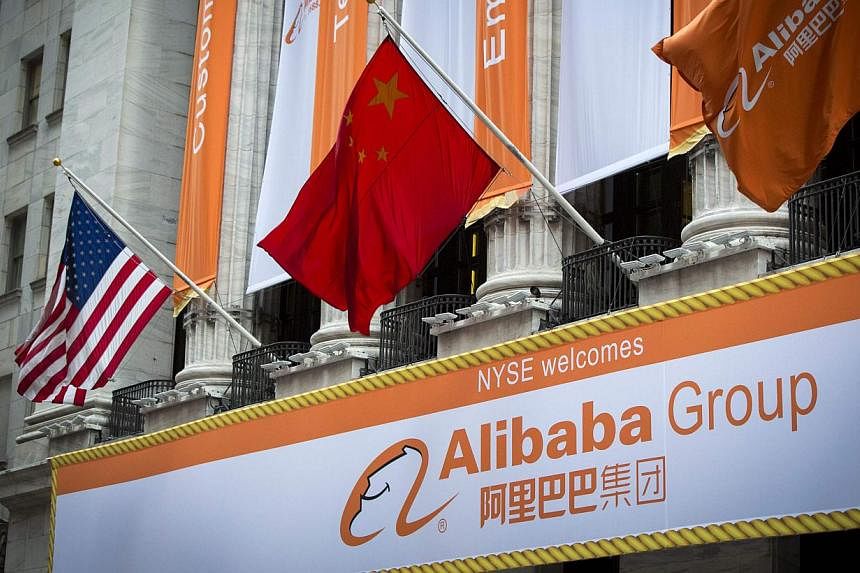

Alibaba Group's orange banners were festooned around the exchange, with its logo on NYSE computer screens. Ma was on hand at the trading floor to watch several long-time customers ring the opening bell at the exchange.

"I don't want disappointed shareholders, I want to make sure they make money," Ma said of the pricing, on CNBC, adding: "I worry about when the customer is happy."

With underwriters electing to sell more shares, the company's initial public offering becomes the largest in history, surpassing Agricultural Bank of China's US$22.1 billion listing in 2010.

NYSE launched extensive tests to ensure it would be able to handle heavy trading volume and held a call on Friday morning for members of the trading and operations community to make sure systems were working properly.