For the 24 hours to 23:00 GMT, the USD is trading marginally lower against the JPY and closed at 102.07.

In the Asian session, at GMT0300, the pair is trading at 101.78, with the USD trading 0.28% lower from yesterday’s close.

Early morning, the Bank of Japan (BoJ) kept its monetary policy unchanged and stuck to its policy of increasing base money by ¥60-70 trillion per year by buying assets mostly in Japanese government bonds. Meanwhile, the bank cautioned against the present gloomy export and industrial output scenario of the nation.

Meanwhile, the trade deficit in Japan narrowed to ¥537.1 billion, following a trade deficit of ¥675.9 billion in the previous month. Markets anticipated the deficit would fall to ¥592.8 billion. Additionally, the Bank of Japan has reported that, on an annual basis, housing loans in Japan has risen 2.7% in Q2 2014, compared to a rise of 2.9% recorded in the preceding quarter.

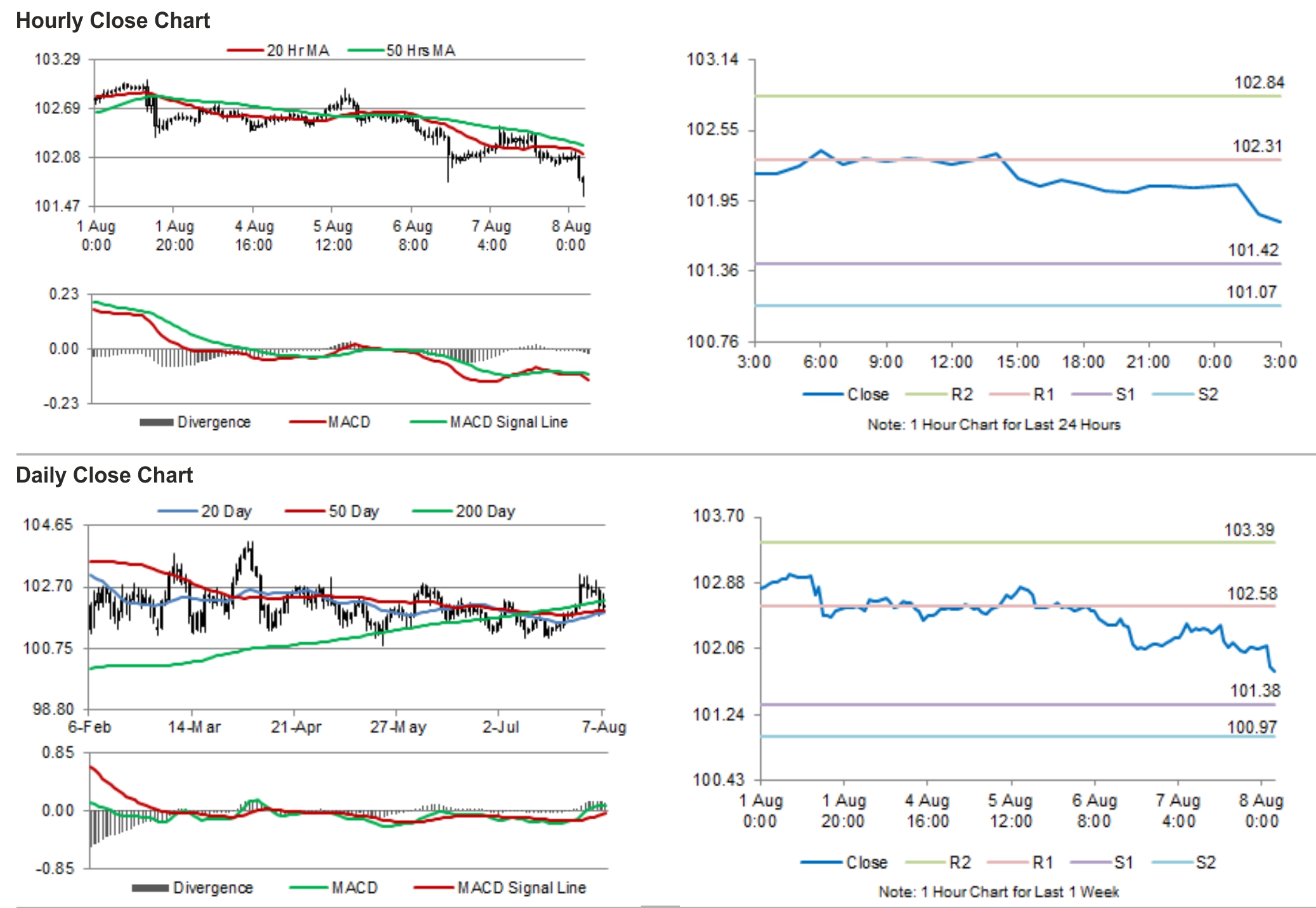

The pair is expected to find support at 101.42, and a fall through could take it to the next support level of 101.07. The pair is expected to find its first resistance at 102.31, and a rise through could take it to the next resistance level of 102.84.

Going forward, investors would keenly await BoJ Governor, Haruhiko Kuroda, will hold a news conference to get insights on the Japanese economy.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.