During the Australasian session the New Zealand Dollar (NZD) exchange rate maintained a steady position against the Pound (GBP) and US Dollar (USD) but slid against the Australian Dollar (AUD). With the Reserve Bank of New Zealand decision looming, the ‘Kiwi’ was able to rally against the US Dollar on Tuesday as the US core Consumer Price Index came in slightly below expected levels. It had been forecast that the core measure (which doesn’t take into account fuel or food) would print at 2.0% in June, year-on-year, but it actually came in at 1.9%.

On the month consumer prices climbed by 0.3%. As the result slightly dampened expectations for a sooner-than-forecast Federal Reserve interest rate increase, the US Dollar lost ground against higher-risk and emerging-market currencies like the New Zealand Dollar.

Aussie CPI Pushes New Zealasnd Dollar Lower

Overnight economic reports for New Zealand were severely lacking but currency market movement was inspired by Australia’s Consumer Price Index for the second quarter.

The odds of the Reserve Bank of Australia having to slash interest rates in the near future were significantly diminished after the inflation figures came in at expected levels.

In the second quarter Australian CPI printed at 0.5%, quarter-on-quarter. This was down from a 0.6% quarterly increase in consumer prices in the first three months of the year. The New Zealand Dollar accordingly slumped against its Australian counterpart. In the opinion of forex expert Martin Rudings; ‘‘Aussie’ might be getting a bit of support here as well as people are selling Kiwi and buying ‘Aussie’. I suspect that is a bit of positioning ahead of tomorrow’s RBNZ. There is probably a greater risk that they don’t raise rates in this meeting.’ The New Zealand Dollar to Australian Dollar exchange rate dropped to a low of 0.9186 before steadying at around 0.9192.

BoE Minutes See Pound Sterling Soften

Over the course of the European session the Pound extended losses against the Australian Dollar thanks to a slightly disappointing set of minutes from the July Bank of England policy meetinglast few months there were expectations that some of the Monetary Policy Committee might have adopted a different attitude regarding the timeline for increasing interest rates. However, not one of the nine-member policy board voted in favour of hiking interest rates.

The central bank intimated that it believes some of the heat may have come off the UK housing market and also mentioned that the global outlook had been slightly compromised by recent events.

The minutes stated; ‘On balance, the news about the central outlook for the global economy had been to the downside over the month, and upside risks to activity seemed to have diminished somewhat. This contrasted with the position at the beginning of the year, when expectations for 2014 had generally been for a global growth rate close to the long-term average.’ The less-than-inspiring minutes quashed rate hike expectations and pushed the Pound lower against almost all of its most traded currency counterparts during local trading.

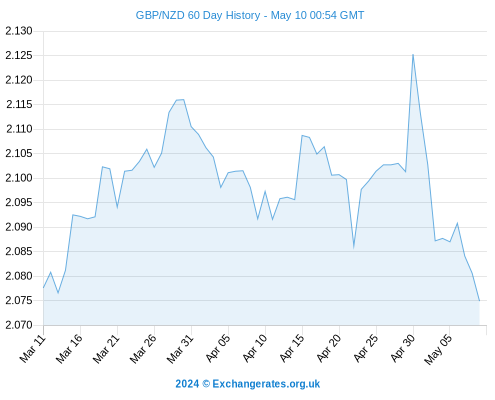

Of course, with the Reserve Bank of New Zealand interest rate decision now only hours away, it seems likely that the GBP/NZD pairing will experience additional extensive volatility before the week is out. If the RBNZ fails to deliver the rate increase markets expect, the Pound could recoup losses against its rival. Similarly, if the central bank intimates that this will be the last interest rate increase for the year the ‘Kiwi’ could edge lower.

The New Zealand Dollar to Pound Exchange Rate is currently in the region of 0.5095. The Pound to New Zealand Dollar Exchange Rate is currently in the region of 1.9616. The US Dollar to New Zealand Dollar Exchange Rate is currently in the region of 1.1514