Where will the British Pound Sterling (GBP) move against the Euro (EUR), Aus Dollar (AUD), Japanese Yen (JPY) and Canadian Dollar exchange rates today?

A continuation from our previous FX forecasts, here's a roundup from our foreign exchange experts.

Here are the latest conversion rates today:

The Pound to Australian Dollar exchange rate is trading up +0.22 pct at 1.83009 AUD.

The Pound to Canadian Dollar conversion rate is +0.05 pct higher at 1 GBP is 1.79619 CAD.

The Pound to Euro exchange rate is steady at 1.27016 GBP EUR.

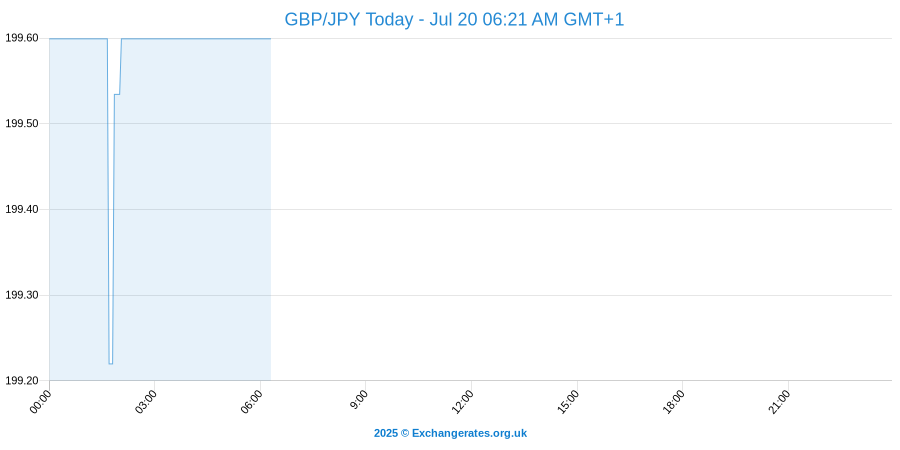

The Pound to Yen exchange rate converts up +0.11% at 174.03031 GBP JPY.

The Pound to Dollar exchange rate is -0.01 pct lower and converts at 1 GBP equals1.60850 USD.

Note: these are inter-bank forex rates to which margins are applied when comparing money transfers - speak to a recommended FX provider to lock in the best exchange rates. Also get free email updates or rate alerts.

Pound to Aus Dollar Forecast

Sending large amounts of money abroad? Did you know you could save compared to using the high street banks? Get a free guide and start a chat with our team of foreign exchange experts.

The Pound fell against the Australian Dollar in yesterday’s foreign exchange market after the Reserve Bank of Australia (RBA) kept interest rates unchanged as widely predicted by the majority of analysts. The RBA kept interest rates at their record low level of 2.5%, where they have been since August 2013 and maintained that it was "prudent to have a period of stability in rates."

Annette Beacher, economist at TD Securities commenting on yesterday’s RBA statement said "The statement today is much more of a 'cut and paste' of recent months. We were all looking for a phrase along the lines of a 'depreciation of the Australian dollar will help with the economy' [because] that's the phrase they used regularly... so that entire phrase or tone was missing today. The governor knows we watch every phrase so it could be a deliberate strategy not to talk about how low the currency is but to emphasize how high it is compared with commodity prices and historical norms".

Pound vs Yen Outlook Today

Likewise, the Pound also fell against the Japanese Yen )GBP JPY) after the overnight news that the Bank of Japan (BOJ) kept its massive monetary stimulus intact but analysts felt that there is a less optimistic tone to their commentary on the Japanese economy with a warning of weakness in Japanese factory output"It's true the effect [of the sales tax hike] on the economy is being prolonged. There's also the effect of bad summer weather".

Pound to Euro Exchange Rate Forecast

Against the Euro, the Pound retraced some of its recent losses after further bad data out yesterday from the euro zone’s leading economy, Germany.

The German Economy Ministry reported that German industrial output fell by a much bigger margin than expected in August. Indeed, the data showed that this is the biggest monthly drop in industrial output since the financial crisis of early 2009.

The data showed that German Industrial output fell by a whopping 4% month-on-month in August.

Of interest, the German economy seemed to have a strong start to the year but shrank by 0.2% in the second quarter. Some analysts are now predicting that the German economy may have contracted again in the third quarter.

The German Economics Ministry also revised the output data for July downwards to show just a 1.6% increase from a previously reported 1.9% rise.

The rise in the value of the Pound against the Euro was tempered by a data release from the respected National Institute of Economic and Social Research (NIESR) who are now suggesting that the UK economy grew by just 0.7% in the third quarter after registering a growth rate of 0.8% in the second quarter of this year. In annual terms, the NIESR estimate that the UK economy is now 3.1% larger than it was the same period a year ago and 3.5% bigger than it was at its previous peak in January 2008.

The NIESR report also indicates that "There does however remain a reasonable amount of spare capacity in the UK economy. Given this, we continue to expect the first increase in interest rates to come in February 2015." Of interest, this is just 3 months ahead of the UK general election and a move in rates that close to an election could lead to the Bank of England being accused of political bias.

Meanwhile, the Office for National Statistics (ONS) reported that UK industrial production was flat on the month in August but grew by 2.5% year-on-year. Factory output was also flat in terms of quarterly rates of change.

Foreign Exchange, So What's Going on?

Overall, the foreign exchange market is gyrating between risk appetite and risk aversion on an almost daily basis at the moment and this is only adding to the recent rise in overall market volatility.

Risk aversion usually brings an increase in demand for the safe haven qualities of the likes of the US Dollar, Swiss Franc and Japanese Yen.

Risk appetite tends to strengthen not only the high yielding currencies like the Australian and New Zealand Dollars and the South African Rand.

These currencies are also known as commodity currencies because of their economic make up and an increase in risk appetite also helps the Canadian Dollar.

Known in the currency markets as the ‘loonie’, its fortunes tend to fluctuate with the price and demand for oil.

Yesterday, the markets swung back to risk aversion after the International Monetary Fund (IMF) downgraded its global growth forecast for both this year and 2015. The IMF now expects world economic growth to come in at 3.3% in 2014, a drop of 0.1% from the rate it last forecast only in July. In 2015, the IMF expects world economic growth of 3.8%, a drop of 0.2% from its last prediction in July.

Of interest, the IMF downgrade comes less than a month after the Organisation for Economic Co-operation and Development (OECD) slashed its own forecast for global economic growth because of concerns about a stuttering recovery in the U.S. and the continued fragility of the euro zone.

Tomorrow brings the latest monthly policy announcement from the Bank of England. Analysts are predicting a ‘no change’ policy announcement but we will have to wait until later on in the month to find out how the nine members of the Bank of England’s Monetary Policy Committee (MPC) voted.