For the 24 hours to 23:00 GMT, the USD strengthened 0.15% against the JPY and closed at 108.16. The Japanese currency came under pressure, after Japan’s economic watcher’s survey for future deteriorated to 48.7 in September, after registering a level of 50.4 in the prior month, while the nation’s survey for current situation came in lower than market forecasts in the same month.

In the Asian session, at GMT0300, the pair is trading at 108.11, with the USD trading marginally lower from yesterday’s close.

Early morning data indicated that, Japan’s machine orders registered a drop of 3.3% on an annual basis in August, less than market expected decline of 4.9%. Machine orders had risen 1.1% in July. Additionally, the nation’s average office vacancies in Tokyo rose 5.65% on a monthly basis in September, following an increase of 6.02% recorded in the prior month.

Separately, the BoJ Governor, Haruhiko Kuroda reiterated that the central bank would not hesitate to make necessary adjustments in its monetary policy, in order to achieve the 2% inflation target.

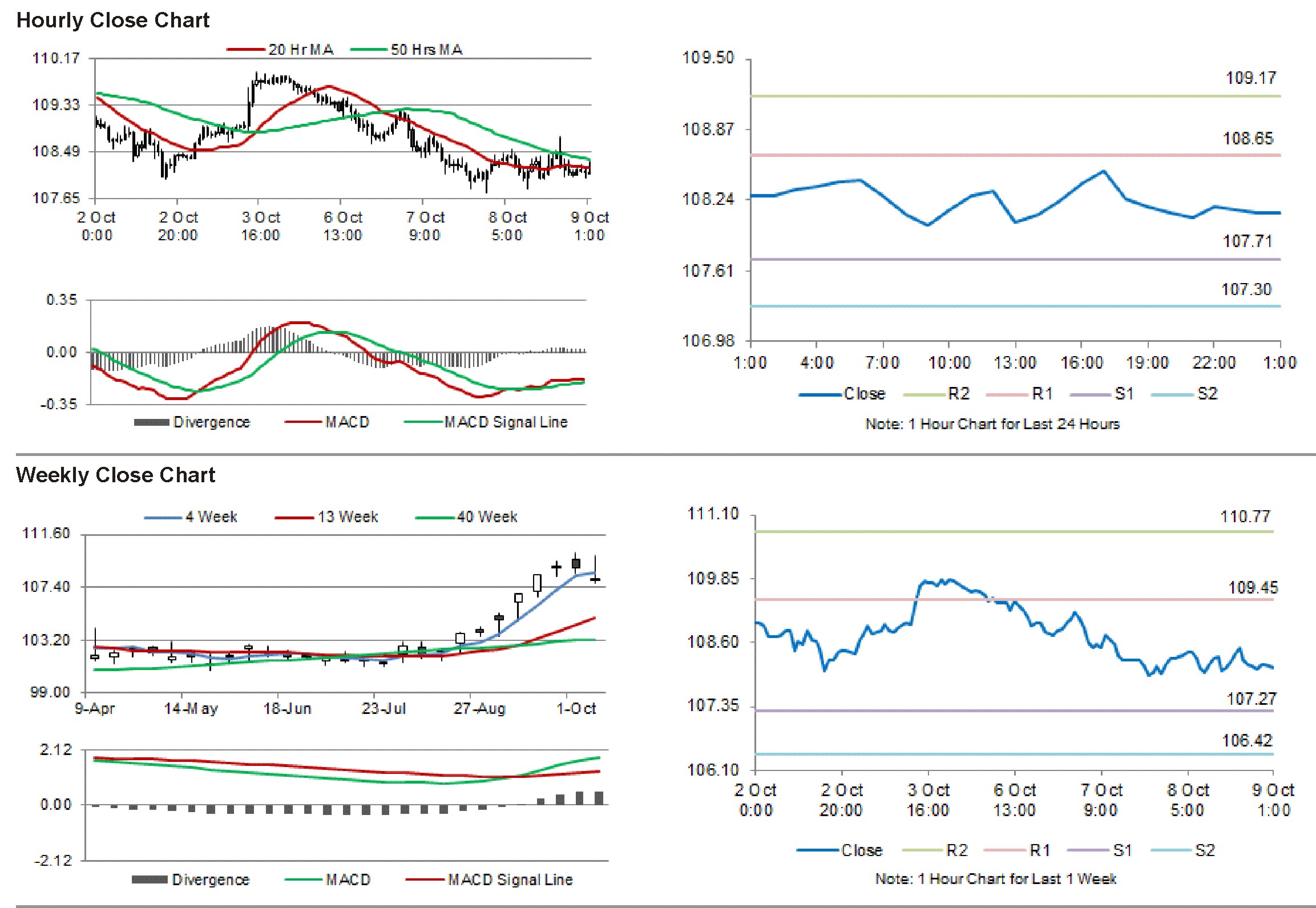

The pair is expected to find support at 107.70, and a fall through could take it to the next support level of 107.30. The pair is expected to find its first resistance at 108.64, and a rise through could take it to the next resistance level of 109.17.

Meanwhile, investors look forward to Japan’s machine tool orders data, scheduled in a few hours.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.