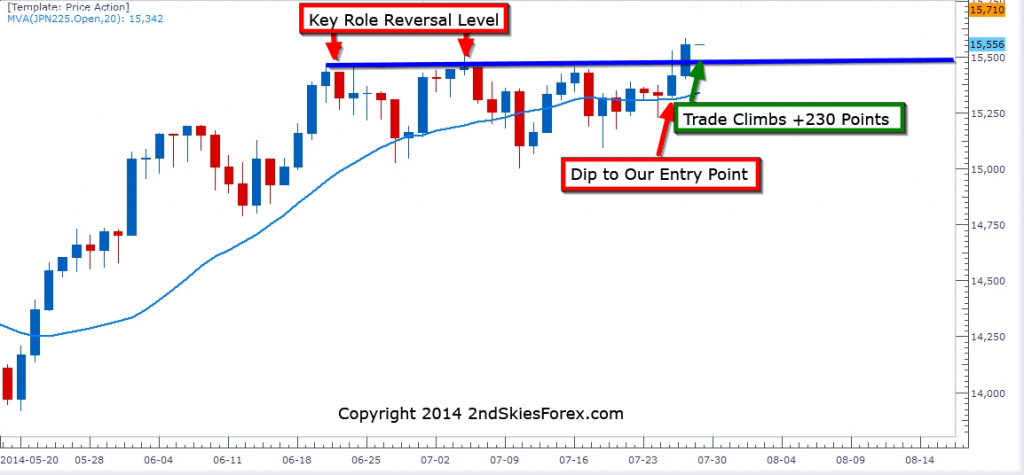

Nikkei 225 – Price Action Squeeze Setup Profits Heavy After Breakout

On our July 24th daily market commentary, we noticed how the Nikkei was setting up for a medium term breakout by forming a price action squeeze. We specifically suggested buying on dips to the 15325 level, with the Japanese index hitting a low the next day of 15316, then rocketing higher over the next two days.

This trade netted well over a +2R profit, so congrats to the members in our trading community who profited nicely from this trade. This goes to show the importance of understanding price action context, and not being limited to trading just price action patterns/signals looking for 1-2 bar patterns. When you learn to read the underlying context and order flow, you can find setups typical pattern traders will not.

For now, look to trade inline with the trend, and watch for pullbacks towards the 15500 area key role reversal level, all the way down to the daily 20 ema for potential levels to get long. For those who have not taken profit, we’d suggest taking some off the board and neutralizing all risk. The next levels to watch on the upside are 15750 and 15900, so a lot of potential profit available.